Bitcoin und die Altcoins klettern langsam wieder nach oben, doch steht der Aufwärtstrend schon wieder vor der Tür?

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Bitcoin und die Altcoins klettern langsam wieder nach oben, doch steht der Aufwärtstrend schon wieder vor der Tür?

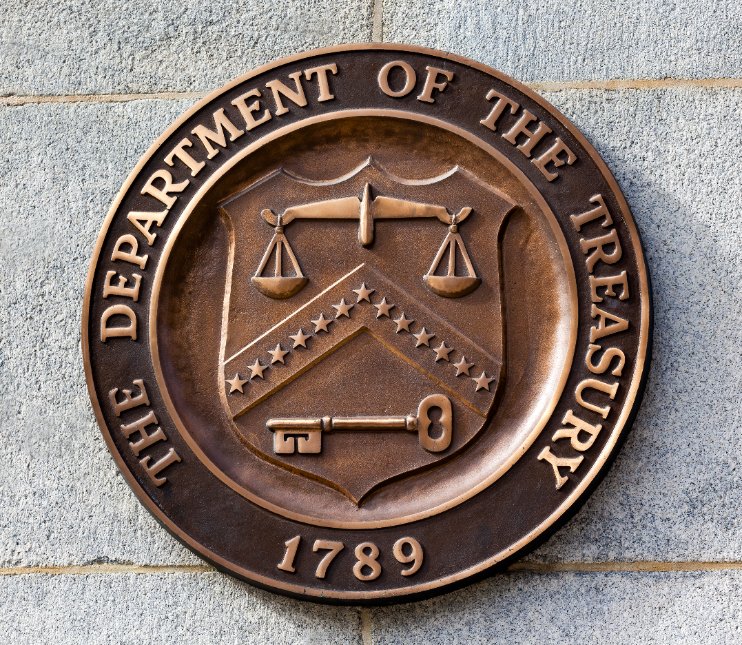

The US Treasury wants to see a little more close cooperation between various global regulators on the topic of cryptocurrency regulation.

The department, whose commentary on the need for international coordination was made in a Fact Sheet released on Thursday, says having such interactions are critical to tackling potential risks that might find fertile ground with the increased use of digital assets.

“Uneven regulation, supervision, and compliance across jurisdictions creates opportunities for arbitrage and raises risks to financial stability and the protection of consumers, investors, businesses, and markets,” the department said in the release.

The framework highlighting interagency engagements between the US and allies across the globe was handed to President Biden by the Secretary of the Treasury.

This also involved the Secretary of State, the Secretary of Commerce, and the US Agency for International Development (USAID).

The US Treasury’s call was part of a framework on digital assets sent to President Joe Biden, and follows an earlier Executive Order targeted at ensuring responsible innovation in the crypto industry.

The US government’s goal, according to the Treasury officials, is to have a unified approach towards promoting key innovations in digital assets. However, it also wants to forge ties across the globe to make things like investigating illegal transactions through offshore accounts easier.

Adequate regulation and cooperation will make it easy to combat money laundering, potential financing of terrorism, ransomware attacks sanctions evasion. These and other major concerns, the department said, can pose both national security and financial stability risks.

As such, the US Treasury is looking at further coordination and commitment from leading organizations such as the G7, the G20, Financial Stability Board (FSB), Financial Action Task Force (FATF) and the Organization for Economic Cooperation and Development (OECD).

The post US Treasury calls for international cooperation on crypto regulation appeared first on CoinJournal.

Mit einem Sprung über den wichtigen 200-Week Moving Average könnte der Bitcoin-Kurs sogar bis auf 30.000 US-Dollar katapultiert werden, weshalb auch die Stimmungslage wieder ins Positive umschlägt.

Blockchain.com is one of the cryptocurrency companies likely to lose millions of dollars as a result of the collapse of crypto hedge fund Three Arrows Capital.

A report by CoinDesk states that the crypto exchange, among the oldest in the industry, could see $270 million flushed down the drain due to 3AC’s liquidation.

Three Arrows Capital is one of several crypto firms caught in the throes of a massive contagion, catalyzed by blatant financial irresponsibility. Terra’s collapse in May appears to have been just the tip of the iceberg.

With liquidations and bankruptcy filings all over, the market is likely yet to see the full impact of what has happened at companies such as Celsius Network, Voyager Digital, BlockFi and Vauld.Some more will have probably have bitten the dust by the time the tide fully recedes.

As for Blockchain.com, CoinDesk cites a shareholder letter the company published on Friday noting 3AC’s insolvency risks putting a $270 million hole in the exchange’s balance sheet. According to the report, these are the sentiments of Blockchain.com CEO Peter Smith.

Earlier in June, Smith commented on the “historic wash out” in crypto, noting that the space was likely to see continued crushing of “high risk capital.”

1/ Question of the week: what is happening in crypto markets right now? Answer: A historic wash out of leverage and risk capital across the space.

— Peter Smith (@OneMorePeter) June 24, 2022

On Thursday, Galaxy Digital CEO Mike Novogratz said the events in the crypto industry, specifically around the collapsing companies, could be subject to investigation and prosecution.

The post Blockchain.com could lose $270 million loaned to 3AC: Report appeared first on CoinJournal.

Shiba Inu plans to launch new stablecoin

SHIB tokens posted a 6% jump in the past week

New token underway as part of Shiba Inu’s expansion plan

While market sentiments initially drove meme tokens, some are gaining multiple use cases and project expansion. Shiba Inu inu is one such. The network recently integrated metaverse gaming and is now entering the stablecoin space. Its rival Dogecoin has also seen adoption as a form of payment.

Shiba Inu token is based on the Ethereum blockchain as an ERC-20 asset. The token was founded in 2020 under the pseudonym ‘Ryoshi.’ While the original aim of Shiba Inu was to have a decentralized digital currency for value sharing, the network is seeing numerous uses.

SHIB is the native token powering Shiba Inu as a utility token. The protocol has created two other tokens, Leash and Bone, available in its in-built ShibaSwap DEX. Token holders can stake SHI tokens for xSHIB at the xSHIB pool.

Shiba Inu’s lead developer, Shytoshi Kusama, has announced plans to launch an experimental stablecoin. The developers said that SHI stablecoin would launch in about a year. SHI comes amid a volatile stablecoin market that saw algorithmic TerraUSD collapse.

The meme-token community is also planning to have a new reward token called TREAT. The token will reportedly be useful in the Shibarium metaverse and the upcoming collectable card game. Kusama added that Shibarium was on track with new developers working on the project.

The developments around Shiba Inu seem to be giving it some bullish momentum. The latest data from CoinMarketCap shows that the meme token is trading at $0.00001081 after a 2.67% increase in the past day and a 6.85% weekly gain.

Source: TradingView

Source: TradingView

The daily price outlook above shows that SHIB has remained range-bound since May 12. The tokens have been trading between a low of $0.00000726 and a high of $000001243. However, the MACD is showing a bullish momentum. The RSI is slightly above a neutral reading but above the oversold zone.

SHIB is showing bullish momentum as cryptocurrencies embark on a recovery path. While meme tokens like Shiba Inu were initially seen as lacking real use cases, the trend seems to be changing. Entry into the stablecoin space and the metaverse could give SHIB long-term value and benefits to the holders.

The post Shiba Inu to launch a new stablecoin. Is it a buy? appeared first on CoinJournal.