Der provisorische Insolvenzverwalter sieht sich als einzige autorisierte Person, um weitere Insolvenzverfahren einleiten zu dürfen.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Der provisorische Insolvenzverwalter sieht sich als einzige autorisierte Person, um weitere Insolvenzverfahren einleiten zu dürfen.

November has been a terrible month for the cryptocurrency industry. Most crypto prices have collapsed by more than 20% while the total market cap of all digital coins has crashed from over $1 trillion in October to about $830 billion.

Digital coins have crashed because of the fallout of FTX, the second-biggest cryptocurrency exchange in the world. Therefore, there are fears of contagion in the sector. Still, some analysts believe that DeFi networks will benefit from the collapse of FTX and other centralized companies like Voyager Digital and BlockFi. So, here are the best DeFi cryptos to buy for the long term.

Uniswap is a leading DeFi ecosystem built on Ethereum, Polygon, Avalanche, and Celo. It is a leading decentralized exchange (DEX) that makes it possible for people to buy and sell cryptocurrencies.

Uniswap handles more than $1 billion worth of transactions on a daily basis. Indeed, its Ethereum volume has moved above that of Coinbase.

Analysts believe that Uniswap is a good investment because of its leading market share in the DEX industry. Its ecosystem is also growing rapidly while the amount of fees it generates is the third biggest in the industry after Ethereum and Lido.

Its fees in the past 24 hours were $1.43 million, compared to Ethereum’s $3.1 million. Further, its reputation makes it one of the best DEX in the industry.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

Capital.com is a global broker which offers over 200 cryptocurrencies for its users. It comes with a range of features such as; great security, 24/7 support, demo accounts and a wide variety of assets. On top of that, it also has no inactivity, withdrawal or deposit fees, which makes it stand out from other crypto brands.

Buy UNI with Capital.com today

Lido is one of the biggest DeFi platforms in the liquid staking industry. It has a total value locked (TVL) of more than $33 billion, making it the third-biggest players in the DeFi industry. It has over $5.7 billion in staked assets and has paid over $212 million in fees.

Most of these assets are in Ethereum’s network, which has over $5 billion. It is followed by Polygon, Solana, and Polkadot. LIDO prices will likely do well in the long term. Lido generated fees of over $1.7 million.

As LDO is such a new asset, it’s yet to be listed on major exchanges. You can still purchase LDO using a DEX (decentralised exchange) though, which just means there are a few extra steps. To buy LDO right now, follow these steps:

We suggest eToro because it’s one of the world’s leading multi-asset trading platforms, an exchange and wallet all-in-one with some of the lowest fees in the industry. It’s also beginner-friendly, and has more payment methods available to users than any other available service.

You’ll need to create your wallet, grab your address, and send your coins there.

Head to 1Inch, and ‚connect‘ your wallet to it.

Now that you’re connected, you’ll be able to swap for 100s of coins including LDO.

PancakeSwap is the third-biggest DEX in the world after Uniswap and dYdX in terms of volume. It is a DEX that makes it possible for people to buy and sell digital currencies. It has features that enable people to trade non-fungible tokens (NFT) and participate in decentralized lotteries. Like FTX, PancakeSwap provides traders with a platform to trade perpetual futures.

PancakeSwap has a TVL of over $3.8 billion and it handles over $600 million in transactions on a daily basis. CAKE will likely thrive in the coming months as more investors and users shift to DEXes.

Skilling is a Scandinavian based cryptocurrency broker which has a desktop website as well as apps for iOS and Android devices. It supports over 50 cryptocurrencies and it has a demo account to allow users to gain familiarity with the platform. Skilling has no hidden fees, it is an officially regulated broker and it supports a wide range of payment methods.

Capital.com is a global broker which offers over 200 cryptocurrencies for its users. It comes with a range of features such as; great security, 24/7 support, demo accounts and a wide variety of assets. On top of that, it also has no inactivity, withdrawal or deposit fees, which makes it stand out from other crypto brands.

Buy CAKE with Capital.com today

The post Best DeFi cryptos to buy for the long term appeared first on CoinJournal.

The dominoes continue to fall, triggered by this FTX saga.

