Caroline Pham stellt fest, dass die Bemühungen außerhalb der USA bezüglich einer gemeinsamen Krypto-Regulierung bereits weiter fortgeschritten sind.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Caroline Pham stellt fest, dass die Bemühungen außerhalb der USA bezüglich einer gemeinsamen Krypto-Regulierung bereits weiter fortgeschritten sind.

Key Takeaways

Coinbase has been in a world of pain recently.

Just last week, the exchange announced it was laying off 20% of its workforce, having already cut 18% last June. I wrote a piece analysing what this meant for the company, which was trading at a market cap below $10 billion, 90% down from the price at which it went public in April 2021.

This came after CEO Brian Armstrong unloaded 2% of his stake in the company in October, after which I wrote a deep dive analysing what it all meant for a company that has been viewed as the torch-bearer to carry crypto into mainstream circles once and for all following its high-profile floating on the Nasdaq.

But today, more bad news came. The exchange announced it is halting all operations in Japan, citing “market conditions”.

Despite the onslaught of bad news, Coinbase’s share price has been a big winner in the early weeks of 2023, up 48% in just 18 days.

This comes amid the biggest crypto rally in 9 months, which has seen prices surge across the board. While the bounceback in Coinbase’s share price is great news for investors, it also ironically sums up exactly what the problem is – Coinbase’s correlation to the crypto market.

There are few things more volatile than crypto, so it is not good news to be tied at the hip to its price action. But Coinbase’s performance is dependent on the crypto market because as the price falls, transaction volumes and interest in the industry, and by extension Coinbase, plummets.

During the pandemic, this was a great thing. The money printer was on maximum power, interest rates were low and retail investors were all aboard the FOMO train, armed with a healthy curiosity about crypto and a fat stimulus cheque.

But with the changing macro environment, the crypto industry has freefallen from $3 trillion to $800 billion, before this recent surge popped it back above $1 trillion.

Despite the pleasant pump this past few weeks, zooming out tells you that Coinbase has shed 85% of its value since going public, gone through two rounds of layoffs, seen its CEO sell 2% of his stock in October and now is ceasing operations in Japan.

All Japanese Coinbase customers will have until February 16th to withdraw their holdings from the platform. If they fail to do so, the remaining assets will be converted to Japanese yen. Coinbase had worked hard during the previous crypto winter to expand into the Japanese market, so the abrupt departure is a shame.

But Coinbase is not the only exchange to make this move, with rival Kraken also announcing it was ceasing Japanese operations last month. Also like Coinbase, Kraken had cut a large chunk of its workforce, laying off 30% of employees after the FTX collapse shook the market. The plight of Coinbase’s extreme correlation with the crypto market is once facing exchanges across the industry.

