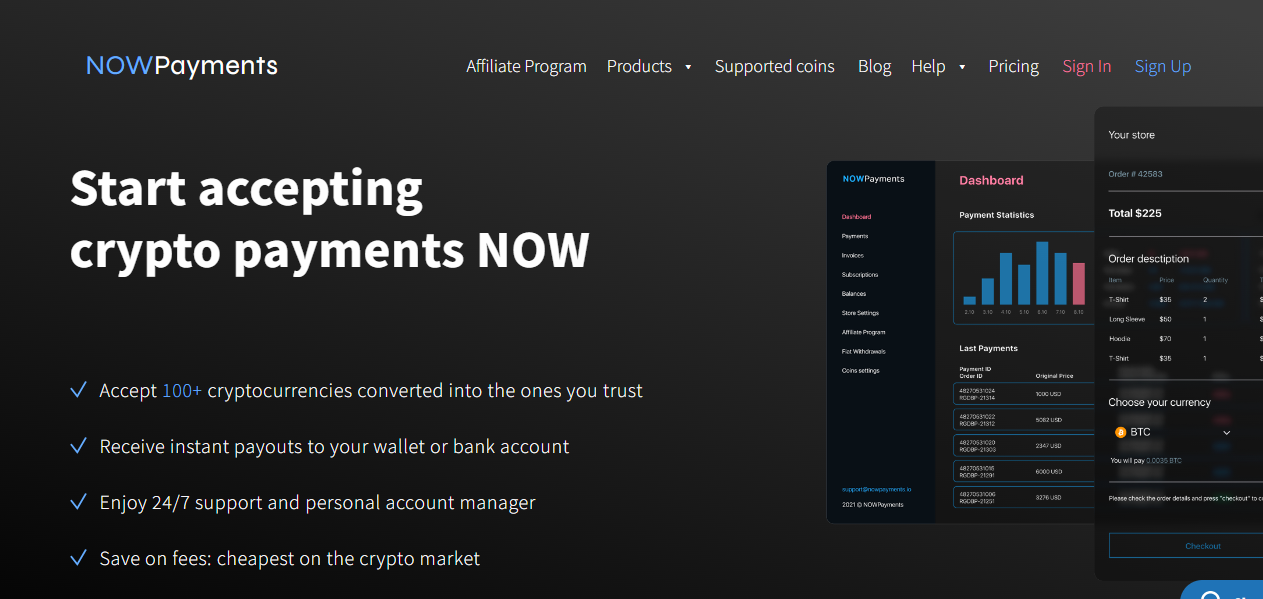

NOWPayments is a cryptocurrency payment gateway that lets users accept payments in more than 100 cryptocurrencies. It supports auto coin conversion, allowing merchants to accept their crypto of choice even if the customer makes payment in another one.

The gateway supports fiat conversion and has a Mass Payout solution, a Twitch donation button, and customized solutions for casinos.

The platform gives access to a personal account manager, lets customers receive instant payouts to an e-wallet or bank account, offers 24/7 support, and is known for some of the lowest fees on the market.

Among the tools available to merchants are API, widgets, invoices, and plugins for WooCommerce, PrestaShop, Opencart, ZenCart, Magento 2, etc. Last but not least, NOWPayments doesn’t take custody of users’ funds.

How it works

NOWPayments lets online marketplaces accept payments in crypto quickly and easily. It works like this: the marketplace sets the price, lists a Bitcoin address, and receives payments without go-betweens. All payments made are visualized in one table.

Each Bitcoin payment is linked to the specific customer and their purchase. Order and payment IDs streamline cash flow.

The merchant can see the sum of money sent and if it corresponds to the original price because each payment is attached to a specific item in the store. They can track the payment under Status and get updates on their payments here.

Users of NOW can use a tool to get instant payment notifications if they integrate the API to create a native-looking payment gateway. They’re notified when a transaction has been completed.

The inbuilt crypto swap tool exchanges customers’ coins before the system reflects the payment in the merchant’s account.

Finally, the dashboard lists the number of payments the merchant has received on a specific day, in a given month, and over the course of its existence.

Key features

NOWPayments is most notable for its capacity to make accepting crypto payments online effortless and easy. You can integrate it into WooCommerce or other content management systems already being used on your website.

The platform employs a helpful support team, who accompany customers at every step of the setup process.

The crypto exchange feature makes it easy to manage a large number of different cryptos. Users can not only accept more than 100 different cryptos but also convert each one to a single, preferred digital or fiat currency automatically.

Pros

· Easy integration into existing operations and sites

· Responsive customer support

· Easy to exchange crypto assets

· Straightforward to accept crypto payments online

· Does not take custody of user funds

· Plugins available for a number of CMS platforms

Cons

· No mobile app

· No support for point-of-sale (PoS) systems

· Sandbox documentation could be improved

Reasons to register with NOWPayments

The company behind NOWPayments is ChangeNOW, which has been active in the cryptocurrency space for many years and has never had a security issue. NOWPayments has inherited this strong track record. ChangeNOW has even helped people recover funds lost in incidents with crypto exchanges.

Users’ funds with NOWPayments are safe because the user is always in control of them. The only real risk is when assets are being exchanged. The user controls the private keys to their crypto assets and needs to be comfortable with the respective responsibility.

What makes NOWPayments unique?

NOWPayments is unique in the problems it solves with fiat exchange, crypto swapping, user funds control, etc. Let’s look at how it does this.

More customers want to be able to pay in crypto, but some businesses accept fiat only. By providing a crypto-to-fiat option, NOWPayments helps them get more customers. NOWPayments’ range of buttons and plugins and the intuitive API can benefit any organization that wants to begin accepting cryptocurrencies.

Many businesses that already accept crypto will only take payment in the leading ones, like Bitcoin or Ethereum. It can be a problem if the customer wants to pay in another crypto.

The cryptocurrency payment gateway helps businesses overcome this issue by providing automatic conversion. The customer can pay in their crypto of choice, but the seller will get the coin or token they initially required.

Last but not least, NOWPayments stands out with its round-the-clock support. Each customer is assigned a personal account manager. The payment platform provides full assistance regardless of the issue and integration support.

Final thoughts

NOWPayments enables a simple but effective practice: the vendor sets the price, lists a Bitcoin address, and receives direct payments. As a non-custodial service, it might not be a good option for users who are uncomfortable with the responsibility of holding their funds.

The post What to know before signing up with NOWPayments appeared first on CoinJournal.

Cardano price chart and key price levels. Source:

Cardano price chart and key price levels. Source: