-

Uniswap price has been in a recovery mode in the past few weeks.

-

Analysts expect that decentralized exchanges will thrive in the long term.

-

It has formed a bearish divergence pattern.

Uniswap price has made a slow recovery in the past few weeks as demand for its ecosystem rose. UNI rose to a high of $6.15, which was about 30% above the lowest level this year. Its market cap has risen to about $4.6 billion, making it the 17th biggest cryptocurrency in the world.

Uniswap ecosystem growth

Uniswap is changing the blockchain industry. It first decentralized the exchange sector by making it easy for people to swap tokens easily in a decentralized manner. Today, it is the biggest DEX by volume. According to CoinMarketCap, the third version of Uniswap handled tokens worth over $536 million.

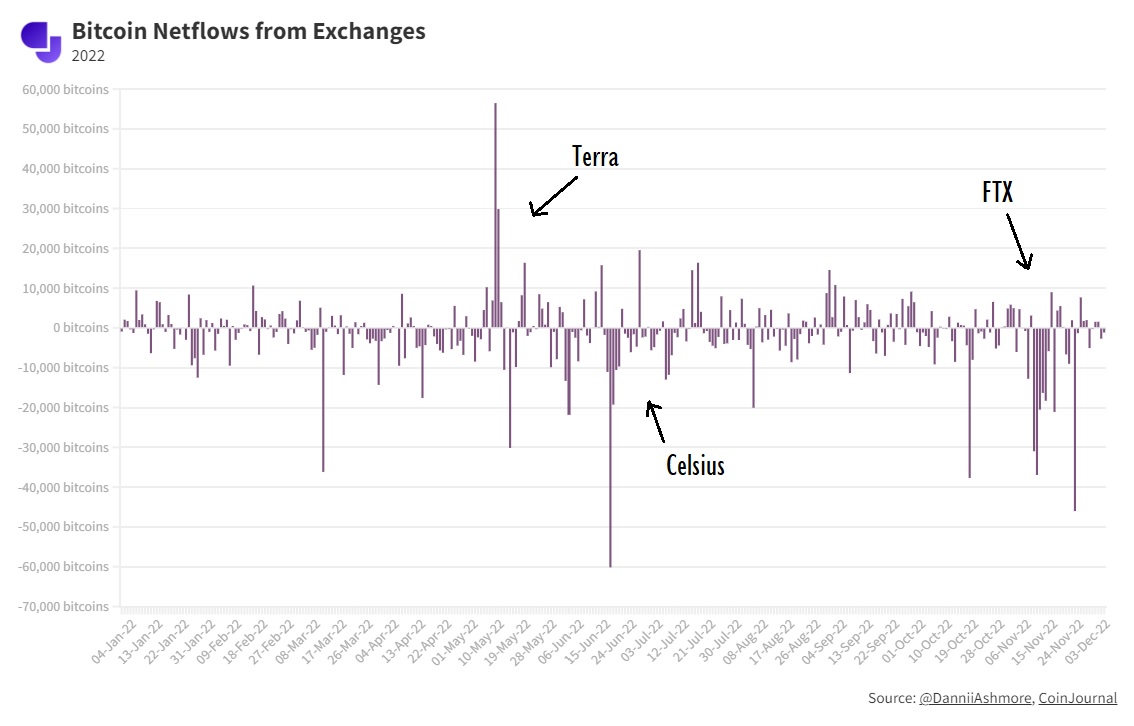

Analysts expect that decentralized exchanges will do well in the future because they are relatively safer than centralized platforms. As we have written in these articles, several centralized platforms like FTX, Voyager Digital, Celsius, and BlockFi have collapsed this year. Most decentralized platforms have done relatively well.

Uniswap price has also moved to the non-fungible token (NFT) industry. It has created a platform where people can buy and sell NFTs in a decentralized manner. The most popular NFT collections in its ecosystem are CryptoPunks, Bored Ape Yacht Club, Mutant Ape Yacht Club, and Art Blocks among others.

While Uniswap’s NFT platform is relatively new, its volume has continued growing since it was launched. The benefit of its platform is that it aggregates NFTs from across multiple chains, meaning that it has more listings than the average platform.

Another benefit is that it is decentralized and there are signs that such platforms are better and safer. Still, the challenge is that there are concerns about the future of NFTs as interest rates remain significantly high.

Uniswap price prediction

The four-hour chart shows that the Uniswap price has been in a slow bullish trend in the past few weeks. In this period, the token managed to move from the year-to-date low of $4.7 to a high of $6.55. It is now hovering at the highest level since November 15.

UNI has rallied above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has formed a bearish divergence pattern. In price action analysis, this pattern is usually a sign that the bullish trend is fading.

It has also formed a small double-top pattern. Therefore, Uniswap will likely continue falling as sellers attempt to retest the support at $6. A move above the resistance at $6.48 will signal that there are more buyers in the market.

eToro

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

OKX

OKX is a top cryptocurrency exchange which offers over 140 cryptocurrencies to invest in. OKX takes customer security very seriously, they store almost all of their clients‘ funds in cold storage, and the exchange is yet to be hacked. On top of this, the exchange offers very low fees and customers can even use their crypto as collateral for loans on the platform.

The post Uniswap price prediction as a bearish divergence forms appeared first on CoinJournal.