Major crypto lender Genesis Capital suspended withdrawals on its lending business yesterday. If there is one thing that crypto investors know by now, it is this: once that fateful decision to suspend withdrawals is taken, the jig is up.

This is a big deal. Genesis had $2.8 billion of active loans as of Q3 in 2022, while it originated $8.4 billion over the course of the quarter. That’s a hefty chunk of change.

In my piece last week looking at what was next for crypto, I talked about the inevitable contagion.

“Expect some contagion to ripple out of this, as we don’t know yet who was exposed to who – but FTX, as such a large player in the industry, will no doubt drag a few bodies down with them”

Well, to quote that catchy Drake song, “bodies are (starting) to drop”. It’s just not a question of if; it’s more a question of who.

Genesis said its decision to suspend loan operations was due to “abnormal withdrawal requests which have exceeded our current liquidity”. Yeah, I bet.

The ecosystem is – and will continue to be – tested to its limit. Let’s keep looking at Gensesis, a key figure in the lending space. One partner they have is Gemini, for whom they provide this yield-earning service. Gemini, the exchange run by everybody’s favourite identical twins, Tyler and Cameron Winklevoss (I wonder if Cameron is peeved that Tyler always gets listed first?), therefore had people worried.

A few hours after Genesis’ announcement, Gemini then issued a statement saying that withdrawals from their Earn programme had been suspended. Inevitable.

“We are working with the Genesis team to help customers redeem their funds from the Earn program as quickly as possible. We will provide more information in the coming days,” Gemini said.

1/6 We are aware that Genesis Global Capital, LLC (Genesis) — the lending partner of the Earn program — has paused withdrawals and will not be able to meet customer redemptions within the service-level agreement (SLA) of 5 business days. https://t.co/9e48pF3Ymn

— Gemini (@Gemini) November 16, 2022

The firms join BlockFi in suspending withdrawals, yet another crypto lender in desperation mode following the FTX collapse. The firm is reportedly ready to layoff workers and file for bankruptcy.

There is a big difference between what is happening at all these companies and FTX, however. Sure, all the firms are employing reckless risk management, a complete lack of diversification and have been asking for all this mayhem.

As Sam said in one of his stream-of-consciousness tweet threads (which have only served to throw gasoline on all this fire), “that risk was correlated – with the other collateral, and with the platform. And then the crash came…and at the same time there was a run on the bank”.

Which, you know, should not exactly take a rocket scientist to figure out. Crypto is immensely correlated and extraordinarily volatile. So, when you invest in 100% crypto, it should not really be a surprise when these red days come.

That is exactly what happened at BlockFi, Gemini Earn and all these products. You know – exactly like what happened at Voyager Digital, Celsius and all the other cowboy firms who promised customers yield in return for their assets.

By now, people know these platforms are risky. They know that every cent they put in is vulnerable to a disappearance act.

But FTX was not one of these platforms. FTX was an exchange. And riddle me this, Sam. How does an entity that is not a bank suffer from a run on the bank? I keep saying FTX was an exchange because it is vitally important. Customers should deposit cash to exchanges, before either leaving it there as cash, or buying crypto assets. Then, when they go to withdraw, it should just be…there.

The exchange should make money on trading fees, deposit fees, whatever. It should not be acting like a fractional reserve bank, sending deposits to its sister trading firm and then gambling with them.

Customers may have known what was going on at BlockFi and the gang, but with FTX, they didn’t. And that is why people are so angry. It’s also why it feels like fraud (although I have no idea about the ins and outs of the laws. My gut tells me Sam was smart enough to avoid direct violations, but who knows).

$8 billion of cash doesn’t disappear into thin air without a few problems. Genesis is a big one, but there will be more. It’s why I am surprised that Bitcoin has held up relatively well.

The pain won’t stop here, as discussed in my piece yesterday – not only is this a massive drain on liquidity, but Bankman-Fried had his hands on a lot of companies.

For anyone still in yield-earning products, I would be very scared. For me, once Terra collapsed, these platforms presented a risk-reward profile which I simply couldn’t justify any longer. Sure, they may say that they are good, but so did management teams at Celsius, BlockFi, and all the rest of them. The most important thing to quell a bank run is to keep panic to a minimum – they all know that.

