Während es für die Investition in der Krise viel Applaus gibt, werden auch kritische Stimmen am Vorgehen von MicroStrategy laut.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Während es für die Investition in der Krise viel Applaus gibt, werden auch kritische Stimmen am Vorgehen von MicroStrategy laut.

Wird die kommende MiCA-Verordnung mit dem liechtensteinischen Blockchain-Gesetz kompatibel sein? Das erklärt Dr. Thomas Dünser, der für den Aufbau des Innovations-Frameworks als auch das TVTG verantwortlich war.

Real-world economic performance undeniably impacts global cryptocurrency markets, with Bitcoin (BTC), the biggest crypto asset by market capitalization, proving an excellent guide to the health of the crypto industry. Recent increases in inflation worldwide, but particularly in the US, have seen the value of Bitcoin slide during the second half of 2022 as the global economic crisis takes hold.

While this isn’t great news for existing investors in the world’s leading cryptocurrencies, such as BTC, excellent investment opportunities in exciting new crypto projects remain. One of the most enticing new crypto projects is Metacade, which saw an enthusiastic uptake during its beta presale stage, raising almost $1 million in just three weeks.

Metacade is the world’s first virtual gaming arcade that uses Web3 and blockchain technology to revolutionize the GameFi metaverse industry. The platform will host the broadest range of play-to-earn (P2E) games in the metaverse and offer gamers the same level of fun and social interaction they’d get visiting a real-life video arcade from the comfort of their gaming chair or sofa.

The P2E element of the community is one of several ways community users benefit from the platform. The other revenue stream initiatives are:

In addition to the opportunities to earn, Metacade is a platform that allows budding developers to earn their stripes by supporting them to learn game development and has plans to become a self-sufficient and fully-fledged DAO by Q4 2024.

Unlike many GameFi platforms, Metacade has a diverse offering that stretches beyond the P2E element. The native token for the platform is the MCADE coin, and there are several ways Metacade generates revenue.

Metacade’s revenue-generating features include a range of pay-to-play arcade games, just like gamers would expect to find in a real-world video arcade. There’s also advertising on the platform, entry fees for prize draws and to compete in tournaments, and the launchpad initiative, which allows external companies to release games in Metacade for a price. These revenue streams provide the funds that flow into gamers’ wallets as they earn rewards.

The number of titles available on Metacade will continue to grow. This growth will be aided from Q3 2023 by the introduction of the Metagrants initiative. Metagrants are a source of funding for developers to build games on the platform. Developers submit gaming proposals to be voted on by MCADE token holders, who determine the community’s favorite ideas. The winning developers will receive funding to help turn their proposals into reality. The first Metagrant-backed games hit the Metacade library in Q1 2024.

Other features in the pipeline include introducing a jobs board in Q1 2024 to boost the Work2Earn initiative. The board will feature a range of opportunities from internships, short-term gig work, and full-time roles within the GameFi industry with Metacade-approved partners, giving anyone with a genuine interest in working in Web3 development a helping hand to get started in the industry.

Meanwhile, Metacade’s transition into becoming a DAO begins in Q2 2023, with the process estimated to take 18 months before community members assume all of the critical roles. This autonomy is one of Metacade’s leading lights; it hands control of the platform’s future direction to the most important community members.

The breadth of Metacade’s plans, found in more detail in their white paper, makes it an exciting prospect for investors hunting for new crypto projects. With many other GameFi developments focusing on a minimal range of options, it’s easy for them to become little more than a fad.

Metacade’s offering will not fall into that trap. The range of games on offer will continue to increase, providing additional opportunities to earn, whether through competitions, playing, or creating social content to engage with the community. Furthermore, the continual addition of new games means there’s no risk of the platform becoming boring or stale since it will continually reinvent itself with the regular release of new and exciting titles. As a result, Metacade has solid project longevity.

Additionally, the community will ultimately have complete autonomy over how Metacade develops. Gamers’ interests will forever be at the heart of the platform’s development, unlike in more traditional gaming, where developers have to balance that with providing a return to shareholders.

These plans place Metacade at the forefront of the blockchain gaming revolution.

