Der ehemalige CEO von FTX erklärte, dass er auf einer Konferenz von der The New York Times als Referent zu Gast sein werde.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Der ehemalige CEO von FTX erklärte, dass er auf einer Konferenz von der The New York Times als Referent zu Gast sein werde.

The XNO price soared to $1.72, which was the highest level since May 7. At its peak, the coin was up by more than 215% from the lowest level this month. According to CoinMarketCap, Nano has a combined market cap of more than $134 million, making it the 150th biggest coin in the world.

Nano is a relatively small cryptocurrency that seeks to become a leading medium of exchange in the digital zone. It is a digital coin that can be spet and accepted anywhere in the world. Unlike other cryptocurrencies, it does not need to be mined, printed, or minted

Nano is also different from other cryptocurrencies in that it was not financed through an ICO. Instead, the Nano Foundation used The Faucet, which was a website that allowed people to complete Google CAPTCHAs. As a result, they were able to reach people who had the time to invest.

There are benefits of using Nano for payments. For example, it has no hidden fees and is lightning fast. It is also highly decentralized, meaning that it non-inflationary. Therefore, unlike Bitcoin and ETH which have significant fees, Nano charges no fees. It is also a clean digital coin that

It is unclear why the Nano crypto price has jumped this week. A possible reason is that on-chain volume has been in a strong bullish trend. According to Nano Looker, the on-chain volume rose by more than 378% in the past 24 hours. It rose to 22,227,484. At the same time, the number of confirmed transactions declined by 43% to 107,661.

XNO price also rose as investors bought the dip. The view is that the coin became significantly undervalued after its collapse this month.

The daily chart shows that the XNO price went parabolic this week. As it did that, it became one of the best-performing cryptocurrencies. It managed to move above the important resistance level of $1 and moved above all moving averages. The Relative Strength Index (RSI) moved above the overbought level of 70.

It also rose above the important resistance level at $1.40, the highest level on May 27. Therefore, there is a likelihood that this rebound is part of a dead cat bounce. As such, there is a possibility that it will pull back slightly and move below $1.

The post XNO price prediction as Nano goes vertical appeared first on CoinJournal.

FTX’s bankruptcy proceedings continue, and the company has now asked a judge to allow it to hire BitGo to secure its assets.

Bankrupt crypto exchange FTX has notified a federal judge that it wants to hire BitGo to safeguard the remainder of its digital assets as bankruptcy proceedings play out.

BitGo is a leading institutional custody firm.

The cryptocurrency exchange signed a custodial agreement with BitGo n November 13, a day after someone completed unauthorised transfers draining $372 million worth of assets from the company’s accounts.

FTX and its various affiliates currently seek the consent of the judge overseeing its bankruptcy before moving assets. This latest cryptocurrency news means that FTX wants to ensure the safety of its assets.

The crypto exchange told the court during yesterday’s hearing that it was concerned about theft and cyber threats. Hence, the reason it wants to move its assets to BitGo.

Per the terms of the deal, FTX will pay a $5 million upfront fee to BitGo. The crypto custody firm will also charge FTX a monthly fee equal to the average U.S. dollar value of the digital assets it stores, multiplied by 1.5 basis points.

FTX lawyers revealed in the filing that it would cost the company around $100,000 per month, based on the initial transfer of $740 million worth of assets to BitGo. The crypto exchange added that it would continue to investigate and attempt to recover lost or stolen assets as the bankruptcy proceedings continue.

The FTX lawyers added that recovering funds stolen from the exchange could increase the number of assets in custody. In a message to The Block, co-founder and CEO of Bitgo Mike Belshe said;

“It’s time to get serious about ending the human-created disasters in crypto. When you break down FTX subsidiaries, the ones that used BitGo products are solvent and safe. The ones that didn’t, aren’t.”

Any objection to the custodial services agreement is due by December 7th. The next FTX bankruptcy heading in the United States Bankruptcy Court for the District of Delaware will take place on December 16th.

In an interview with Coinjournal earlier this year, Ben Chan, CTO of BitGo, revealed that the company is focusing on custody this year as they seek to improve and strengthen its position in custodial services.

However, BitGo is also planning to offer other financial services soon, with Chan revealing that the company is interested in decentralised exchange.

The post FTX to hire BitGo to safeguard its assets during bankruptcy appeared first on CoinJournal.

Obwohl die Stimmung auf dem Kryptomarkt so schlecht ist wie noch nie, bleiben die Fundamentaldaten stark.

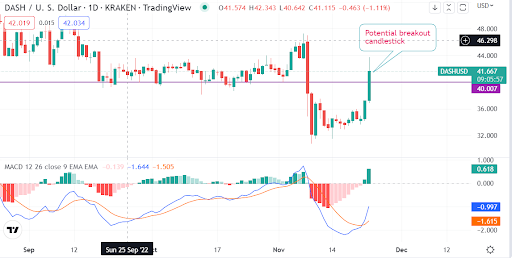

Privacy-focused cryptocurrency Dash (DASH/USD) saw increased buyer interest on Wednesday. As cryptocurrencies turned up, the token’s value increased by 20%, one of the strongest. DASH was riding on the positive sentiment, pushing above the $40 resistance.

Dash offers an open-source platform for cheap and fast financial transactions in a decentralised ecosystem. However, unlike other cryptocurrencies, Dash offers an additional layer of privacy for transactions. Native token DASH surpassed an all-time high of $460 in 2021. The strong gains highlighted investors’ speculations on tokens of platforms that offered greater anonymity in crypto. However, as the crypto winter ravaged this year, DASH has gone underwater. Recent intrigues also involve pressure from regulators against privacy-focused protocols.

About a week ago, reports emerged that the European Union was creating an anti-money laundering proposal. The new rules prohibit crypto firms and lenders from allowing privacy coins, DASH, Monero, and Zcash. That follows another legislation earlier in the year in which officials worked to restrict transactions with non-hosted wallets.

It remains to be seen what the future of privacy coins like DASH will look like. It still makes sense to bet on the token as opportunities emerge. But should you be ready to buy DASH now?

Technically, DASH trades at a monthly high of $42. The MACD indicator has initiated a bullish crossover but remains in a bear zone.

DASH’s short-term momentum is bullish, although the longer-term trend is bearish. A breakout candlestick can be seen towering above the $40 support.

A successful breakout will be confirmed by how the daily candlestick closes. If the candlestick closes above the support, $40 will become a new support and set DASH for further gains. Buyers will target $47 next or higher, depending on the prevailing crypto sentiment and momentum.

On the contrary, the daily candlestick closing below $40 would leave a bearish pin bar. This is a less likely scenario, given the strong breakout by DASH at the key level. The bear scenario would leave the DASH price vulnerable to $35.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

OKX is a top cryptocurrency exchange which offers over 140 cryptocurrencies to invest in. OKX takes customer security very seriously, they store almost all of their clients‘ funds in cold storage, and the exchange is yet to be hacked. On top of this, the exchange offers very low fees and customers can even use their crypto as collateral for loans on the platform.

The post DASH returns 20% in a day. Has the cryptocurrency turned bullish? appeared first on CoinJournal.