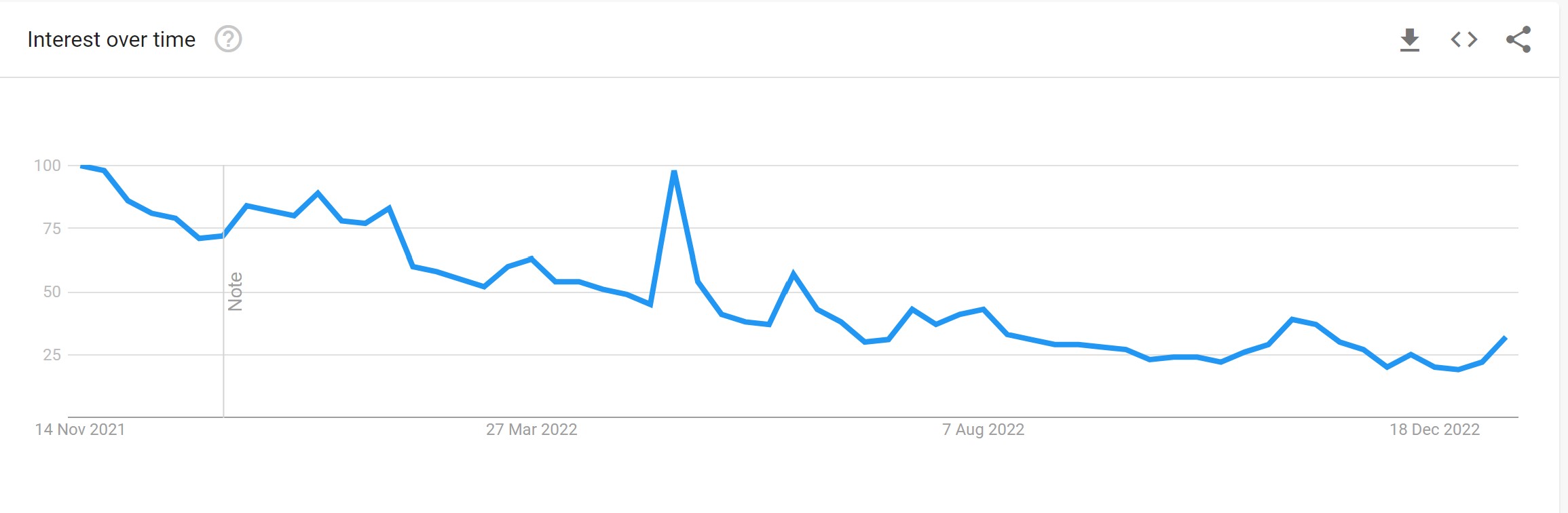

Coinbase Q3 results revealed that transaction volume fell 44% from Q2. The fall in volume and interest ultimately is what has caused the plummeting share price, layoffs, and now ceasing of Japanese operations, with a glance at Google Trends all you need to see the scale of the dropoff in the public’s attention to the exchange.

For $COIN investors, they will hope that the last few weeks of softer macro data and a crypto bounceback are an omen of things to come, otherwise this share price rally will be short-lived.

For $COIN investors, they will hope that the last few weeks of softer macro data and a crypto bounceback are an omen of things to come, otherwise this share price rally will be short-lived.

The post Coinbase terminates Japan operations, why is share price still up 50% in two weeks? appeared first on CoinJournal.

Ethereum price has been in a strong bullish trend in the past few days.

The fear and greed index has moved to the greed zone.

Ethereum price momentum waned on Wednesday as investors reacted to the improving market conditions. ETH surged to a high of $1,612, the highest level since November 6 last year. It has jumped by more than 47% from the lowest point in December. So, what next for ETH prices?

Ethereum has been in a strong bullish trend in the past few weeks as the mood in the crypto market improves. This rise has coincided with the sharp increase of other coins like Bitcoin, Litecoin, and OKB.

Crypto prices have surged for several reasons. First, it rallied because of the falling inflation in the United States. Data published last week showed that the headline consumer price index (CPI) dropped from 7.1% in November to 6.5% in December.

Core consumer inflation also dropped to 5.7% in December. This means that inflation has dropped in the past six straight months. Further, wage inflation has started moving downwards even as the unemployment rate dropped to 3.5%.

Therefore, investors believe that the Federal Reserve will start to shift its interest rate policies in the coming months. The Fed hiked rates from between 0 and 0.25% in January 2022 to over 4% in December. Therefore, with inflation falling, there is a likelihood that the Fed will shift its tone.

Second, the fear and greed index has moved from fear to greed recently. The one tracked by CNN has moved to 65 while the crypto fear and greed index has risen to 52. Historically, Ethereum and other cryptocurrencies thrive when the index is rising.

Third, Ethereum has seen the total value locked (TVL) in Ethereum surge to about $27 billion, Lido’s TVL has surged by 31% in the past 30 days while Convex and Aave have seen their TVLs jump by over 25%.

The daily chart shows that the ETH price has been in a strong bullish trend in the past few days. As it rose, it moved above the upper side of the descending channel shown in black. The coin also rose above the key resistance level at $1,354, the highest point on December 15.

It also jumped above the 25-day and 50-day moving averages while th Relative Strength Index (RSI) moved to the overbought level. Therefore, the coin will likely continue soaring as buyers target the key resistance at $2,000.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

OKX is a top cryptocurrency exchange which offers over 140 cryptocurrencies to invest in. OKX takes customer security very seriously, they store almost all of their clients‘ funds in cold storage, and the exchange is yet to be hacked. On top of this, the exchange offers very low fees and customers can even use their crypto as collateral for loans on the platform.

The post Ethereum price targets $2k as fear and greed soars appeared first on CoinJournal.

Shiba Inu price went parabolic on Wednesday as it reached a high of November.

The developers wrote about the upcoming Shibarium launch.

Shiba Inu (SHIB/USD) price went parabolic as investors reacted to the latest developments on Shibarium launch. The SHIB token jumped by more than 20% in the past 24 hours. It has soared by over 57% from the lowest level in December 2022. Other top-performing cryptocurrencies are STEEM, LOKA, and HIVE.

Shiba Inu is a leading cryptocurrency that was started as a joke in 2021 during the crypto mania. It was created to be a better alternative to Dogecoin, which was having its best time as its price surged. But the two are different. Dogecoin is a coin that is similar to Bitcoin while Shiba Inu is an Ethereum token.

Shiba Inu price has done well in the past few days as investors wait for the upcoming Shibarium launch. Shibarum is a layer-2 network that will solve some of the existing challenges in the network. Some of these challenges are on speed, scalability, and costs.

Shibarium will join other popular layer-2 networks like Polygon, Arbitrum, and Optimism. After launch, it means that other developers will be able to build applications on top of it. In a statement, the developers said that Shibarium will mostly focus on gaming, the metaverse, and non-fungible tokens (NFT). Analysts believe that the Shibarium launch will be one of the biggest crypto news of the year.

