Die leicht verbesserten Rahmenbedingungen helfen dem Bitcoin auf die Sprünge, und aus dem Aufschwung könnte sich womöglich eine neue Kletterpartie entwickeln.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Die leicht verbesserten Rahmenbedingungen helfen dem Bitcoin auf die Sprünge, und aus dem Aufschwung könnte sich womöglich eine neue Kletterpartie entwickeln.

Der Blockchain Bundesverband stellt in Aussicht, dass die europäische Krypto-Regulierung schon bald fertig ist.

As we get closer and closer to one of the biggest events in the brief history of cryptocurrency – the Ethereum Merge – there are a number of metrics which are suggesting activity is picking up across the space.

The first is the Ethereum Name Service (ENS), which saw its third highest month of revenue in August. Generating $4.3 million in revenue, the service saw 34,000 accounts register names for the first time.

August 2022 stats for ENS

– 301K new .eth registrations (total 2.17m names)

– $4.7m in protocol revenue (all goes to the @ENS_DAO)

– 2,744 ETH in revenue (3rd highest month)

– 34K new eth accounts w/ at least 1 ENS name (total 540k)

– >99% of OpenSea domain vol pic.twitter.com/utU8i4cBMT— ens.eth (@ensdomains) September 1, 2022

These names are a neat feature of Ethereum. Instead of providing somebody a long Ethereum address, instead a simple name ending in .eth can be provided, such as harrypotter.eth, for example. This name can be linked to one’s wallet, meaning it’s all that needs to be given when asking for a payment. Simple and intuitive.

The boost in these names being registered shows that people are positioning themselves for the Merge, slated to go live on September 15th.

The amount of ETH locked up in the staking contract is now up to 13 million ETH, which is about 11% of the total supply. At the current market price of $1,635, that translates to over $21 billion of Ethereum locked up in the staking contract.

What is important to note here is that the Merge will not enable withdrawals of this ETH. I had previously speculated about whether a flooding of ETH into the market post-Merge could place downward pressure on the price – after all, much of the Ethereum has been locked up for quite a while, as the above graph shows.

However, investors will not be able to withdraw their ETH until another upgrade is implemented, which is not planned for 6 months to a year down the line. This should dull the concern around the supply/demand level as the Merge goes live. There are also liquid staking alternatives which mean the liquidity has not been totally inexistent to date.

And so we close in on the watershed moment, only two weeks away as I write this. The big question remains, will this be a “buy the rumour, sell the news” type event, or will Ethereum pump off the back of it.

My thoughts for the moment are simple – I think for the short-term price action, the macro climate is currently far more important, with spiralling inflation. A hawkish Fed and tense geopolitical climate still driving markets across the board.

The post Ethereum gathers steam for Merge, ENS domains rise and stakers patiently wait appeared first on CoinJournal.

Der momentane Aufschwung von Cardano hat wohl zu wenig Rückenwind, um einen neuen Aufwärtstrend einzuläuten.

One of the most fascinating things about Bitcoin for me is the ability to jump on-chain and track a whole range of indicators. As the years go by and we build up more of a sample of how Bitcoin performs, these metrics become all the more powerful.

