Der IWF prognostiziert eine Verlangsamung des Wirtschaftswachstums von 6,1 Prozent im letzten Jahr auf 3,2 Prozent im Jahr 2022. Einige Leute glauben, dass das für Krypto negative Folgen haben wird.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Der IWF prognostiziert eine Verlangsamung des Wirtschaftswachstums von 6,1 Prozent im letzten Jahr auf 3,2 Prozent im Jahr 2022. Einige Leute glauben, dass das für Krypto negative Folgen haben wird.

Das Logo von Crypto.com war beim Großen Preis von Frankreich nicht zu sehen. Alfa Romeo, AlphaTauri und Alpine sollen alle Krypto-Logos entfernt haben.

Ethereum is in the process of an upgrade that will help it scale better. However, Ethereum is still far off from achieving this goal. As Vitalik Buterin recently put it, Ethereum is 40% complete even after the merge.

This slow development in Ethereum has opened the way for new, more efficient blockchains to gain adoption. While there are many Ethereum competitors in the market today, below are some of the best and most competitive. These two could be heavily undervalued now that the cryptocurrency bear market has pushed them to record lows.

Solana (SOL) remains one of the top platform blockchains in the market. This is all thanks to its scaling capabilities and the fact that it has some of the lowest transaction costs of all major platform blockchains today.

While Solana has been bearish for the last couple of months, many analysts are optimistic that Solana has the potential to do well going into the future. One of the key factors likely to drive Solana’s growth is NFTs, and the potential is beginning to take shape.

One of the positive pointers to Solana’s potential is SolSea, a Solana-based NFTs platform. While SolSea has been around for a while, it recently rebranded and has many big plans for the future. Among the plans for the relaunched SolSea is to turn it into a YouTube for NFTs. That’s according to SolSea CEO Vitomir Jevrermovic.

Since Solana has low fees, which makes it favorable for anyone looking to launch an NFT, this dream can easily be achieved. That’s because there is a strong chance that most people looking to launch NFTs will look to Solana going into the future.

Avalanche (AVAX) remains one of the best platform blockchains today, driven by its high speeds and security. Avalanche can handle up to 4500 transactions per second and has never had any real security issues.

Besides, the Avalanche team is working hard to drive adoption, which is a plus for its long-term adoption. For instance, in August 2022, the Avalanche team will be in South Korea to help drive the adoption of Web 3.0.

Given that Web 3.0 has the potential to reimagine the web as we know it, Avalanche’s adoption on this front could give it an edge over other blockchains. Besides, Avalanche is positioning itself for infinite scalability by introducing subnets.

The post Top undervalued Ethereum competitors to watch in 2022 appeared first on CoinJournal.

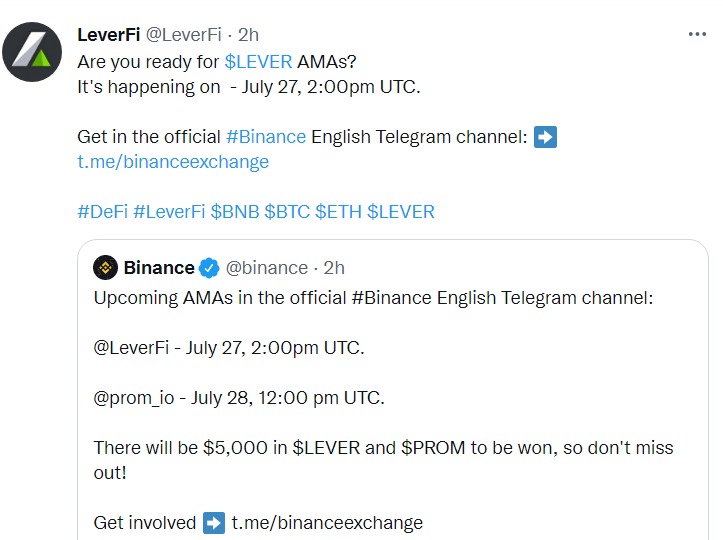

LEVER crypto price jumped sharply on Wednesday as other coins rebounded. The coin rose by about 15%, according to data compiled by Binance. It was trading at $0.0030, which was about 20% below the lowest level this year. The small-cap coin has a market cap of over $41 million.

