Der FTX-Skandal könnte zur Folge haben, dass schon bald viele Kryptos als Wertpapiere eingestuft werden, um für mehr Anlegerschutz und Rechtssicherheit zu sorgen.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Der FTX-Skandal könnte zur Folge haben, dass schon bald viele Kryptos als Wertpapiere eingestuft werden, um für mehr Anlegerschutz und Rechtssicherheit zu sorgen.

Are you a crypto gamer or play video games? The advent of blockchain has enabled gaming to go to the next level. Crypto gaming allows you to play and earn cryptocurrencies or non-fungible tokens (NFTS) after winning. There are notable platforms where you can game and earn tokens. With crypto gaming relatively new, you can buy and benefit from the price appreciation of the native tokens to associated blockchains. Here are our top picks based on market capitalisation:

ApeCoin is the biggest gaming blockchain, with a market cap of $1.429 billion. The gaming blockchain is famous for the Bored Ape and Mutant Ape NFT collections.

The native token APE is classified as an ERC20 token, meaning it resides on the Ethereum blockchain. The token was officially released on March 16, 2022. APE has particularly been robust lately on the launch of staking feature and NFT marketplace. Stakers on the platform will start earning rewards on December 12, 2022.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

Since 2018 Nexo has strived to bring professional financial services to the world of digital assets. Leveraging the best of the team’s years of experience in FinTech along with the power of blockchain technology, Nexo empowers millions of people to harness the value behind their crypto assets, shaping a new, better financial system.

Besides ranking as a popular metaverse platform, The Sandbox (SAND/USD) is a crypto gamers’ darling. Players can create 3D worlds and participate in play-to-earn games on The Sandbox.

SAND, the native token, facilitates gameplay transactions. Users can use SAND to buy plots of land in the metaverse. SAND comes second among gaming tokens on market cap, with a valuation of $865 million.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

OKX is a top cryptocurrency exchange which offers over 140 cryptocurrencies to invest in. OKX takes customer security very seriously, they store almost all of their clients‘ funds in cold storage, and the exchange is yet to be hacked. On top of this, the exchange offers very low fees and customers can even use their crypto as collateral for loans on the platform.

It is a top blockchain gaming platform popularly known for Pokémon-Esque creatures dubbed Axies. In fact, despite ranking lower on the market cap than its predecessors, Axie Infinity is recognised as a leader in play-to-earn gaming. Gamers engage in a monster-battling game for an alluring promise of rewards.

Axie Infinity native token AXS is the governance token. The token has a market cap of $848 million.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

OKX is a top cryptocurrency exchange which offers over 140 cryptocurrencies to invest in. OKX takes customer security very seriously, they store almost all of their clients‘ funds in cold storage, and the exchange is yet to be hacked. On top of this, the exchange offers very low fees and customers can even use their crypto as collateral for loans on the platform.

Another metaverse platform that ranks fourth in gaming tokens’ with a market cap of $729.4 million. Gamers can play games on Decentraland, buy and sell digital real estate, and interact with other users.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

OKX is a top cryptocurrency exchange which offers over 140 cryptocurrencies to invest in. OKX takes customer security very seriously, they store almost all of their clients‘ funds in cold storage, and the exchange is yet to be hacked. On top of this, the exchange offers very low fees and customers can even use their crypto as collateral for loans on the platform.

Gaming tokens carry a promising future amid the prolonged crypto winter. With the sharp decline in prices, the top gaming tokens could return big when cryptocurrencies recover.

The post Top 4 gaming tokens to buy when the market returns appeared first on CoinJournal.

Sushiswap developers have submitted a new governance proposal to the community.

The proposal seeks to divert 100% of fees generated on the platform to Sushi’s multisig.

The funds would be used for Sushi’s multisig for a year or until new tokenomics are implemented.

Developers of the decentralised finance (DeFi) protocol, Sushiswap, have submitted a new proposal to the community. According to the proposal, 100% of the fees generated on the platform would be diverted to Sushi’s multisig for one year or until new tokenomics are implemented.

This latest cryptocurrency news comes as Sushiswap is currently facing a significant deficit in its treasury. The deficit threatens the protocol’s long-term operational viability.

In his proposal, the Head Chef, Jared Gray, said;

“After reviewing expenditures, it’s clear that a significant deficit in the Treasury threatens Sushi’s operational viability, requiring an immediate remedy. In my original proposal, Sushi operated with an annual runway of 9M USD. However, after my detailed review, we reduced that requirement to 5M USD. We made the reduction possible by renegotiating infrastructure contracts, scaling back underperforming or superfluous dependencies, and instituting a budget freeze on non-critical personnel and infrastructure.”