The Metacade beta sale sold out in less than four weeks, making it one of the most attractive new crypto projects currently in its presale stage. The price will increase by more than double as the ninth and final presale round concludes, raising a total market cap of $28 million.

Getting on board with Metacade couldn’t be simpler. Tokens can be purchased on Metacade’s website by anyone with a Wallet Connect-supported crypto wallet.

You can purchase MCADE with ETH (Ethereum) or USDT (Tether). First, connect your wallet to Metacade’s website to access the DEX, and then accept the option to purchase MCADE with ETH or USDT.

You can buy BTC at eToro here.

You can participate in the Metacade pre-sale here.

The post Bitcoin (BTC) Price Slides as Inflation Is Going Up – Here’s Why Crypto New Projects Like Metacade (MCADE) Could Surge appeared first on CoinJournal.

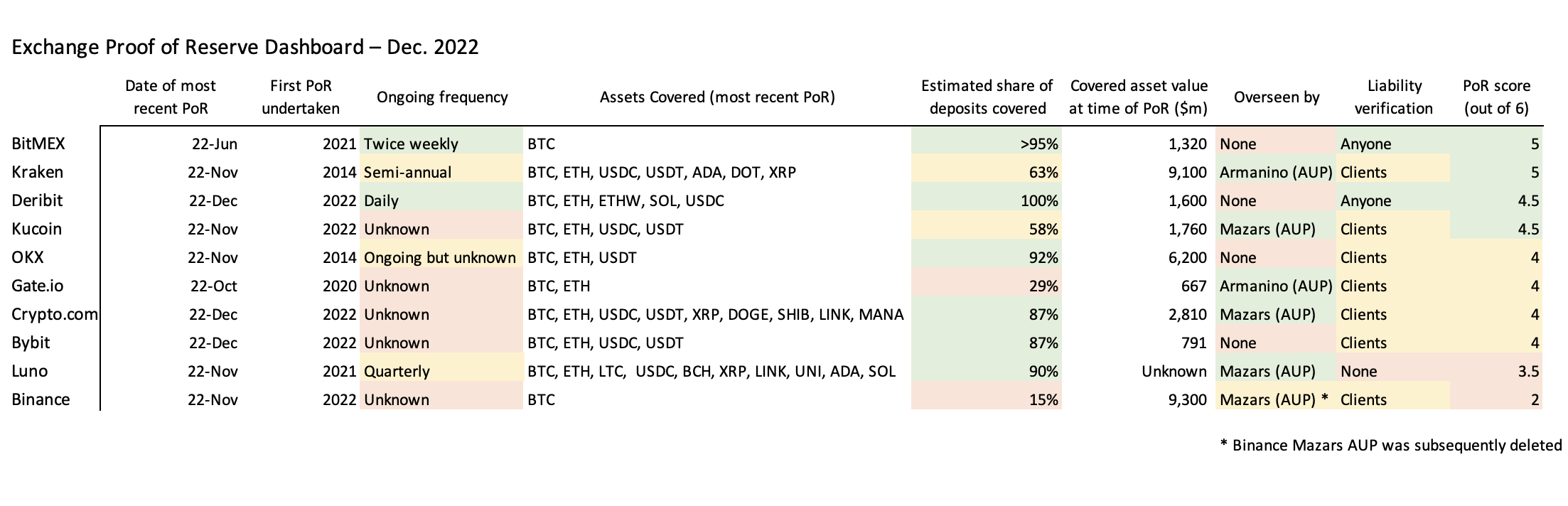

BitMEX and Kraken crypto exchanges received highest scores for their proof of reserves attestations.

BitMEX and Kraken score highly in an assessment of proof-of-reserves attestations by major crypto exchanges.

That’s according Nic Carter, one of the most popular Bitcoin advocates out there.

In a Medium article highlighting the score list and rankings of some of the leading crypto trading platforms, Carter points out the latest PoR results and offers insight into why some of the exchanges just getting to publish their cryptographic proof of reserves may still have a lot of work to offer the assurances the market seeks.

