Die Entlassungen von bis zu 20 % der Belegschaft sind laut Huobi in erster Linie durch Umstrukturierungen nach einem Führungswechsel bedingt.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Die Entlassungen von bis zu 20 % der Belegschaft sind laut Huobi in erster Linie durch Umstrukturierungen nach einem Führungswechsel bedingt.

US authorities are ramping up pressure on Sam Bankman-Fried’s inner circle as they scrutinize Nishad Singh, a former close FTX associate according to insiders. Singh was integral in the founding of FTX. He has not been charged with anything, but he may be. Bloomberg’s Sonali Basak reports.

Basak says:

We don’t know, but we do know he was in the “penthouse”, he lived with SBF. He was an insider who was really close friends with Sam’s brother. Gary Wang, who pled guilty, is cooperating. Part of the CFTC’s allegations are that code was written to help Alameda take out this unlimited line of credit that has essentially been found to be customer money. The aim is to see what role Nishad Singh played.

Who else might prosecutors be looking at? One issue is the cooperators in the investigation. Damian Williams of the US District Attorney’s office said there are thousands of documents, signal messages, etc. Is it just the penthouse you’re looking at, or is it the broader FTX empire?

Basak brought up Ryan Salem, who was found in the court documents in the Bahamas to have tipped off Bahamian authorities. Then, there’s the entity FTX.US, which is said to be more shielded. There are things people knew…that this “penthouse suite” kept from them.

When Singh’s name first came up, the new control of FTX had taken over. They put out that report and they talked about this idea that SBF had taken out about a billion dollars in loans through Alameda. They also said Singh and Wang had borrowed hundreds of millions. That’s the allegation. They have not responded, at least not publicly.

Some of the information is coming from the bankruptcy filings. The prosecutors are not bankruptcy experts. The authorities are working on tracking “whose loans went where to buy what.” Ultimately, you’re going to have to seize those assets and get that money back.

In related news, crypto broker Genesis Global Trading eliminated 30% of its staff. Withdrawals have been halted by Genesis Lending for over a month. The question is: how much of this is contained to lending and how much is it a bigger problem for crypto conglomerate Digital Currency Group’s (DCG) head Barry Silbert, who is a big Wall Street voice?

CNBC reported that Cameron Winklevoss, co-founder and president of Gemini crypto exchange, accused Silbert of engaging in “bad faith” tactics. He wants to resolve a thorny lending dispute with the company that emerged after FTX collapsed.

The dispute arose from an agreement between Gemini and Genesis Lending, a DCG subsidiary. Gemini offered customers yields of up to 8% through its lending product Gemini Earn. To generate that yield, Gemini lent customer funds to Genesis Global Capital, which lent them out to institutional clients.

Gemini suspended redemptions for its Earn service a few days after FTX filed for bankruptcy. Genesis Global Capital also suspended its loan services. While Gemini denies any link to FTX, Genesis tweeted in November that they had around $175 million in funds locked inside FTX.

On January 2, Cameron Winklevoss wrote an open letter to Barry Silbert, alleging the latter had refused to meet with the Gemini team on numerous occasions. He set a deadline on January 8 when Gemini wants to see a proposal to resolve the conflict…or else.

It was a fiery letter, the hosts on Bloomberg conceded. Basak concluded:

When these things are hashed out on Wall Street, they are done behind investment bankers and lawyers. In crypto, they’re done on Twitter…

The post Prosecutors ramp up pressure on SBF associate Nishad Singh appeared first on CoinJournal.

Jim Cramer talked about why Silvergate is a ‘pivotal’ part of the crypto ecosystem on Mad Money, CNBC.

Silvergate’s shares plummeted, losing more than 43% yesterday, then another 2% or so. They are down by more than 90% from their all-time high in November 2021. According to the bank, the crypto industry’s breakdown caused a run on deposits, prompting it to fire 40% of its staff and sell assets at a major loss. Silvergate held deposits for FTX units and Alameda.

According to Cramer, stocks can always go lower and as long as they’re above zero, it’s fine. However, Silvergate is a pivotal part of the crypto ecosystem because it’s a “great example of everything that’s wrong with this industry.” Cramer said:

The bank made a series of horrifying disclosures, which caused (the drastic fall). If we don’t address it, I worry that the market cap will shrink to the point where we won’t be allowed to talk about it on air.

Silvergate Bank was founded as a savings and loan association in 1988. It was transformed into a bank in 1996 by Dennis Frank and Derek J. Eisele. At first, it was quite small with just three branches in southern California.

In 2013, CEO Alan Lane made a personal investment in Bitcoin, and the bank went into crypto. They launched services to companies in the crypto space, especially crypto exchanges. They got in very early according to Cramer, when most banks didn’t want to have anything to do with Bitcoin. Then, it was “really only Bitcoin.”

Silvergate grew rapidly thereafter, reaching $1.9 billion in assets by 2017. The company was listed in November 2019 at a stock price of $13. The price had risen by 1580% in November 2021.