The Decentralised Finance (DeFi) industry has seen significant growth in the past few years. While the past few months have been challenging, there are signs that it is bouncing back. For example, the total value locked (TVL) in the sector has risen to over $85 billion.

LeverFi is a relatively small blockchain project in the DeFi industry. The network allows users to yield farm using leverage. In other words, its lets traders to deposit yield-bearing collateral and trade the fluctuations in asset prices with up to 10x leverage.

LeverFi accepts a wide range of assets such as mainstream coins like BTC and ETH and liquidity pool assets like Curve, UNI, and Cake. All these assets are then deployed in platforms like Yearn Finance, Convex, and Pancake to earn yields. These leveraged trades are then settled using the Lever platform.

According to the developers, Lever will be deployed in Ethereum’s blockchain and then scaled in other popular platforms like Avalanche and Arbitrum.

The LEVER crypto price is rose as investors cheered the recent addition to the Binance platform. This means that users can buy and trade the $LEVER coin in its platform. At the same time, Binance Futures recently added the $LEVER perpetual contracts with up to 20x leverage.

The current rally is mostly because of the upcoming Ask Me Anything (AMA) of Lever’s platform, which will be hosted by Binance. The company will give over $5,000 worth of rewards.

The hourly chart shows that the LeverFi price bounced back on Wednesday ahead of the upcoming AMA It moved slightly above the descending trendline that is shown in blue. It moved slightly above the 25-day moving average while the Relative Strength Index (RSI) moved below the overbought level. The coin will likely resume the bearish trend and retest the key support level at $0.0025.

The post LEVER crypto price prediction: Why is LeverFi soaring? appeared first on CoinJournal.

Ethereum price bounced back on Wednesday as the market refocused on the upcoming interest rate decision by the Federal Reserve. ETH rose to a high of $1,460, which was significantly higher than this week’s low of $1,356.

Ethereum price staged a strong recovery this month that saw it soar to a multi-month high of $1,665. This rally happened as investors bought the dip as they anticipated the upcoming merge. The combination of the current version with the Beacon Chain is expected to take place in September of this year.

Once complete, the merge will bring the biggest shift in the blockchain industry in years because of the important role that Ethereum plays in it. It will make popular applications built on Ethereum like Aave, Uniswap, and Compound faster and less costly.

Ethereum price also jumped because of the strong inflows in the decentralised finance (DeFi) industry. The total value locked (TVL) across the sector rose from over $72 billion to about $85 billion. This was a strong recovery considering that the sector has been under intense pressure in the past few months.

ETH price is now bouncing back for two main reasons. First, the US dollar index has pulled back slightly ahead of the upcoming FOMC decision. The bank is expected to publish the latest decision during the American session.

Analysts expect that the bank will hike interest rates by another 0.75%. If this happens, it means that the Fed will have increased rates by 225 basis points this year alone. The US dollar is possibly retreating as investors price in a less hawkish statement from Powell.

Ethereum price is also rising as the stock market recovers. Futures tied to the Dow Jones, S&P 500, and Nasdaq 100 rose by more than 1% after the mixed earnings by companies like Microsoft and Google.

The 4H chart made a strong bearish breakout on Tuesday as the crypto sell-off accelerated. It reached a low of $1,356, which was the lowest level since July 18th. The coin managed to move below the 25-day and 50-day moving averages. At the same time, it invalidated the bullish flag pattern that is shown in black.

Now, Ethereum price is attempting to retest the lower side of the ascending channel. This is known as a break and retest pattern, meaning that the coin will likely have a bearish breakout in the near term. If this happens, the next key point to watch will be at $1,278.

The post Ethereum price forecast: break and retest pattern forms appeared first on CoinJournal.