Despite reducing the project’s annual runway requirement from $9 million to $5 million, the treasury still provides for only about 18 months of runway.

The developers are now proposing to set up Kanpai, a fee-diversion protocol. The proposal, if accepted, will lead to 100% of fees diverted to the Treasury multisig for one year or until the project’s new token distribution and reward schemes become active.

The developers pointed out that the proposal is a temporary solution to a long-term problem. The proposal was put in place because new tokenomics will take time to implement

The Head Chef said;

“Kanpai is a temporary solution to a long-term problem, and a new tokenomics proposal is on the horizon, which will help address the long-term value proposition of Sushi for stakeholders. Sushi must implement a holistic token model that allows the rebuilding of the Treasury and delivers value for all stakeholders while reducing the fiscal liability carried solely by the protocol.”

In addition to Kanpai, the Sushi team said it increased its funding by securing several multi-million dollar partner deals.

However, the developers added that relying on business development deals is only part of a successful business model to secure Sushi’s future. In October, asset management firm GoldenTree invested $5.2 million in Sushiswap.

The post Sushiswap developers propose to divert 100% of fees generated to Sushi’s multisig appeared first on CoinJournal.

Mark Cohen war ebenfalls im Verteidigungsteam beim hochkarätigen Fall um Ghislaine Maxwell.

League of Kingdom Arena is a Decentraland competitor.

It combines the concepts of gaming with NFTs.

The number of active users in its ecosystem has dropped.

LOKA price has held quite well in the past few days even as user growth in the ecosystem dropped. League of Kingdom’s token rose to a high of $0.5342, which was the highest level since December 1. It has jumped by over 87% from the lowest level in November.

Gaming and NFTs are two of the biggest use cases for the blockchain industry. Their popularity grew during the Covid-19 pandemic as cryptocurrency prices surged and as people remained locked up in their homes. Some of the top blockchain gaming ecosystems were Sandbox and Decentraland.

League of Kingdom Arena is a blockchain gaming and NFT platform built on Ethereum and accelerated in Polygon. In it, the participants fight for dominion and win rewards as they go up the ladder. In addition, since it is a decentralised ecosystem, people can easily participate in their governance by buying LOKA coins.

There are other ways to participate in the League of Kingdom Arena. For example, you can buy your virtual land, which is viewed as a virtual piece of real estate. Holders of this land earn Ethereum rewards.

Further, users can adopt Drago and start earning $DST coins. The Drag Soul Token is similar to Axie Infinity’s Smooth Love Potion, which is used to fuel the ecosystem. Also, you can buy the LOKA token and take part in its governance.

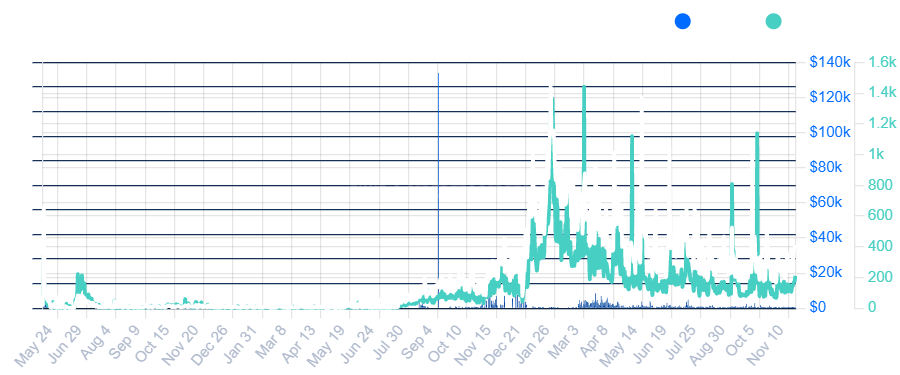

LOKA price has done well in the past few weeks even as its ecosystem growth has engaged reverse gear. In the past 30 days, the number of unique active wallets (UAW) in its ecosystem has dropped by 13% to 2,000. The number of transactions has dropped by 33k to 2.96k while the volume of these transactions has crashed by 56%. As shown below, the all-time trends of these metrics has not been encouraging.

The four-hour chart shows that the LOKA price has been in a strong bullish trend in the past few days. It has moved above the ascending trendline shown in black. Also, the coin rose above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved above the overbought level.

In the near term, the League of Kingdom token price will likely continue rising as buyers target the key resistance level at $0.60. In the long term, however, the coin will likely retreat as sellers target the key point at $0.45.

The post LOKA price prediction as League of Kingdom user growth slides appeared first on CoinJournal.