In addition to Shiba Inu, other Shiba Inu tokens will also benefit. They include leash (LEASH) and bone (BONE). According to CoinMarketCap, the two have a combined market cap of more than $5 billion. Shibarium validators will need to lock up bone to run the Heimdall validator software.

The developers also noted that Shibarium will lead to more SHIB being burned since each transaction will lead to several tokens being burned. They added that:

“The development team is currently evaluating potential gas fee rates for the blockchain network. The network’s gas fees are expected to be lower than the current fees on the Ethereum mainnet.”

The daily chart shows that the SHIB price has been in a strong bullish trend in the past few days. It moved above the important resistance level at $0.000010, the highest point on December 6. The token has surged above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) moved to the overbought level. Therefore, the SHIB crypto price will likely retreat slightly and then resume the bullish trend. If this happens, it will likely retest the key support level at $0.000010.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

OKX is a top cryptocurrency exchange which offers over 140 cryptocurrencies to invest in. OKX takes customer security very seriously, they store almost all of their clients‘ funds in cold storage, and the exchange is yet to be hacked. On top of this, the exchange offers very low fees and customers can even use their crypto as collateral for loans on the platform.

The post Shiba Inu price prediction ahead of Shibarium launch appeared first on CoinJournal.

It feels a little crazy to be writing this, but here we are anyway. 2023 is off to a flyer in the crypto markets, with optimism abounding that softer inflation data will lead to a loosening of monetary policy sooner than the market previously anticipated.

And one such “asset class” to benefit is that of memes. Doggy coins are printing returns that are straight out of Q1 of 2021, a time when Reddit was going to war with Wall Street over GameStop, Elon Musk was tweeting daily about fluffy dogs and, well, the money printer was firmly switched on.

The king and queen of the space, that is Dogecoin and Shiba Inu, are currently up 22% and 49% respectively this year.

Perhaps the curious case of Bonk sums up this bizarre resurgence best. The meme coin, inspired by Shiba Inu, was launched on Christmas Day on Solana. You know, that same Solana which was firmly in the wars, suffering from its close ties with Sam Bankman-Fried, repeated outages shutting down the network and seeing several of its top projects flee for rival blockchains.

Objectively, launching on Solana – and in the depths of the bear market, no less – was an objectively strange decision. And yet, what is logic in the crypto meme market? The coin was up 2500% within ten days, exploding upwards past a $200 million market cap. It has since fallen back to Earth a little but is still trading at a $50 million market cap.

But why are meme coins doing so well? Well, the first answer is that the entire crypto market is. When looking at even the biggest cryptos, they are all printing impressive returns. Memes don’t look so dizzying in comparison.

The surge is due to inflation data coming in below expectations. While figures are still extreme, and well north of the 2% target of the Fed, there are perceptible signs that it has peaked. Investors have taken this as a sign that the death sentence for risk assets, that is high interest rates, may peel off sooner as a result.

Shiba Inu, for its part, is surging off more than just positive macro factors. It has jumped 20% after news that it will be listed on Upbit, the most popular South Korean exchange. This comes amid hype around the upcoming and much-anticipated Shibarium Beta launch.

Shibarium Beta will be a layer-2 network built on top of Ethereum, the same way Polygon and Arbitum work.

Personally, I can’t put too much weight into this (still mysterious) Layer-2 project from Shiba. Memes are exactly that – memes – and these were never a fundamental play. It would take a lot more than blind speculation about Sihbarium to convince me that Shiba will ever be used for anything other than trying to buy it with the hope of selling it on a greater price.

But that is the thing with memes. There has never been an argument here that there is any value. They’ve always been a sort of middle finger to prudent investing, a misbehaving younger sibling to the “responsibility” of actual investing.

However, this is all fun and games in a climate printing more cash than at any point in history. It’s all great when interest rates are zero and cheap capital is ubiquitous. And it’s amazing when a pandemic strikes the world, with millions of people locked down with nothing to spend their stimulus cheques on.

Unfortunately, that is not the world we live in any longer. I’ve said it before and I’ll say it again – the joke is over with memes. They no longer present as a chance to strike retirement gains. They were always a reckless gamble, and that is fine. But now they are no longer this novel source of endless entertainment, they’re just kind of sitting there as the world deals with the worst economy since crypto was launched when Bitcoin went live back in 2009.

Things may be more optimistic than they were a month or two ago. But inflation is still crippling, despite the fact it has slightly fallen. Rates are still high and there are a million variables that could make this volatile economy a lot worse in a very short space of time.

It’s hardly jaw-dropping to say, but be careful with the doggy tokens. When the music stops – and it always does – it’s not a fun place to be.

The post Are meme coins back, as Shiba and Doge rocket upwards? Eh…no appeared first on CoinJournal.