Will Peck, Leiter der Abteilung für digitale Vermögenswerte beim ETF-Anbieter WisdomTree, sagte, ein Bitcoin-ETF werde früher oder später genehmigt.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Will Peck, Leiter der Abteilung für digitale Vermögenswerte beim ETF-Anbieter WisdomTree, sagte, ein Bitcoin-ETF werde früher oder später genehmigt.

Bitcoin continues to hold above the $19,000 mark even as currency woes wreaked havoc across stocks and other legacy markets this week.

After dipping to lows beneath $18,600, Bitcoin bounced as high as $20,300 before paring the gains amid a highly volatile market that also saw the S&P 500 Index notch losses that puts it on course for three consecutive quarterly losses. It’d be the first time the index has registered this kind of performance since 2009.

If stocks face another sell-off and the tumbling continues in the face of a Fed tightening and concerns of a recession, Dylan Leclair, a senior crypto analyst, says the market could see a BTC outperformance against equities.

According to the analyst, Bitcoin’s “relative strength” against legacy indices has been encouraging, pointing to a BTC/S&P 500 chart.

Encouraging relative strength from the orange coin against legacy indices.

Still think a long lasting „decoupling“ is highly unlikely in this stage, but relative outperformance is a decent start.

All eyes on FX, global bonds, and equities for the direction of the next move. pic.twitter.com/Enfbl0vn2R

— Dylan LeClair 🟠 (@DylanLeClair_) September 29, 2022

While he doesn’t expect the “decoupling” to be long lasting given broader market conditions, he still thinks the benchmark cryptocurrency could master a decent run against the index. What investors might have to watch out for, he tweeted, is what happens next within the legacy financial markets – equities, FX and global bonds.

The analyst however warns of a potential sell-off for Bitcoin should there be a “huge illiquidity event.” He said:

“Still convicted in my view of a legacy system vol event coming – it’s clear that liquidity tide is drawing out. BTC/USD exchange rate won’t be insulated from a huge illiquidity event, because nothing except USD & vol will.”

Bitcoin was trading around $19,260 on Friday morning (09:45 am ET), just in the green on the day but down 1.2% this past week. The S&P 500 opened higher lower and was at 3,634, more than 1.4% down in the past five days.

The post Bitcoin price: Analyst doesn’t expect long lasting decoupling ‘at this stage’ appeared first on CoinJournal.

Someone wake up Green Day, because September is about to end.

So, what happened this month in crypto? And how do we look as we turn the page to October?

Nothing too major, but Bitcoin and Ethereum trended down over the month. Interestingly, Bitcoin drew down more than Ethereum, which is unusual compared to the pattern we have seen historically, where Ethereum is generally the more volatile of the two.

The Merge was the big news, of course, as Ethereum completed the biggest blockchain upgrade in history on September 15th. The event came and went without a hitch, although pricing didn’t do much – suggesting it was priced in ahead of time, as many suspected.

In the short-term, there is not much the Merge has affected regarding price, but it will be fascinating to track going forwards now that the pipeline underworking the Ethereum ecosystem has been completely transformed.

I’ve written before about my thoughts that the staking yield could even act as a “risk-free” proxy for the world of De-Fi, helping provide a framework for valuations and laying the groundwork for ETH to mature even more.

The groundwork should also allow Ethereum to decouple from Bitcoin. I have long viewed Bitcoin as money and Ethereum as tech, and I think this move further accentuates the dichotomy – money needs proof of work, but the base of a DeFi system does not.

But these are long-term considerations and in the medium-term, we are still very much correlated.

Let’s jump on-chain to see any notable indicators that jumped out to me over the month.

