-

Die Sandbox (SAND), STEPN (GMT) und Gala (GALA) sind einige der besten Gamefi-Token, in die Sie derzeit einsteigen können.

-

Jeder Token hat ein hohes Wachstumsniveau gezeigt.

-

Alle diese Token haben das Potenzial, neue Höhen zu erreichen.

The Sandbox (SAND), STEPN (GMT) und Gala (GALA) sind alles solide Gamefi-Token.

Die Aufsichtsbehörde für virtuelle Vermögenswerte in Dubai, VARA, kündigte ihr Metaverse-Debüt in The Sandbox an. Dies war das erste Mal, dass eine Krypto-Regulierungsbehörde im Metaversum präsent war und dort ihre virtuelle digitale Zentrale eröffnet hat.

Am 3. Mai veröffentlichte STEPN seine Erfolgsgeschichte auch auf Twitter, was zusätzliches Interesse an dem Projekt weckte.

Gala Games kündigte ihr May Mayhem an, das Belohnungen, Non-Fungible Token (NFTs) sowie andere Vorteile bringt.

Wir werden jeden Token einzeln durchgehen, damit Sie wissen, was Sie erwartet.

Sollten Sie The Sandbox (SAND) kaufen?

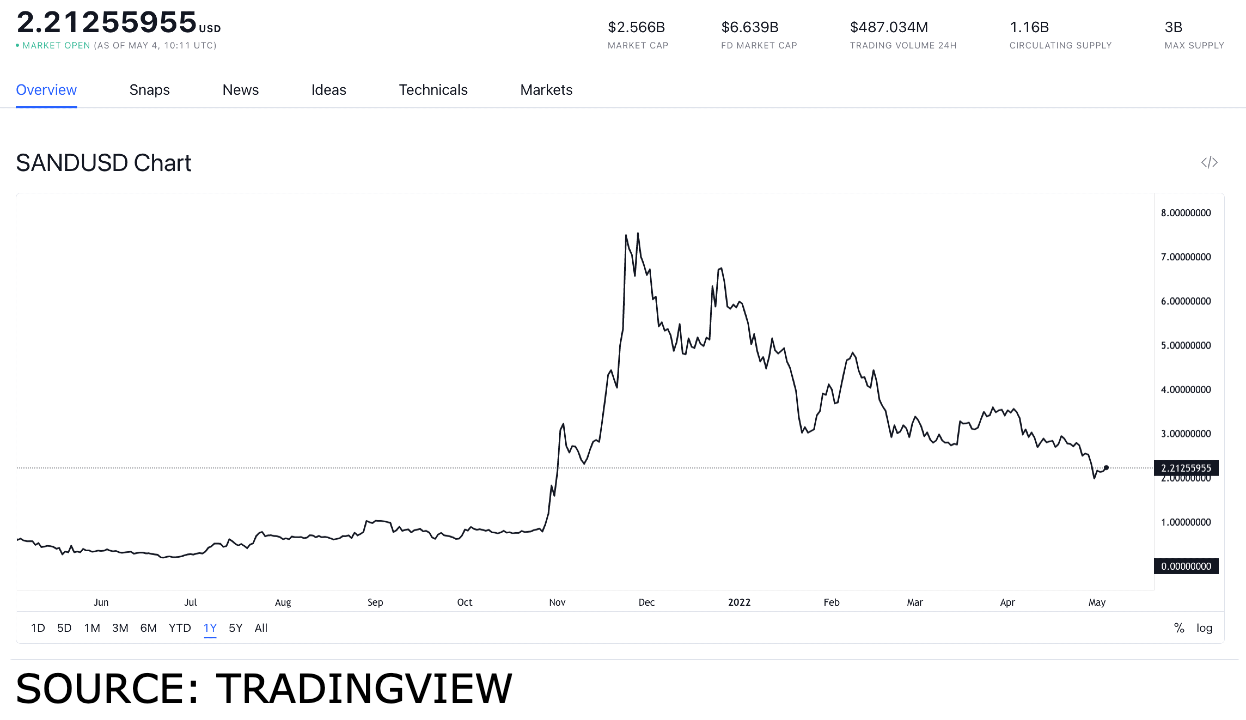

Am 4. Mai 2022 hatte The Sandbox (SAND) einen Wert von 2,21 USD.

Wenn es um den Allzeithochwert geht, hatte The Sandbox (SAND) seinen höchsten Stand am 25. November 2021, als der Token 8,40 USD erreichte. Das bedeutet, dass der Wert des Tokens um 6,19 USD oder um 280 % höher war.

Wenn wir uns jedoch ansehen, wie sich The Sandbox (SAND) im letzten Monat entwickelt hat, hatte es seinen Höchststand am 2. April bei 3,64 USD, seinen Tiefststand am 30. April bei 2,13 USD. Dies bedeutete einen Rückgang von 1,51 USD oder 41 %.

Vor diesem Hintergrund ist SAND mit 2,21 USD ein solider Kauf, da es bis Ende Mai einen Wert von 2,8 USD erreichen kann.

Sollten Sie STEPN (GMT) kaufen?

Am 4. Mai 2022 hatte STEPN (GMT) einen Wert von 3,26 USD.

Wenn wir uns die Performance im April ansehen, hatte STEPN (GMT) am 7. April mit 2,04 USD seinen niedrigsten Wert.

Wenn wir uns seinen Allzeithochwert ansehen, erreichte STEPN (GMT) seinen ATH am 28. April 2022 mit einem Wert von 4,11 ZSD. Dies bedeutet, dass der Wert des Tokens um 0,85 USD oder um 26 % höher war als am 4. Mai.

Vom 7. April bis zum 28. April stieg der Wert des Tokens um 2,07 USD oder um 101 %.

Vor diesem Hintergrund kann STEPN (GMT) bis Ende Mai 4 USD erreichen, was es zu einem soliden Kauf macht.

Sollten Sie Gala (GALA) kaufen?

Am 4. Mai 2022 hatte Gala (GALA) einen Wert von 0,1424 USD.

Gala (GALA) erreichte sein ATH am 26. November 2021 mit 0,824837 USD. Das bedeutet, dass der Token bei seinem ATH um 0,682437 USD oder um 479 % höher war.

Wenn wir uns die Performance des letzten Monats ansehen, hatte Gala (GALA) seinen höchsten Wert am 2. April bei 0,2719 USD, während sein niedrigster Wert am 30. April bei 0,1459 USD lag. Dies bedeutete einen Rückgang um 0,126 USD oder 46 %.

Mit 0,1424 USD ist GALA jedoch ein solider Kauf, da es bis Ende Mai 0,3 USD erreichen kann.

The post Ein frühzeitiger Einstieg in diese Gamefi-Token kann hohe Renditen bringen appeared first on BitcoinMag.de.