Im Interview mit Cointelegraph äußert Cardano-Gründer Charles Hoskinson explizit Kritik an den beiden marktführenden Kryptowährungen.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Im Interview mit Cointelegraph äußert Cardano-Gründer Charles Hoskinson explizit Kritik an den beiden marktführenden Kryptowährungen.

Ab dem 12. Oktober könnte der Bitcoin-Kurs wieder vermehrt Volatilität erfahren, wenn neue Wirtschaftsdaten veröffentlicht werden.

Injective Protocol INJ/USD is a little-known Ethereum-based DEX. The network claims to be an open and interoperable smart contract platform. It is optimised for DeFi applications, an area touted as monumental in the growth of decentralised finance. The DEX uses the Cosmos-backed L2 sidechain for faster speeds, decentralisation, and connection to the Ethereum chain.

Injective provides advanced smart contract features. They include forex synthetics, cross-chain margin trading, derivatives, and futures. The DEX aims to eradicate barriers that limit access to the DeFi sector. It also removes gas fees and ensures high transaction speeds for limitless trading.

INJ token powers the Injective network. It helps in governance and ensures the security of the DEX. The token also enables derivatives collateralisation and is used to reward the market makers.

While the Injective Protocol has been in the market since 2018, it has attracted less attention. That’s partly because it ranks lowly at #159 on CoinMarketCap. Its market cap is only $135.6 million.

Binance is one of the largest cryptocurrency exchanges in the world. It is better suited to more experienced investors and it offers a large number of cryptocurrencies to choose from, at over 600. Binance is also known for having low trading fees and a multiple of trading options that its users can benefit from, such as; peer-to-peer trading, margin trading and spot trading.

Kucoin is a cryptocurrency exchange which offers over 200 cryptocurrencies. Kucoin has a wide range of services, such as; a built-in peer-to-peer exchange, spot and margin trading, bank level security and a wide range of accepted payment methods. Users can benefit from a beginner-friendly interface and relatively low fees.

Considering price data, INJ hit $27 last year before the market crash. The token’s low in the year remains at $1.13, but recent recoveries have taken the token to $1.8. Are we set for an explosive move?

Source – Trading

The daily chart outlook is positive for the Injective Protocol token. While the cryptocurrency faces rejection at the $2 level, momentum is strong from the MACD indicator.

The token has attempted a breakout at $2 multiple times. That suggests that buyers are gathering momentum. On the downside, INJ has rejected a decline below $1.74 since August.

While investing in INJ at the moment is premature, a potential breakout would be a win for bulls. Investors should buy on a breakout or further lower on the current correction.

The post What is the Injective Protocol, and why is it an exciting watch? appeared first on CoinJournal.

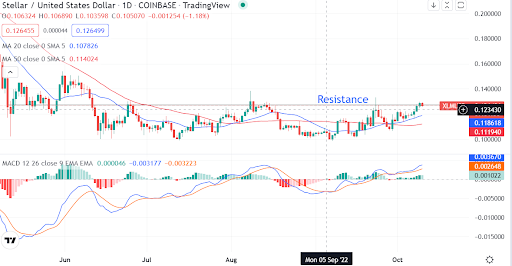

Stellar Lumens XLM/USD trades at key resistance of $0.126. However, momentum is building, with key technical indicators pointing to a potential breakout. According to the CoinMarketCap data, Stellar Lumens has added nearly 10% in the past one week. The gains are the highest in the week after Ripple’s XRP.

LunarCrush AltRank™ places XLM and XRP as potential bullish movers. According to a tweet on October 8, XLM, alongside XRP, has a low AltRank. The ranking is interpreted as a sign of a bullish move. Crypto analytics firm DYOR.net also recognises XLM among the top digital assets with potential bullish trends.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

Capital.com is a global broker which offers over 200 cryptocurrencies for its users. It comes with a range of features such as; great security, 24/7 support, demo accounts and a wide variety of assets. On top of that, it also has no inactivity, withdrawal or deposit fees, which makes it stand out from other crypto brands.

Buy XLM with Capital.com today

Source – TradingView

Source – TradingView

On the daily chart, XLM is attempting to break above the resistance. In fact, XLM is retesting the resistance after unsuccessfully dislodging it last month. The token remains supported by the 20-day moving average and 50-day moving average. A 20-day MA crossover above the 50-day MA confirms a bullish momentum.

If we turn to the MACD, the indicator is in the bullish zone. A growing divergence of the oscillator and the signal line indicates that momentum is building up for XLM. With momentum building at the resistance, the odds are for a breakout rather than a correction.

XLM remains on a potential breakout. The fundamentals and the technical align, reinforcing a bullish view. Should the cryptocurrency break to the upside, XLM would move higher to find the next resistance at $0.148.

Currently, investing in XLM at the key level is not a good idea. Wait for a breakout and assess the trade. Potentially, the inflation data on Thursday could drag markets and force a correction. Aside from the market dynamics, XLM should be on the investors’ watch list.

The post Stellar Lumens makes a bullish statement. Why do you need to watch the token? appeared first on CoinJournal.

Selbst in Zeiten der Krise steigt die Difficulty von Bitcoin immer weiter, was einen klaren Beleg dafür liefert, dass die Miner kreative Wege finden, um weiterhin profitabel zu sein.