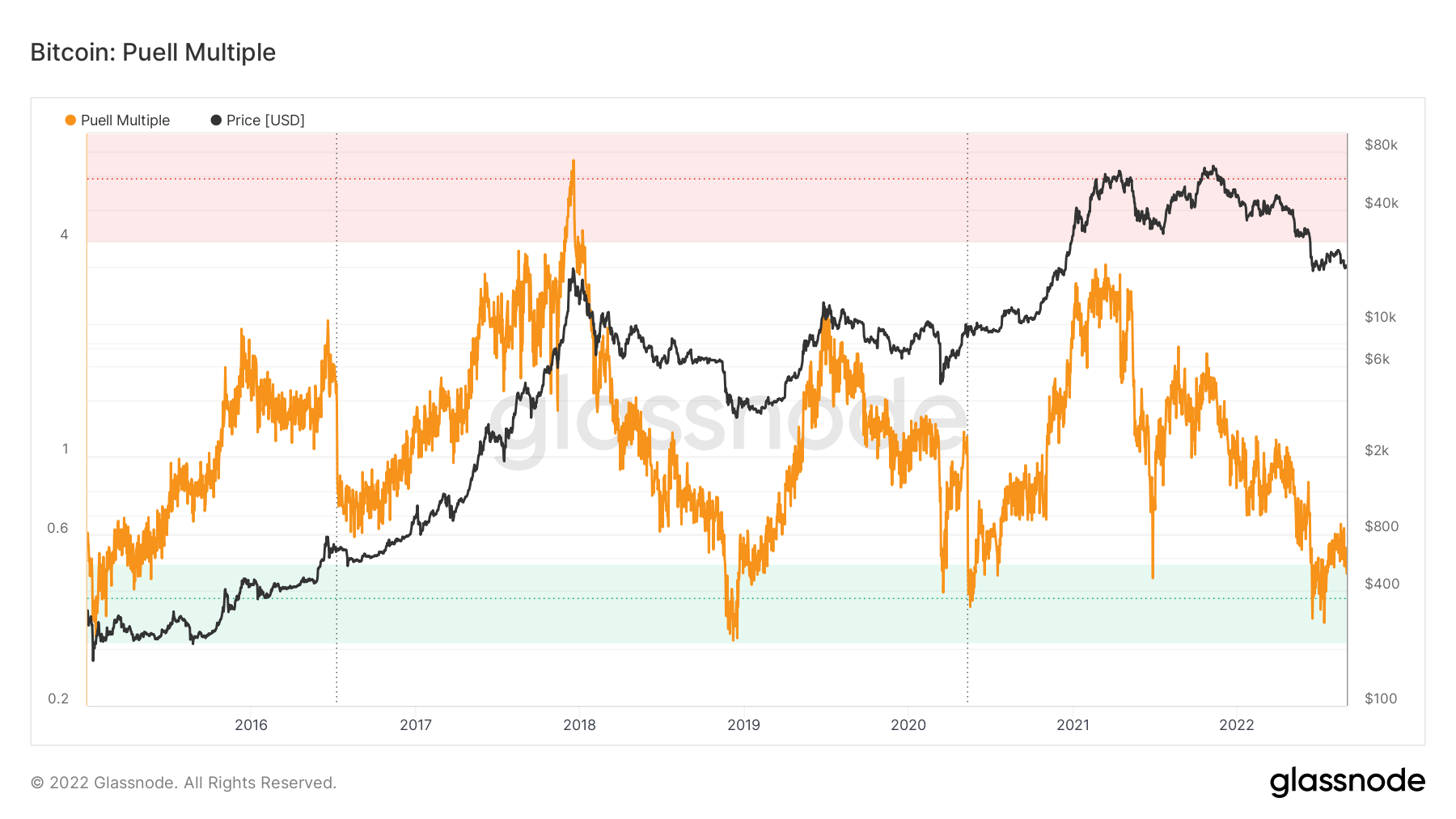

One of my favourite on-chain indicators is the Puell indicator. This takes the total miner revenue and adjusts it by its yearly moving average. So, the calculation of the indicator takes mining revenue and divides it by the 365-day simple moving average of mining revenue.

Miner actions often provide unique insights into the market. They are often viewed as compulsory sellers because their revenue is in Bitcoin, whereas their fixed costs – electricity, mostly – are in fiat. Obviously, they have to cover these fixed costs and so the issuance of bitcoins from miners will always be intrinsically related to price.

The Puell indicator pretty much tracks when the amount of bitcoins entering the market is too great or too little relative to historical norms. Looking back at it historically, there is quite a strong relationship – the price tends to move upward when the Puell indicator falls into the green zone on the chart below.

