Der Anwalt von Ripple John Deaton hat auf seiner Webseite CryptoLaw eine Petition, die Tausende Leute unterschrieben haben. In dieser wird gefordert, dass der Kongress ein verdächtiges Treffen zwischen der SEC und FTX untersucht.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Der Anwalt von Ripple John Deaton hat auf seiner Webseite CryptoLaw eine Petition, die Tausende Leute unterschrieben haben. In dieser wird gefordert, dass der Kongress ein verdächtiges Treffen zwischen der SEC und FTX untersucht.

„Die Kommission hält es für angemessen, die Frist für die Genehmigung oder Ablehnung der vorgeschlagenen Regeländerung zu verlängern“, so die SEC.

The crypto lending arm of Genesis Global Trading, which prices itself as the premier institutional digital asset financial services firm, has temporarily suspended the redemption and issuance of new loans.

Genesis announced the developments through a tweet saying:

“We recognize how challenging this past week has been due to the impact of the FTX news. At Genesis we are entirely focused on doing everything we can to serve our clients and navigate this difficult market environment.”

The lending unit, which is known as Genesis Global Capital, had $2.8 billion in active loans according to its 2022 Q3 report.

Genesis Trading, which is Genesis Global Capital’s dealer/broker, is capitalized independently and operates separate from the lending unit.

In a follow up tweet, Genesis said:

“We would like to emphasize that Genesis Global Trading, our broker/dealer that holds our BitLicense, is independently capitalized and operated – and separate from all other Genesis entities.”

It further emphasized that:

“Genesis’s spot and derivatives trading and custody businesses remain fully operational. We continue to support our clients who rely on us during volatile market conditions to manage their risk and execute on their business strategies.”

According to Genesis, the default of a loan issued to Three Arrows Capital negatively impacted the “liquidity and duration profiles’ on their lending entity and since then they have been “de-risking the book and shoring up our liquidity profile and the quality of our collateral.”

But there have been abnormal withdrawals exceeding the lending unit’s liquidity due to the market turmoil caused by the FTX crisis thus necessitating the temporary suspension of redemption and new loan origination in the lending business.

Genesis has also said that they are exploring best solutions for the lending business including sourcing new liquidity.

The post Genesis’ $2.8B crypto lending unit halts withdrawals appeared first on CoinJournal.

According to a recently released monthly outlook by Coinbase, the crypto market could be in for a longer winter than previously anticipated all because of the FTX crisis. Coinbase’s report support what was highlighted in our earlier news coverage, showing the crypto market could suffer more because there were many counterparties that had interacted or lent funds to either Alameda or FTX.

According to Coinbase’s report, the FTX crisis has made investors lose confidence in crypto platforms and also created a liquidity crisis within the crypto market that could easily extend until the end of 2023. The implosion of the world’s third-largest cryptocurrency exchange has triggered a fallout in the crypto ecosystem.

Many institutional and individual investors who had cashed in on FTX have their funds stuck on the exchange after it filed for bankruptcy on November 11. This in a way has caused fear among investors and buyers and thus deterring them from the cryptocurrency ecosystem.

The FTX bankruptcy proceedings may have significant legal complications and may also limit the probability of contagion as the courts look for a safe outcome.

With the whole drama around FTX having upset what was otherwise an emerging positive comeback since the Terra Luna collapse, the FTX bankruptcy will be closely watched although a lot within the crypto space depends on the path of US Federal Reserve interest rates.

Already bid-ask spreads on most crypto platforms have widened since market makers who used FTX as a liquidity pool feel less confident transacting in it.

In the report, Coinbase says:

“We believe poor liquidity conditions may last through at least the end of the year. Stablecoin dominance (see chart 1) has risen to a very high 18% of the total crypto market cap, which has itself fallen from ~$1T at the end of October to ~$800B as of November 12.”

Besides lack of confidence among investors and liquidity crisis, the crypto market is also witnessing very high volatility levels considering the amounts of withdrawals being witnessed across crypto platforms due to fear.

For example following the increased Bitcoin outflows from exchanges, Bitcoin volatility has increased to 66% which is close to what was witnessed at the end of June after the Celsius and Three Arrow Capital crisis.

The majority of cryptocurrencies including Ethereum (ETH) and Bitcoin (BTC) have already given up their previous gains.

In conclusion, Coinbase finds that the market will take time to recover from the current situation.

In the report, the exchange notes:

“Remediation will take time, and very likely this could extend crypto winter by several more months, perhaps through the end of 2023 in our view. Truthfully, it was going to be a challenging market regardless, as traditional risk assets still need to reckon with the high likelihood of a US recession in 1H23.”

In addition to the tough condition within the crypto space, there is also the policy tightening in the US and a stronger dollar that has increasingly made it difficult for investors to hold long positions in the crypto market and other high-risk markets.

The post Crypto winter could extend to end of 2023 due to the FTX crisis, report shows appeared first on CoinJournal.

I’m kind of getting sick of the word “contagion”.

Nonetheless, it appears the C-word is coming for the digital asset space again. By now we are familiar with the collapse of FTX, one of the world’s largest cryptocurrency exchanges.

But it’s far from over.

While the crash here does not compare to the infamous death spiral of UST and LUNA (to refresh my PTSD), that scandal does show how far-reaching the tentacles of such a sudden loss of capital can cause.

UST was worth $18.6 billion and LUNA $29.7 billion on the eve of the Terra meltdown in May. Within a couple of days, those figures were zero. FTX, on the other hand, is reportedly looking at a balance sheet hole of $8 billion.

So, the numbers are not as comparable, but the domino effect could be. Numerous firms got caught up in the Terra crash by holding UST on their balance sheets, as well as being over-exposed to other crypto assets, all of which fell in the aftermath of the scandal.

We saw Celsius file for bankruptcy, owing $4.7 billion to over 100,000 creditors. Voyager Digital, another crypto lending firm, also had over 100,000 creditors on the hook – although for a lower sum of $1.3 billion.

Then there was Three Arrows Capital, owing $3.5 billion to 27 different companies. I could go on, but you get the point. The crypto industry was far to incestuous, with companies holding pieces of other companies, despite all being exposed to the same systemic risk.

In retrospect, it all reads like a cautionary tale for risk management and diversification. How crypto companies thought it was wise to trade their own Treasuries, assets and whatever other liquidity they had, on the very same highly volatile asset class to which their business was already exposed, is beyond me.

But they did, and the domino effect followed.

The question now becomes this: who is exposed to FTX?

One hopes that the industry learned a lesson from Terra and hence is more prudent this time around. Then again, the flipside is that FTX seemed like they were as safe as could be: funds were stored there in stablecoins and fiat – not just highly volatile cryptocurrencies.

Much like those who fell victim to UST thought that it was a stable asset pegged to $1, there are those who got blindsided by FTX, simply leaving their funds in the exchange denominated in fiat currency.

We know now that Sam Bankman-Fried had other ideas, sending these funds to his sister trading firm Alameda Research, following a series of bad investments and loans getting called in. Ironically, these loans were likely called in the aftermath of the LUNA crash, when spooked investors moved to get their funds of crypto by all means possible.

Companies are already beginning to wobble. BlockFi, yet another crypto lender, paused withdrawals and issued a statement outlining that the damage was stark.

“We do have significant exposure to FTX and associated corporate entities that encompasses obligations owed to us by Alameda, assets held at FTX.com, and undrawn amounts from our credit line with FTX.US,” BlockFi said.

They had signed a deal with FTX in July for a $400 million revolving credit facility. It is hard to see them recovering after pausing withdrawals – which we know by now is the death sentence.

The money actually goes beyond aggressive crypto firms. Sequoia Capital, SoftBank, and Tiger Global, who are as big and boring as traditional investors get, have all been burned.

“Based on our current understanding, we are marking down our investment to $0”, Sequoia said in a note to LPs. I think we can all agree that’s a fair call.

SoftBank is reported to have lost $100 million, while Tiger Global is apparently down $38 million.

I was let go by Sequoia Capital today. Buck had to stop somewhere. I was the 27 year old associate responsible for copying and pasting revenue and profit numbers from a spreadsheet in the FTX data room into a PowerPoint slide in an investment memo as diligence

— Kyle Russell (@kylebrussell) November 10, 2022

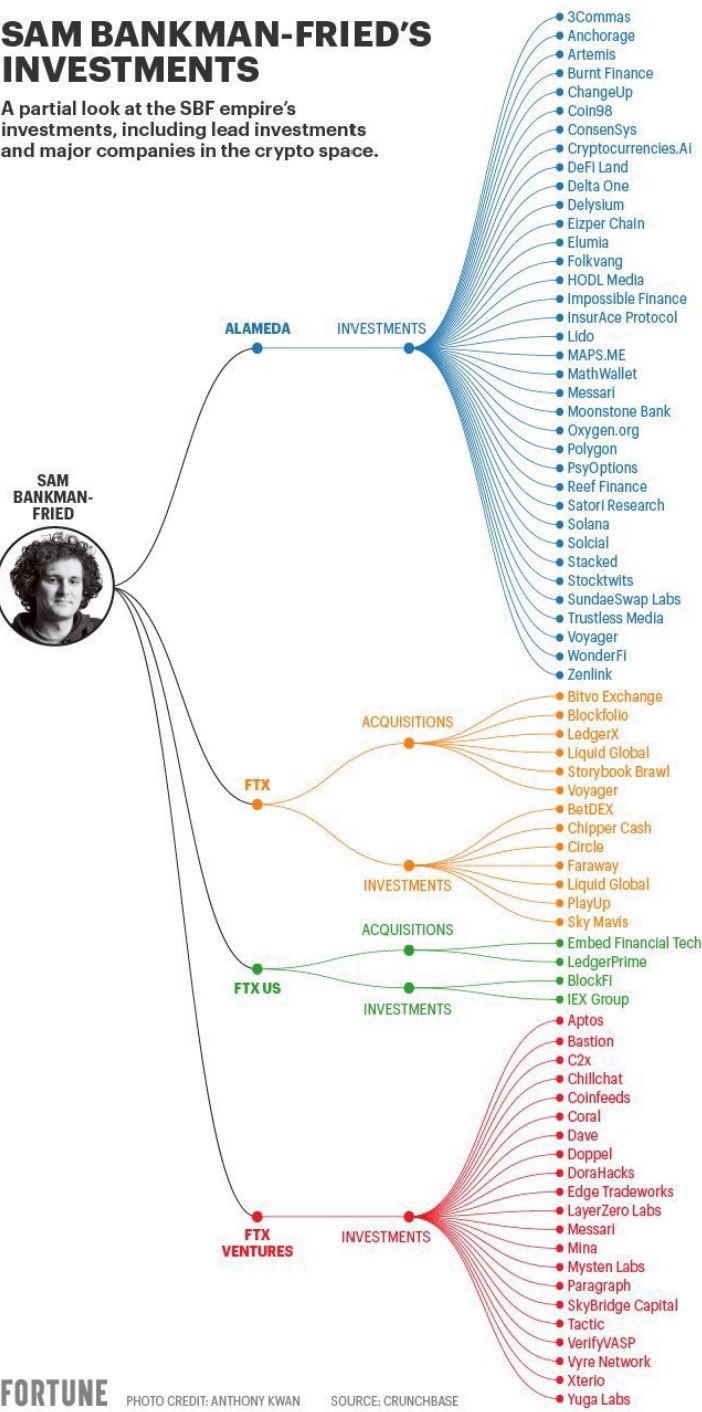

A quick glance a the below graphic should tell you all you need to know:

As I said, I don’t expect this to be as grave a liquidity crisis as LUNA. But it would be delusional not to expect further pain – and that includes some sombre announcements which will come out of the blue. There will be companies caught up in this mess that will take people by surprise.

$10 billion is a hell of a lot of money. It can’t disappear without reverberations elsewhere. Hopefully, the damage is as minimal as could be hoped for, given the lessons shown by the LUNA fiasco.

But surely this will finally persuade CEOs and treasury managers to allocate their capital wisely, perform diligent stress tests, pay proper attention to diversification and just…be sensible.

It must, right? Right?

The post Expect crypto contagion as FTX crisis is far from over appeared first on CoinJournal.