Is the yield – be it 4%, 5%, 10% – really worth risking all your holdings? This is no longer an up-only economy. This is a very real bear market, while within the cryptocurrency space, there is capital fleeing for the doors faster than ever before.

So let me ask again. Is that yield really worth it?

The post Are your funds safe? Crypto lending platforms continue to fall appeared first on CoinJournal.

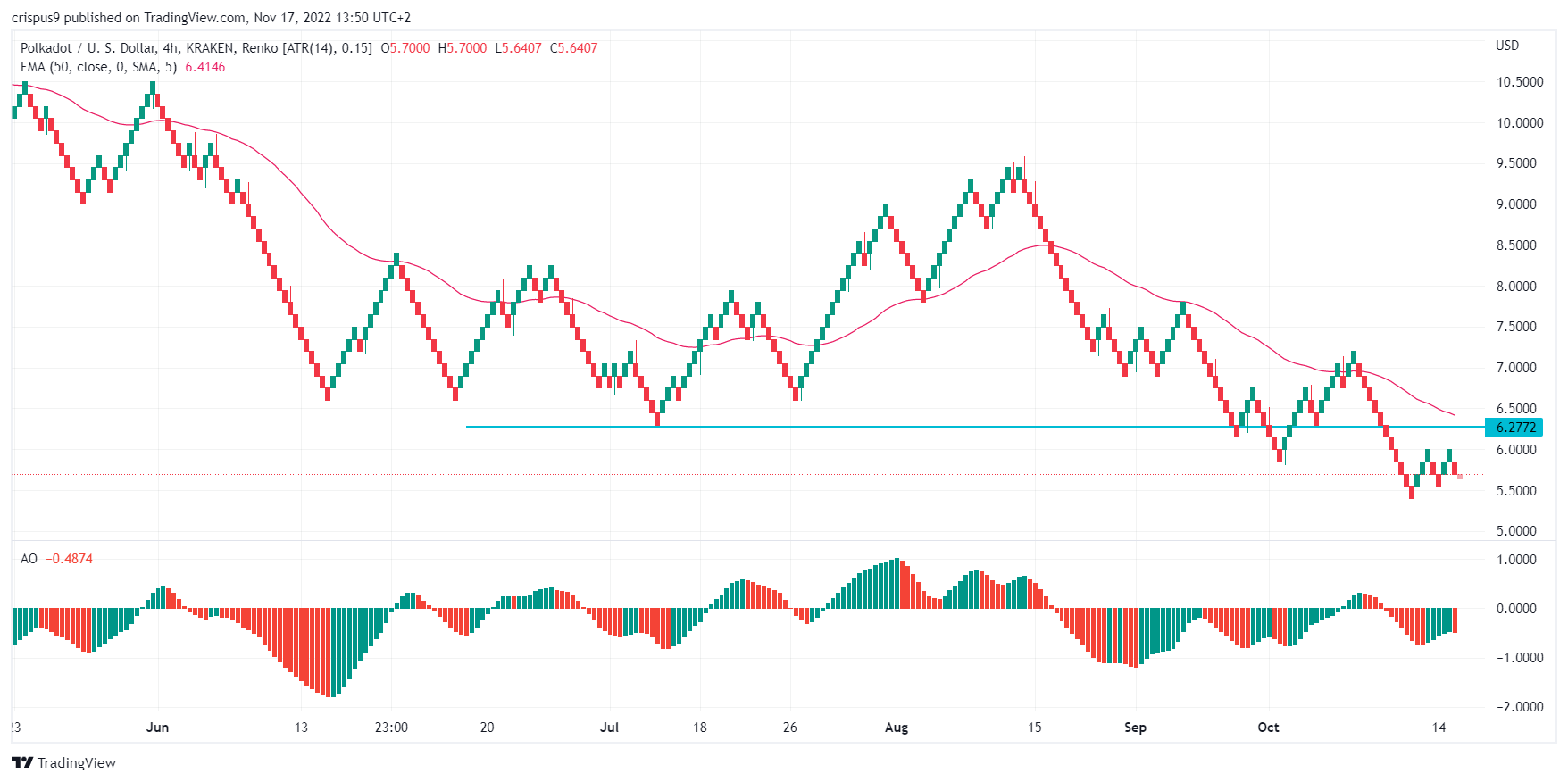

Polkadot price has been in a strong bearish trend in the past few days as the crypto sell-off gains steam. DOT/USD was trading at $5.631, which was slightly below this week’s high of $6. This price is also about 25% below the highest point this month.

