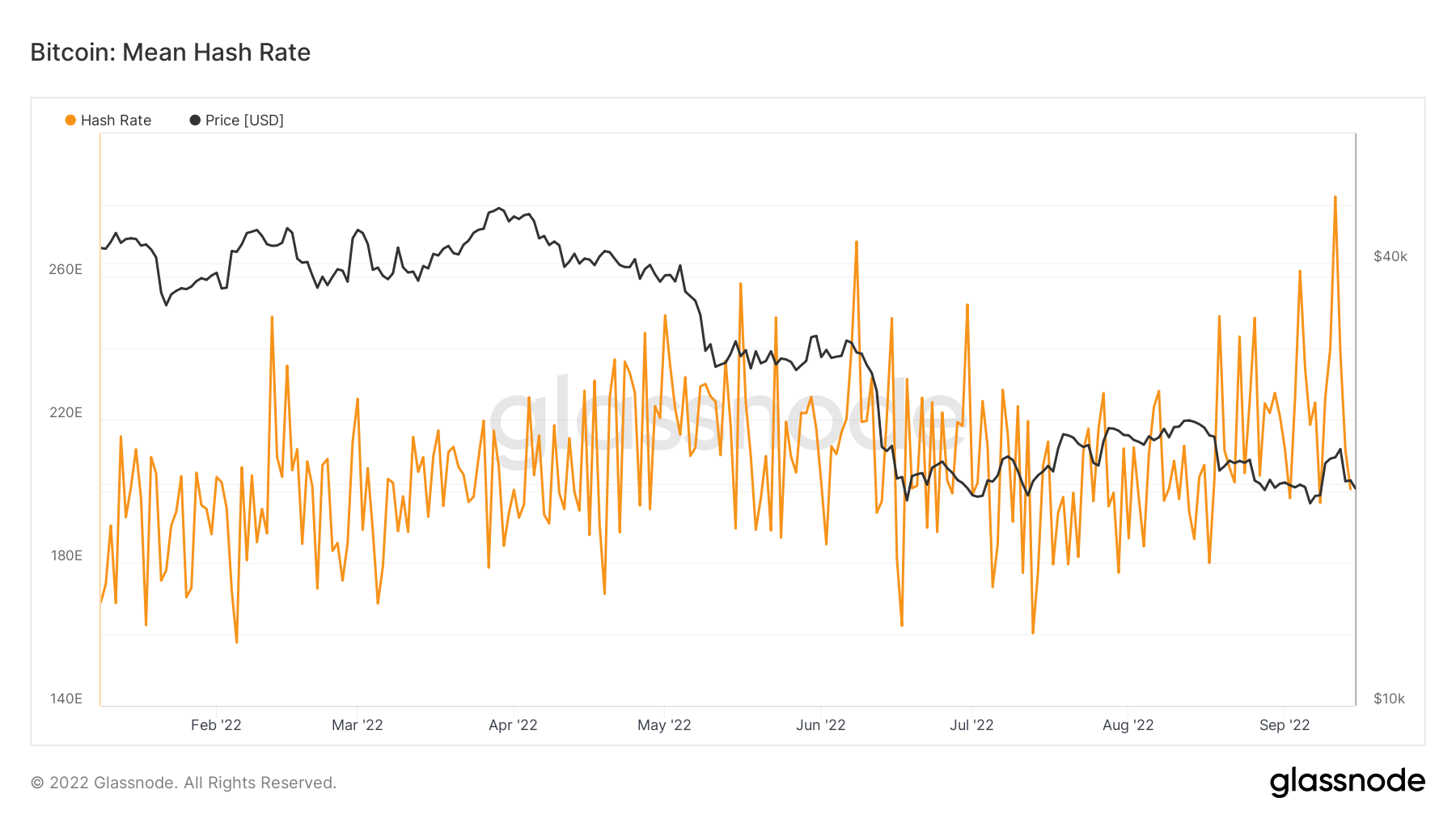

The long-awaited Merge upgrade of the Ethereum Network was successfully completed in the early hours of Thursday, September 15, 2022. The timing corresponded with earlier predictions by Ethereum developers depending on the Ethereum hashrate.

The Merge upgrade creates a more energy-efficient blockchain network since Ethereum has since shifted from being a proof-of-work (PoW) blockchain network to a proof-of-stake (PoS) network. However, the price of Ether (ETH) fell sharply after the Merge and in the early hours of Friday, it was trading at $1,474.20, down about 7.93% from Thursday’s price level.

Nevertheless, analysts expect the price to surge in the coming days once investors unwind hedges that they had bought anticipating hiccups in the rollout. So far, no issues have been reported with the Merge; something that is likely to trigger confidence among investors and possibly drive the prices higher.

According to Jon Charbonneau, a researcher at crypto research firm Delphi Digital, the Merge marks the “biggest event in crypto since the creation of bitcoin and Ethereum. Assuming all remains well, attention will turn toward future Ethereum upgrades.”

To assist investors and traders purchase the Ethereum token after the merge, Coinjournal has prepared this brief guide on the best places to buy Ethereum.

Continue reading to find out more.

Where to buy Ethereum (ETH)

eToro

eToro is one of the world’s leading multi-asset trading platforms offering some of the lowest commission and fee rates in the industry. It’s social copy trading features make it a great choice for those getting started.

Skilling

Skilling is a Scandinavian based cryptocurrency broker which has a desktop website as well as apps for iOS and Android devices. It supports over 50 cryptocurrencies and it has a demo account to allow users to gain familiarity with the platform. Skilling has no hidden fees, it is an officially regulated broker and it supports a wide range of payment methods.

What is Ethereum?

Ethereum was the second blockchain network to be developed after Bitcoin, which was the first blockchain to be developed. Its native token/cryptocurrency Ether (ETH) is the second largest cryptocurrency by market cap.

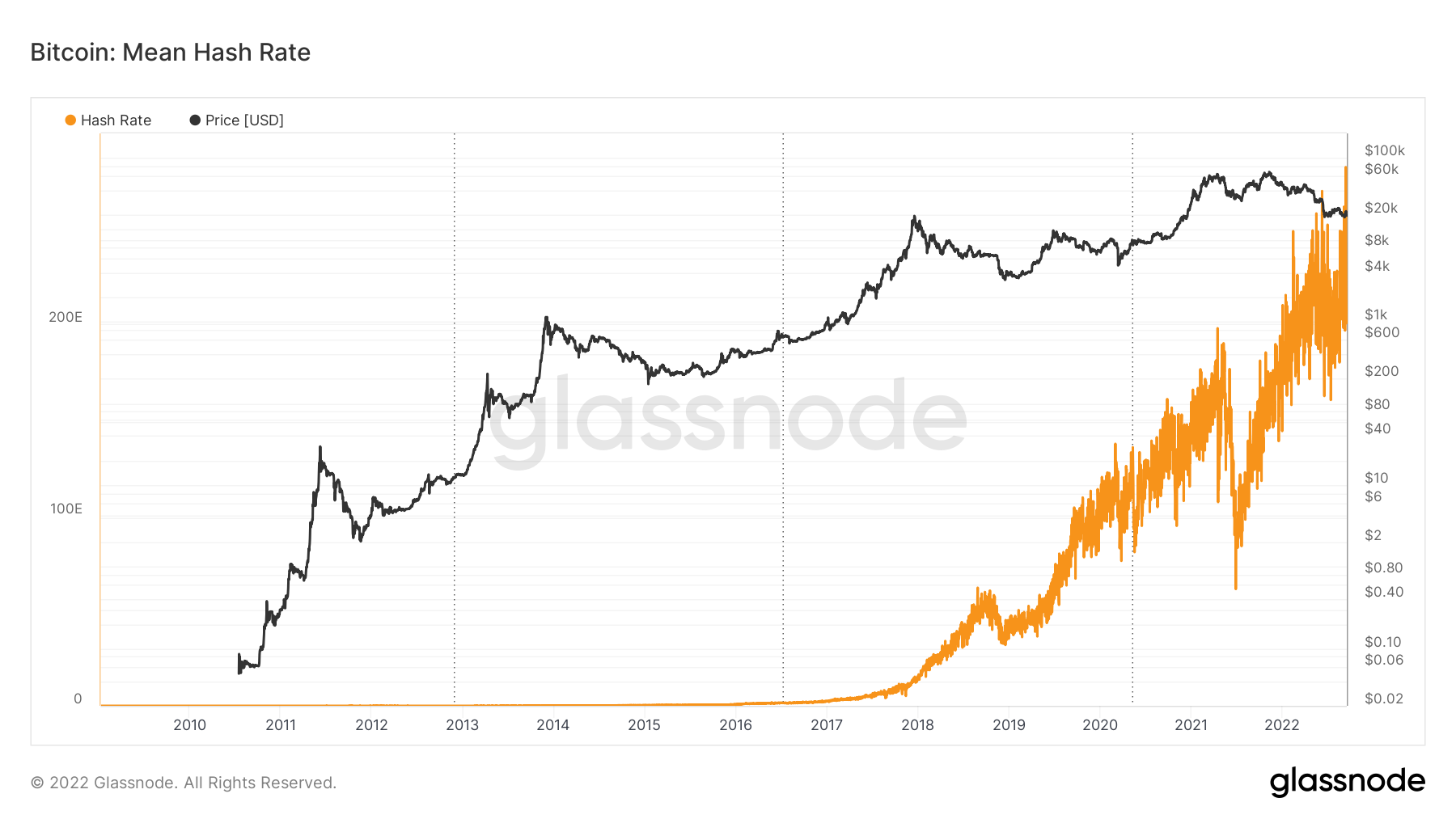

At their launch, both Bitcoin and Ethereum were designed to use a PoW consensus mechanism in confirming transactions within the networks.

However, the PoW mechanism has proved to consume a lot of energy impacting negatively on the environment. Ethereum has embarked on shifting to a PoS mechanism that is less involving, less energy-consuming, and more efficient than the PoW.

Ethereum successfully completed the migration into a PoS system through the Merge Upgrade on Thursday, September 15.

