Die Anklagepunkte gegen die Drahtzieher im Betrugsfall der Kryptobörse FTX mehren sich.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Die Anklagepunkte gegen die Drahtzieher im Betrugsfall der Kryptobörse FTX mehren sich.

Die Aufsicht über den Betrieb des Unternehmens in dem Land hat Cormac Dinan, ein ehemaliger Mitarbeiter bei Crypto.com, Deloitte und Citigroup.

2022. What a year.

In crypto markets, it’s safe to say that it hasn’t been one the best. The world has transitioned to a new interest rate paradigm, with markets realising quite how much of the crypto space was predicted on overleverage at cheap rates.

That cheap credit is gone now and the rug of liquidity has been pulled, with market prices collapsing as a result. Throw in a few scandals – FTX, LUNA and Celsius, to name a few – and the markets have been absolutely torrid.

In this piece, we look back at the top 10 coins at the start of the year.

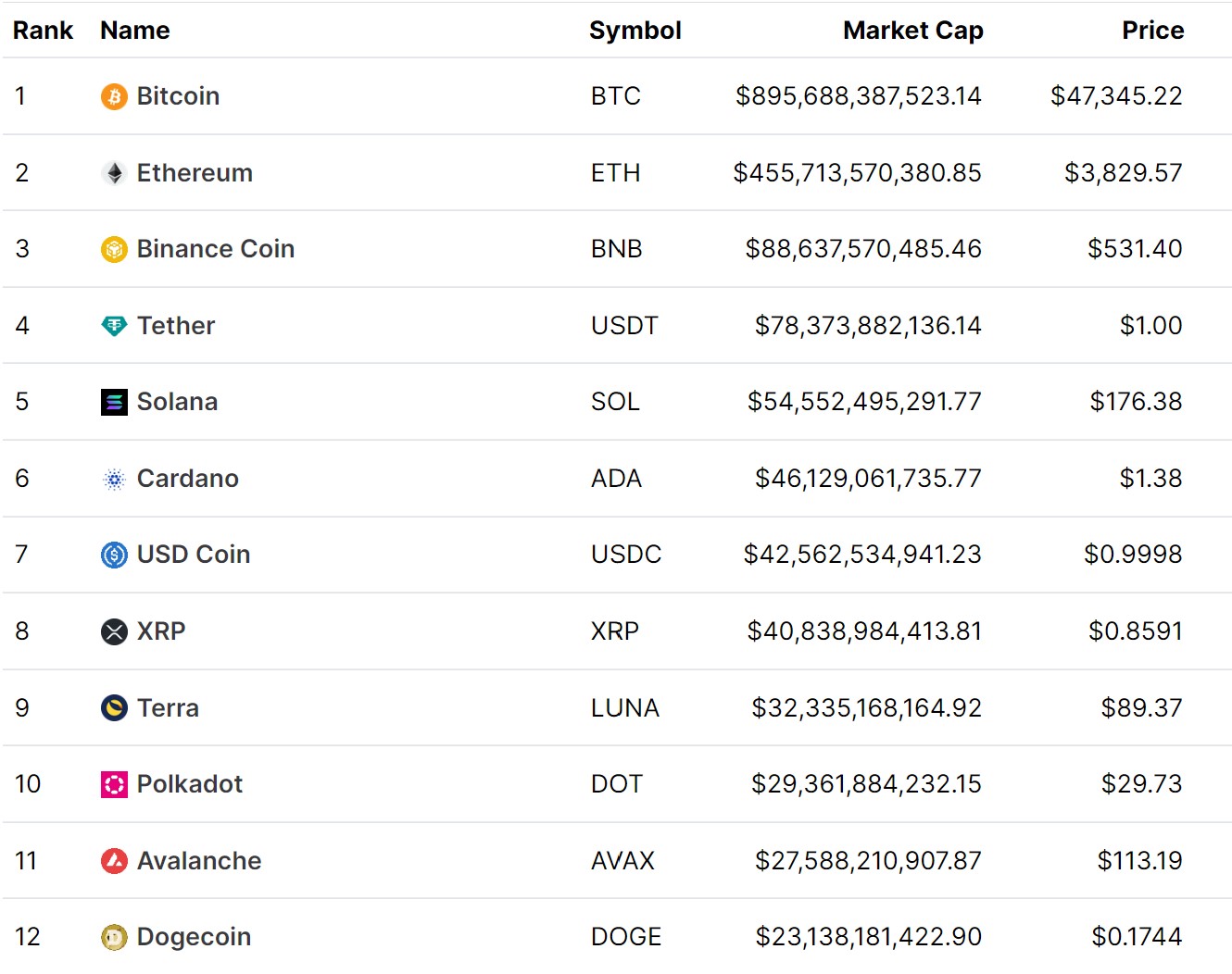

The below is a historical screenshot from the start of the year, taken off CoinMarketCap.