Polkadot is one of the biggest blockchain networks in the world. DOT, its coin, has a total market cap of over $6 billion, making it a top-ten cryptocurrency. At its peak, it was valued at over $30 billion.

Polkadot was created by Gavin Wood, a co-founder of Ethereum, one of the biggest blockchains in the world. The two networks have a similar goal of making it possible for people to build decentralized platforms.

Polkadot’s goal is to unite networks of heterogeneous blockchain shards called parachains. A parachain is a sovereign blockchain that can have its own token. Some of the most popular parachains are Kusama, Acala, and Litentry.

The heart of Polkadot’s ecosystem is a product known as a relay chain. It is an important technology that is responsible for the network’s security, consensus and cross-chain interoperability. Bridges are also important in Polkadot’s ecosystem. They enable Polkadot shards to connect to and communicate with external networks like Ethereum and Solana.

Polkadot price has been in a strong bearish trend in the past few months. The most recent reason for the crash is the ongoing collapse of FTX, the second-biggest exchange in the world after Binance. The collapse of the company has led to fears of contagion in the industry. As a result, the crypto fear and greed index has dropped to the extreme fear level.

At the same time, there are concerns about Polkadot’s ecosystem. In the past few months, the total value locked in key parachains like MoonRiver, MoonBeam, and Acala has been falling.

Is it safe to buy Polkadot? The Renko chart above shows that the Polkadot price has been in a strong bearish trend in the past few months. It managed to drop below the important support level at $6.27, which was the lowest level on July 12. This price was also the neckline of the head and shoulders pattern.

DOT/USD price has moved below all moving averages while the Awesome Oscillator has moved below the neutral level. Therefore, the coin will likely continue falling as sellers target the next key support level at $5.0.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

Capital.com is a global broker which offers over 200 cryptocurrencies for its users. It comes with a range of features such as; great security, 24/7 support, demo accounts and a wide variety of assets. On top of that, it also has no inactivity, withdrawal or deposit fees, which makes it stand out from other crypto brands.

Buy DOT with Capital.com today

The post Polkadot Price: DOT/USD on edge amid contagion risks appeared first on CoinJournal.

Cardano price has not been left behind in the ongoing cryptocurrency meltdown. ADA plunged to a low of $0.32, which was much lower than the all-time high of over $3. With a market cap of $11 billion, it means that its valuation has plunged by almost $80 billion in the past few months. So, is ADA a good investment or is it a value trap?

Cardano is a leading blockchain network that grew incredibly popular in 2021. It was launched by Charles Hoskinson, a co-founder of Ethereum.

Cardano became popular as investors sought for cleaner alternatives to Ethereum, which used a proof-of-work (PoW) mechanism at the time. It was also billed as a faster alternative to Cardano since it can hande thousands of transactions per second (tps).

However, at the time, Cardano did not have an ecosystem since it did not have smart contract capabilities. This changed in August 2021 when the developers launched the Alonzo hard fork.

Since then, thousands of developers have embraced Cardano. However, it is struggling in Decentralised Finance (DeFi), which is one of the top use cases for blockchain networks. It has a total value locked (TVL) of about $70 million, making it the 34th biggest chain in the world.

It is even smaller than relatively unknown projects like Ultron, Canto, and Velas. At the same time, key DeFi apps in its ecosystem have struggled to compete with the likes of Uniswap, Maker, and Aave.