While Kraken and BitMEX rank highest, the world’s largest crypto platform Binance posts a relatively low score. But according to the crypto analyst, the move to have PoRs is undeniably one in the right direction. He sees the momentum as a good signal for cryptocurrencies, terming it “a genuine silver lining from the FTX debacle.”

“We may well yet emerge from this crisis with a major step forward in exchange credibility,” he wrote in his ‘The Status of Proof of Reserve as of Year End 2022’.

Looking at crypto exchange reserves attestations via metrics such as assets for which the platform provided the attestation, estimates of deposits covered and disclosure of liabilities, BitMEX scored the highest with 5 out of 6.

Crypto platform Kraken was second, while Deribit, KuCoin and OKX ranked third to fifth in that order.

Exchange proof of reserves scores and ranking. Source: Nic Carter on MediumWhile some platforms scored highly Binance’s proof of reserves was mostly ‘incomplete’ and thus the exchange scored poorly. In a comment on this, Carter wrote:

Exchange proof of reserves scores and ranking. Source: Nic Carter on MediumWhile some platforms scored highly Binance’s proof of reserves was mostly ‘incomplete’ and thus the exchange scored poorly. In a comment on this, Carter wrote:

“Binance’s first PoR doesn’t grant strong assurances. It only covers Bitcoin, which only represents 16.5% of their client assets. It does allow individual users to verify their inclusion in the liability set but does not contain the entire liability list, making it hard for a third party to verify the procedure.”

The post Nic Carter: BitMEX, Kraken top proof-of-reserves ranking appeared first on CoinJournal.

Polkadot price plunged hard in 2022.

The decline was caused by both internal and external factors.

It will only recover if the Fed shifts its tone and its ecosystem rebounds.

Polkadot price plunged by more than 84% in 2022m capping its worst year on record. DOT slipped to a low of $4.2, which was lower than its record high of $55. This performance was due to the overall weakness of cryptocurrencies, high-interest rates, and the collapse of key players in the crypto industry.

Polkadot price had its worst year on record due to multiple factors. First, it suffered from the biggest crypto news during the year following the collapse of FTX and Alameda Research. This collapse led to major challenges in the industry as exchanges like Binance and Coinbase recorded remarkable outflows.

Polkadot also plunged following the collapse of Terra and its ecosystem, which led to over $40 billion in total losses. The collapse pushed more people to lose faith in crypto tokens.

Further, an extremely hawkish Federal Reserve had an impact on Polkadot and other cryptocurrencies. The Fed hiked rates by 450 basis points and pointed towards more in 2023. This happened as inflation jumped to a 40-year high.

Internally. Polkadot’s ecosystem faced issues of its own. The most significant was the de-pegging of Acala Dollar, an algorithmic stablecoin developed by Acala Network. The stablecoin is yet to regain its peg.

Other Polkadot parachains also had major challenges. For example, Enjin’s Efinity saw little traction as demand for Non-Fungible Tokens (NFT) collapsed. Total NFTs sold dropped by more than 90% from January.

Meanwhile, Moonriver and Moonbeam have also struggled to gain traction in the DeFi and other industries like the metaverse.

Looking forward, the main driver for Polkadot price in 2023 will be the actions of the Federal Reserve. A dovish shift by the Fed will lead to more growth for the stock. DOT and other coins will not recover until the Fed shifts its tone and its ecosystem rebounds.

Turning to the daily chart, we see that the DOT price sell-off caught no breather in 2022. The coin continued falling as risks in the industry rose. As it crashed, it managed to move below all moving averages. It also moved to the lower side of the Bollinger Bands.

Therefore, the coin will likely continue falling as bears target the next key support level at $2. A rebound to about $20 will only happen if the Fed suddenly becomes dovish.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

OKX is a top cryptocurrency exchange which offers over 140 cryptocurrencies to invest in. OKX takes customer security very seriously, they store almost all of their clients‘ funds in cold storage, and the exchange is yet to be hacked. On top of this, the exchange offers very low fees and customers can even use their crypto as collateral for loans on the platform.

The post Polkadot price will not recover in 2023 until this happens appeared first on CoinJournal.