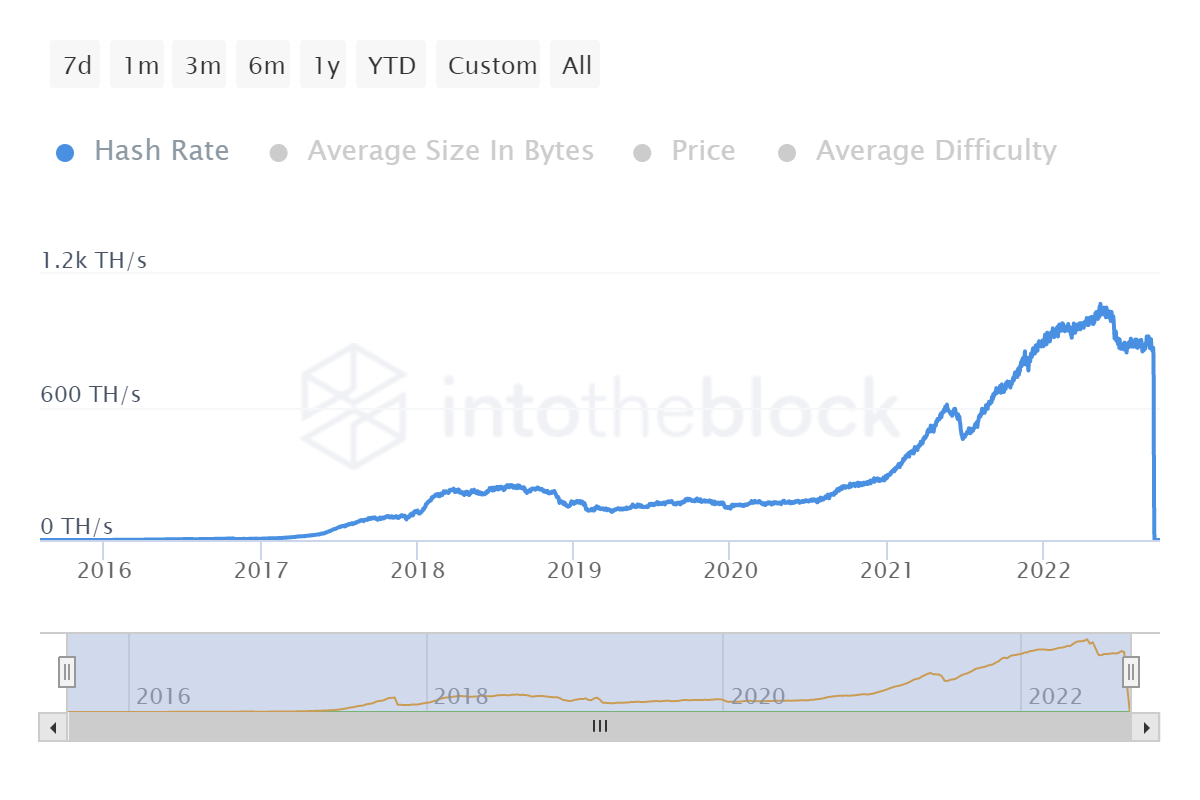

Firstly, given Ethereum completed the aforementioned Merge, there is obviously no more need for miners on the network. This is the exact opposite of ground-breaking news, but it is still cool to see the hash rate drop to zero in the below chart.

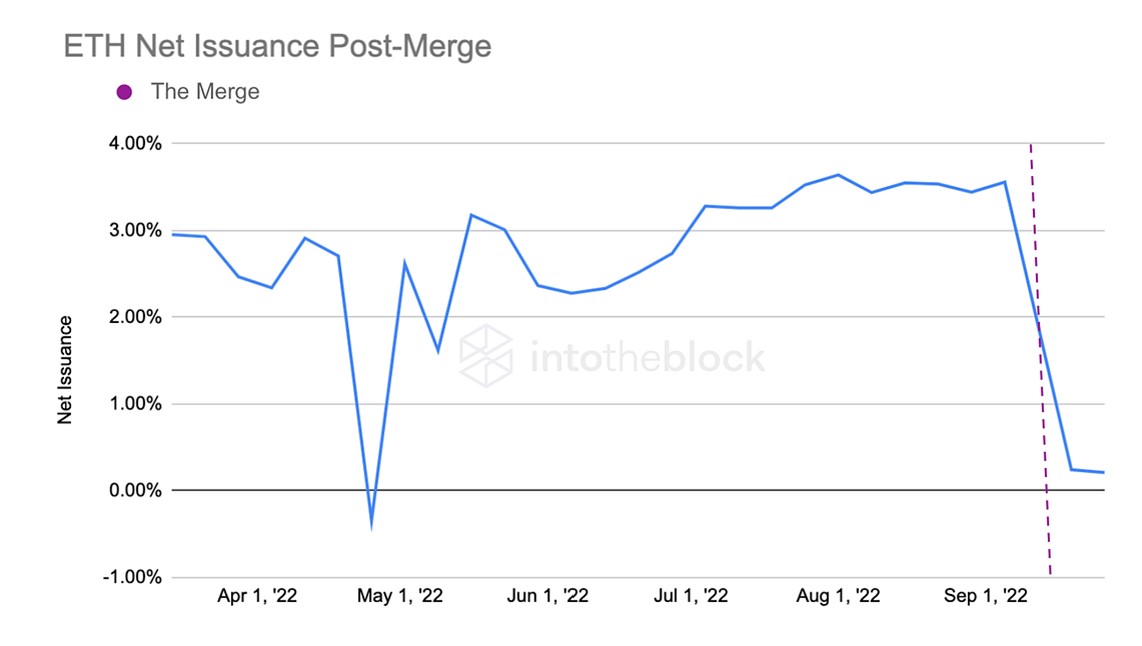

IntoTheBlock shows a neat graph below of the net issuance of ETH dropping after the Merge. It has not fallen to deflationary, which was a narrative many had pushed in the leadup to the Merge.