As mentioned, the price is now down over 90% from then. Cramer explains:

Silvergate established the Silvergate Exchange Network (SEN), a payment network for the crypto space. You can send USD to other Silvergate customers instantly, 24/7, just like crypto transactions. The bank also offered loans with Bitcoin as collateral. They were working on their own stablecoin, like a pseudo money market fund (MMF) that allows you to go in and out of the market without friction, which is the most dangerous link in the crypto chain.

The post Jim Cramer explains Silvergate’s failure on Mad Money appeared first on CoinJournal.

Ethereum Classic is up 18% in the week

The network has witnessed an increased hash rate

Ethereum Classic still faces bear pressure at $19

Ethereum Classic (ETC/USD) has been of bull interest in the last two days. Despite losing by an intraday 1% on Friday, it was still up 18% in the week. A majority of these gains happened on January 04, 2023. The gains pushed the cryptocurrency above a crucial descending trendline that has contained ETC for a while. But how far can ETC gains continue?

Ethereum Classic was tipped for success when Ethereum shifted to the Proof of Stake protocol. Ethereum Classic is itself a Proof of Work protocol. Thus, Ethereum’s shift, also known as the Merge, was expected to push PoW miners to Ethereum Classic. Although initially boosting the price, ETC later crashed as the speculations waned.

The latest ETC gains reignite hopes of miner activity on Ethereum Classic. While the hash rate went downward in December 2022, it started to gain momentum toward the new year. The hash rate improved from 97.5975 TH/s on December 27 to 111.7497 TH/s on December 30, according to CoinWarz data. That could indicate increased miner activity and ETC transactions which boosted prices after the new year. But buyers may need to exercise caution at the current price level.

A technical outlook shows momentum has increased strongly for ETC. The MACD indicator is attempting to break above the neutral zone. However, bears are trying to force a correction after ETC reached resistance at $19.

Despite breaking above the descending trendline, ETC is facing a correction. The price is yet to trade above the previous high.

A break above the $19 resistance is the needed validation to consider further upsides. Investors should only buy ETC if it recovers above $19 with a confirmed bullish momentum. At the current price, ETC still faces a slump back to the $14 bottom price.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

OKX is a top cryptocurrency exchange which offers over 140 cryptocurrencies to invest in. OKX takes customer security very seriously, they store almost all of their clients‘ funds in cold storage, and the exchange is yet to be hacked. On top of this, the exchange offers very low fees and customers can even use their crypto as collateral for loans on the platform.

The post Ethereum Classic breaks above descending trendline but exercise caution appeared first on CoinJournal.

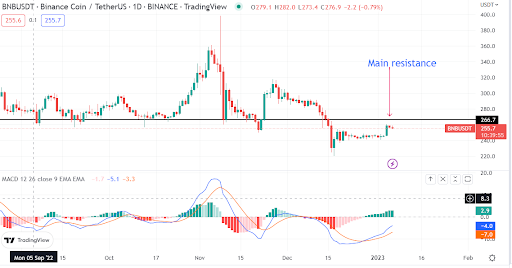

Binance coin has been bearish since the FTX collapse

The cryptocurrency trades on an upside at $255

BNB faces resistance at $266, a crucial resistance level

While 2022 was largely bearish for almost every cryptocurrency, Binance (BNB/USD) was relatively stable. That’s not to mean that the cryptocurrency was bullish, but at least bears did not run riot as they did for most cryptocurrencies. It helped BNB hold strengths. At one time before the collapse of FTX, BNB neared the $400 price level. Since then, BNB has remained bearish. What happened?

The collapse of FTX ignited fears that no crypto exchange was too big to fail. Investors rushed to decentralised exchanges that benefited from huge outflows from centralised peers. Binance, the world’s largest centralised crypto exchange, was among the culprits of the shift. That sent the native token BNB tumbling to $220 by mid-Dec.

Further fears were heightened by Binance’s proof of reserves. As CoinJournal reported, an audit report raised questions showing that the exchange was not sufficiently collateralised. BNB has been suffering in the aftermath, although the latest recoveries are promising.

BNB is mildly bullish on the daily chart. A bullish MACD crossover was initiated, supporting an improved momentum for the cryptocurrency. However, the MACD indicator is bearish. Bulls are yet to close above the neutral zone, which separates the bullish and bearish momentum.

BNB also trades below the resistance at $266. This is the level bulls defended strongly before the FTX-inspired crash. Therefore, the level is a key test for the bulls.

A continuation of the current recovery could see BNB return to its former self and turn $266 into support. For this to happen, bulls must overcome the resistance and break higher.

On the flip side, bears will try to position themselves as the BNB price reaches $266. Already, there is some resistance developing below the resistance zone. A failed breakout will see bears try to force a correction. That could see BNB continue to consolidate below before buyers have another chance.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

Binance is one of the largest cryptocurrency exchanges in the world. It is better suited to more experienced investors and it offers a large number of cryptocurrencies to choose from, at over 600. Binance is also known for having low trading fees and a multiple of trading options that its users can benefit from, such as; peer-to-peer trading, margin trading and spot trading.

The post BNB prediction as price maintains a recovery appeared first on CoinJournal.