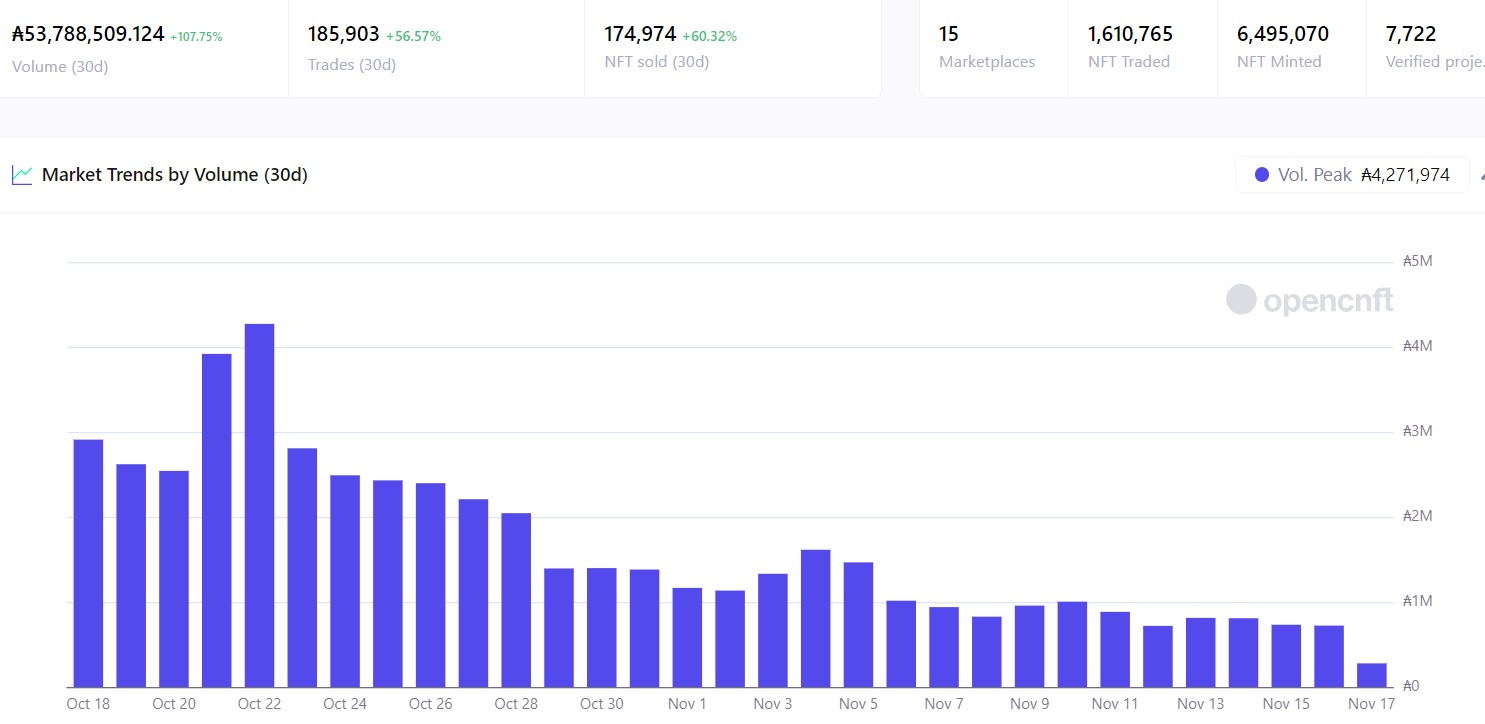

It is, nonetheless, finding some success in the NFT industry. Data compiled by CryptoSlam shows that the total volume of NFTs traded in the network has been growing. In the past 24 hours, it has handled over $237k NFTs. Similarly, in the past 30 days, it has handled NFTs worth over $25 million. However, as shown below, the volume has been dropping.

The renko chart above shows that the Cardano price has been in a strong bearish trend in the past few months. In this period, the coin has moved below all moving averages. It has also moved below the important support level at $0.3341, the lowest point on October 23.

Cardano’s awesome oscillator has moved below the neutral level. Therefore, the path of the least resistance for the coin is lower. As such, at this moment, it is a bit risky to buy Cardano will continue falling as sellers target the key support at $0.300.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

Capital.com is a global broker which offers over 200 cryptocurrencies for its users. It comes with a range of features such as; great security, 24/7 support, demo accounts and a wide variety of assets. On top of that, it also has no inactivity, withdrawal or deposit fees, which makes it stand out from other crypto brands.

Buy ADA with Capital.com today

The post Is Cardano a good investment? appeared first on CoinJournal.