As I said in previous analyses, I believe this was more a case of naively following a “deflationary means price go up and I want price to go up so I will say ETH will be deflationary” kind of logic. But again, Merge went perfectly and it’s cool seeing the issuance rate drop so drastically.

However, perhaps more sombrely is Ethereum fees dropping 80% quarter over quarter. This is for no other reason than a good old-fashioned fall in demand. The macro situation remains absolutely abhorrent and it follows that demand for the network is down (I’m likely being a little harsh as Layer 2’s are partially exacerbating this fall in fees but it is largely due to an overall fall in demand).

However, perhaps more sombrely is Ethereum fees dropping 80% quarter over quarter. This is for no other reason than a good old-fashioned fall in demand. The macro situation remains absolutely abhorrent and it follows that demand for the network is down (I’m likely being a little harsh as Layer 2’s are partially exacerbating this fall in fees but it is largely due to an overall fall in demand).

Flicking over to Bitcoin, the percentage of long-term holders – aka diamond handers – continues to creep back up towards its all-time high of close to 64%, set this time last year. The data shows that this demographic – defines as those holding Bitcoin for longer than a year – remain unmoved, and this latest bearish month is no different.

I was curious as to whether there would be an increase in the hash rate on Bitcoin following the Ethereum merge.

Looking at the graph below, showing the last three months, there does not appear to be much movement. This makes sense, I suppose – there are other coins which miners are able to flick over to easier with their equipment rather than Bitcoin.

Top of that list is good old Ethereum Classic – a coin which I had largely forgotten about until I noticed its hash rate had ballooned to an all-time high on the date of the Merge, nearly 4Xing overnight.

Top of that list is good old Ethereum Classic – a coin which I had largely forgotten about until I noticed its hash rate had ballooned to an all-time high on the date of the Merge, nearly 4Xing overnight.

In truth, this month was about the Merge and nothing more. We can talk about on-chain indicators all we like, and as a blockchain junkie myself, I am more than happy to do so.

But the reality is that in the short term, the only thing that matters for crypto is the macro situation. The lack of activity on price around the Merge proves this.

Crypto has been, and will continue to, trade like leveraged bets on the S&P 500 going forward. So strap in and tune in to the words of Jerome Powell, because that is all that really matters until we get some macro momentum again and things can start to move.

Welcome back, Green Day.

The post September roundup: Merge comes and goes, markets lag and macro does its thing appeared first on CoinJournal.

Bitgert price erased most of the gains it made in August in September. BRISE, the platform’s native token, slipped to a low of $0.00000046 in September, which was about 65% below the highest level in August. According to CoinMarketCap, Bitgert has a market cap of over $223 million.

Bitgert is an upcoming blockchain project that aims to become the best alternative to popular smart contract providers like Ethereum, Cardano, and Solana. Its key benefits are that Bitgert is significantly faster than its competitors and is much cheaper to operate.

On speed, Bitgert can handle more than 100k transactions per second. This is a high speed considering that giant platforms like Visa and Mastercard process less than 30k transactions per second. At the same time, Bitgert has near zero gas fees. This means that it millions of transactions cost less than $5.

Bitgert price did well in August as the ecosystem expanded and after the developers announced plans to launch a new operating system. During the month, the total value locked (TVL) of its ecosystem rose to more than $11 million, helped by Spynx.

In September, however, the situation turned around, with the TVL crashing to less than $6 million. Sphynx’s TVL has dropped by more than 47% in the past 30 days while that of IcecreamSwap dropped by more than 28%.

⚡️ Partnership Ann: @CryptoRubic to integrate Bitgert chain!

Rubic can swap any of 15,000+ tokens, on and between 13 blockchains in one transaction#BRISE #BITGERT pic.twitter.com/iInKK9dAdc

— Bitgert – $BRISE (@bitgertbrise) September 22, 2022

Bitgert had several important announcements in September. For example, Huobi Global listed BRISE, which is a major thing considering that Huobi is one of the leading exchanges in the industry. As a result, Midas NFT and Bitgert announced that they had burned 12.4 billion BRISE.

Bitgert also launched a new influencer grant program as it seeks to grow its ecosystem. Further, Incentive and CryptoRubric integrated with Bitgert. All these are steps in the right direction as Bitgert aims to become a mainstream platform.

The four-hour chart shows that BRISE has been in an overall bearish trend in the past few weeks. In this period, it formed a descending channel that is shown in green. The coin also managed to move below the 25-day and 50-day moving averages.

The current price of $0.00000055 is also its lowest point on August 19. At the same time, the MACD and the Awesome Oscillator have continued moving downwards. Therefore, while the overall trend is bearish, a bullish breakout to $0.0000010 will likely happen in October.

The post Bitgert price prediction: Is BRISE a Viable Buy in October? appeared first on CoinJournal.

Die Richterin Analisa Torres hat nun entschieden, dass die SEC die Dokumente von William Hinman an Ripple Labs übergeben muss.