Following Ethereum’s merge, a new ad campaign is underway targeting Bitcoin’s energy use because of its proof-of-work (PoW) consensus mechanism.

Should I buy ETH today?

Suppose you want to invest in a popular cryptocurrency that is expected to considerably rise in the coming days. In that case, ETH could be a good choice, especially after the successful Merge upgrade.

However, the cryptocurrency market is extremely volatile, and you should invest cautiously.

Ethereum coin price prediction

Despite the price fall after the Merge, analysts expect the price of Ethereum to surge possibly above $2K in the coming days once investors unwind their hedge positions since there are currently no hiccups recorded following the Merge upgrade.

$ETH social media trends

„The merge will reduce worldwide electricity consumption by 0.2%“ – @drakefjustin

— vitalik.eth (@VitalikButerin) September 15, 2022

The post ETH price falls after the Merge: here’s where to buy Ethereum appeared first on CoinJournal.

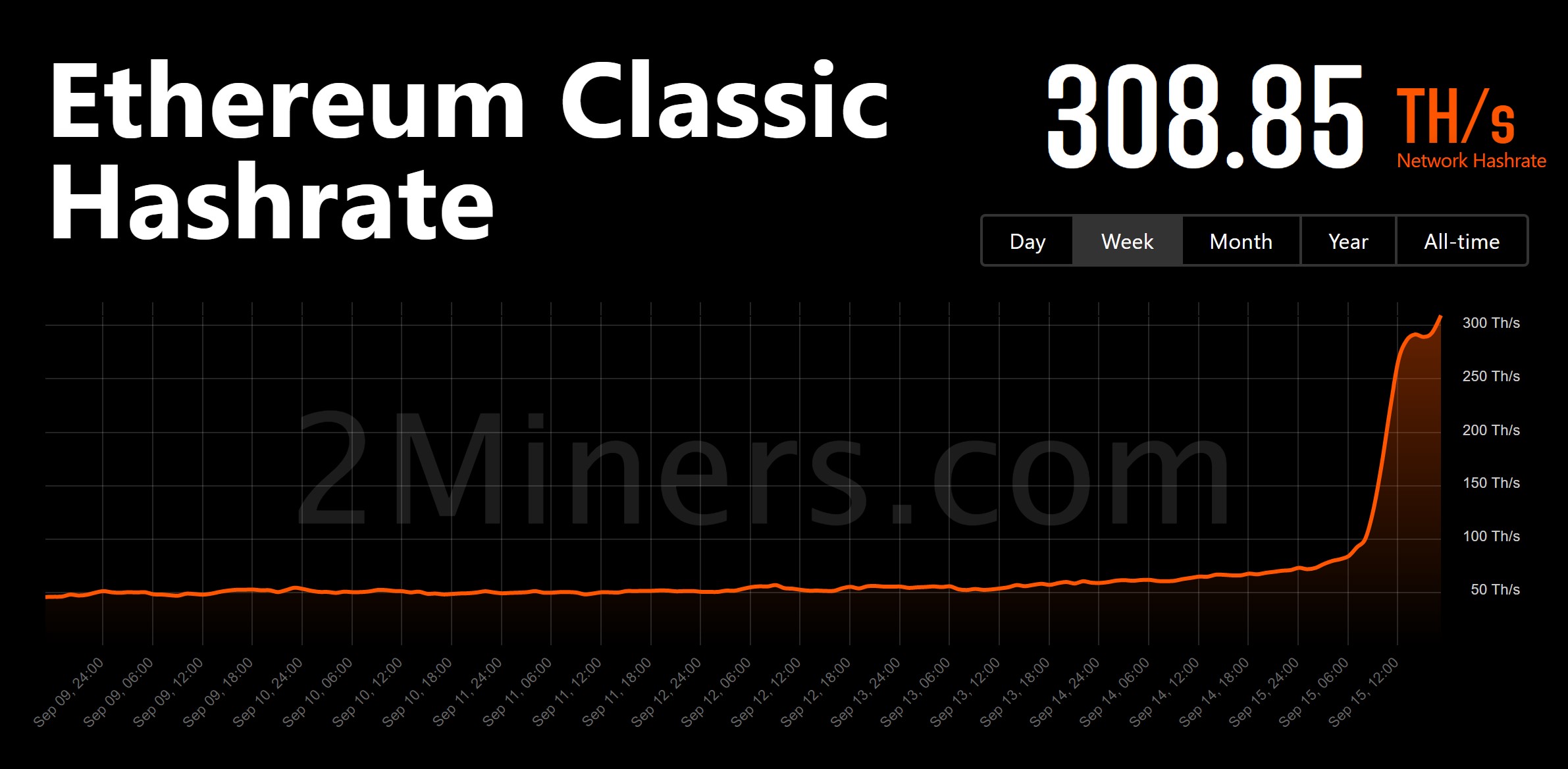

Indeed, other coins have seen upticks in hash rate as well – Monero, Ravencoin, Ergo, to name a few.

Indeed, other coins have seen upticks in hash rate as well – Monero, Ravencoin, Ergo, to name a few.