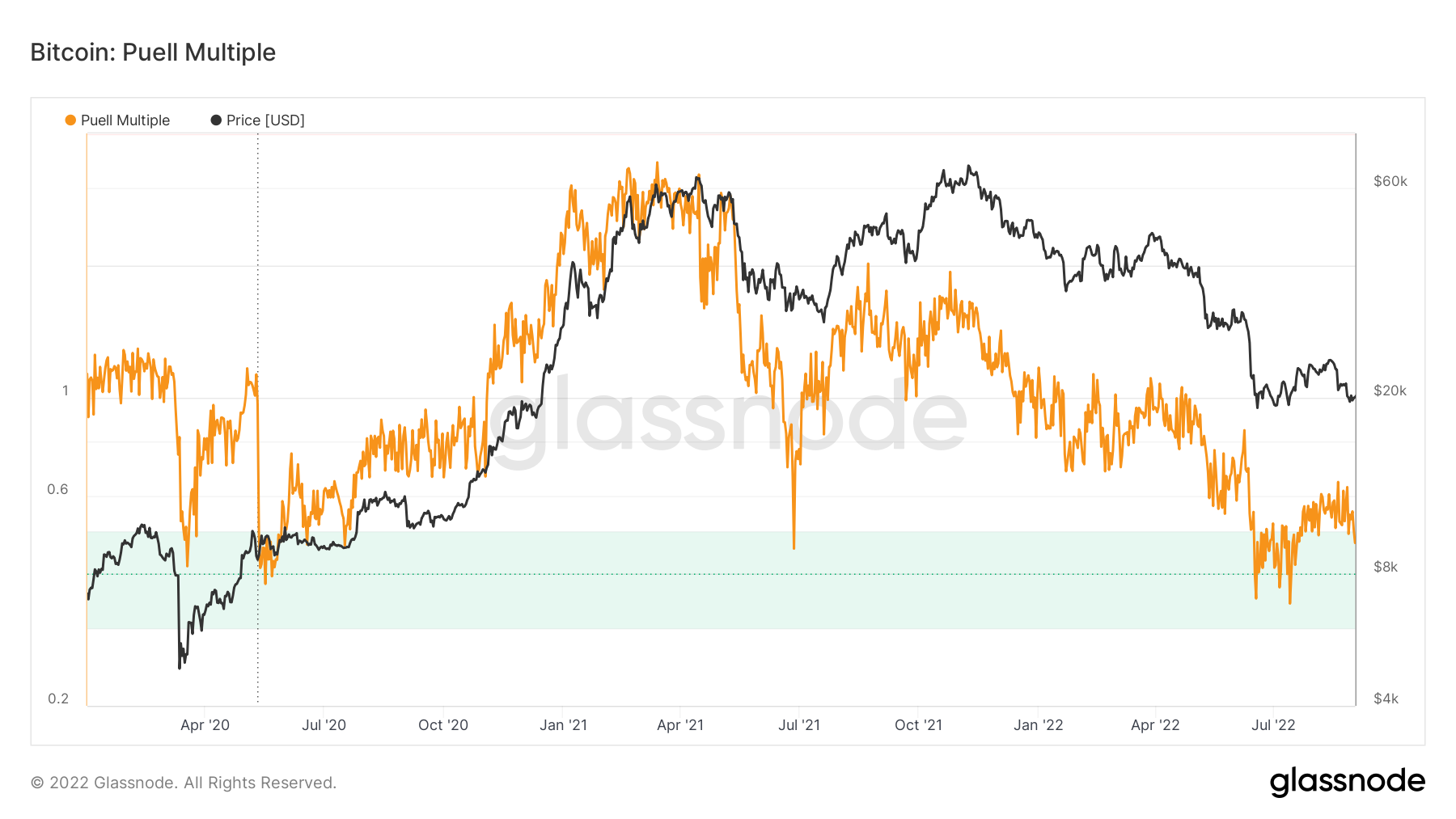

The most recent time the Puell indicator dipped into the “buy” zone was mid-June. Again, we saw upward movement soon after, as Bitcoin had its little rally from about $20,000 up above $24,000. Of course in the last week or so we have dipped back down to below $20,000, as the Fed’s comments on interest rate plans and inflation sparked a wave of risk-off sentiment across all asset classes.

Interestingly, I noticed yesterday that the Puell indicator has dipped back into the “buy” zone. Zooming on the time period since the start of 2020 demonstrates this a bit clearer on the chart.

Then again, I’m always hesitant to use on-chain indicators in isolation. This is never more true than in the current climate, where we have an unprecedented blend of a hawkish Fed, rampant inflation and a geopolitical climate growing more volatile by the day.

This is the only time in Bitcoin’s short history that we have seen this macro blend. Indeed, Bitcoin was only launched in early 2009, meaning it has resided during a period of sustained up-only bull market dynamics. The historical sample size of its price action simply isn’t long enough to draw any firm conclusions, therefore.

The way I would ultimately look at the Puell indicator is that Bitcoin seems primed to move upward IF the macro environment cooperates. But that is a seriously big if. It has been the case all year – and it will continue to be the case – that macro developments are driving markets.

Bitcoin is following the stock market, which is following the news in the inflation, interest rate and geopolitical sectors. So while this is a bullish on-chain indicator for Bitcoin, it means nothing until we get further cooperation in the wider world.

The post Mining revenue suggests Bitcoin is ready to move, but ONLY if macro environment co-operates appeared first on CoinJournal.