Bitcoin is not far off a trillion dollars, trading close to $50,000 and leading the way for the market at large. Ethereum has recently dipped below $4,000, while the third spot is occupied by Binance’s coin, BNB.

Bitcoin is not far off a trillion dollars, trading close to $50,000 and leading the way for the market at large. Ethereum has recently dipped below $4,000, while the third spot is occupied by Binance’s coin, BNB.

Tether is the first stablecoin on the list in fourth, while Solana jumps out next in fifth place. The coin, linked with a revered entrepreneur by the name of Sam Bankman-Fried, is marketing itself as an ETH killer and making serious gains, now over $50 billion in market cap.

The only other stablecoin is USD Coin in seventh, while Dogecoin ranks tenth when excluding the stablecoins, or twelfth overall. There is also LUNA, or Terra, in ninth – the coin which powers the burgeoning DeFi ecosystem that is Terra.

Life is good, life is fun, life is up-only. Sure, the market has peeled back a little from November, when Bitcoin hit its all-time high of $68,739, but prices are still high and profits are flowing. Happy New Year, and roll on 2022.

One year later, you could probably argue things are a little different. I have collated the performance of the top 10 coins (excluding the two stables) into the chart below:

Luna, obviously, has pretty much gone to zero. Solana comes in as the second-worst performer, losing a staggering 92% of its value in 2022. From being ranked as the fourth biggest crypto, it is now sixteenth. Avalanche has also killed investors, falling from eleven to eighteen and shaving 87% of its value in the process.

The best performers, on the other hand, are BNB, XRP and Dogecoin, the trio losing “only” 56%/57% of their value. BNB, despite the recent controversy around Binance, looks set to end the year as the fifth biggest crypto, having let USDC and USDT overtake it.

This year, it really has been only stablecoins that have been immune to the price action. Even Bitcoin and Ethereum are down 64% and 67% respectively. Again, all these figures would be enlarged even further if expanded back to all-time highs of November.

Investors will be relieved to see the year come to a close, such has been the punishment in markets. The only problem is, we are still in a high-interest rate environment, the industry is still dealing with the fallout of FTX, and the world is a very uncertain place right now.

The post 2022: Looking back at the top 10 coins one year ago today appeared first on CoinJournal.

Die Bundestagsanhörung zum Metaverse verpasst Chance zum Gedankenaustausch.

Cryptocurrencies have remained deep within an unforgiving crypto winter for all of 2022. That’s it.

And December is not offering much relief to traders so far, not with heavy duty contagion amid a spike in the number of crypto projects falling into distress.

It’s thus surprising to say that interest in Bitcoin, the world’s largest cryptocurrency by market cap, soared throughout the year. But then it has.

The price of Bitcoin fell below $16,000 after FTX’s implosion, but as CoinJournal recently reported, large investors appear to have used that as an opportunity to buy more. That is interest that has reflected throughout the year as prices nosedived from last year’s peak above $69,000.

According to an in-house metric Yahoo Finance uses to measure investor interest across the markets, BTC has seen a laser-like focus from investors even as prices plunged to lows last seen in 2020.

A report the company published on Thursday showed that the BTC/USD quote has so far accumulated over 157 million views in 2022. Ranked alongside other top assets, the flagship cryptocurrency falls within the top 10. Indeed, as of Thursday, bitcoin ranked 8th on the platform’s list of top 10 trending tickers.

Looking at the list, Tesla Inc. (TSLA) stock quote ranks first with more than 398 million views, followed by the three major US indices (the Dow Jones Industrial Average, the S&P 500 and Nasdaq). Tech giant Apple Inc. (AAPL) sits 5th with more than 249 million page views while Amazon (AMZN) comes next with 199 million views so far.

Ethereum (ETH) is 25th on the list in terms of investor interest as measured by 63.8 million page views so far. Elsewhere, Coinbase (COIN) has also been on top of investors’ list of interesting assets, with the crypto stock ranked 30th after more than 57 million quote views.

The post Bitcoin interest surged in 2022 despite ‘crypto winter’: report appeared first on CoinJournal.