The Terra price crashed to the lowest level since February this year as the cryptocurrencies sell-off accelerated. LUNA dropped to a low of $50.60, which was about 60% below the highest level on record. As a result, its total market cap has declined to about $19.5 billion.

Terra downward trend

Terra was not left behind in the ongoing cryptocurrency sell-off as investors battled the rising volatility and risks in the market. It was not alone considering that other cryptocurrencies also crashed to multi-month lows.

Indeed, the total market cap of all cryptocurrencies tracked by CoinGecko declined to above $1.56 trillion. At its peak, the market cap rose to more than $3 trillion, making them large asset classes in the world.

Terra has therefore declined as many people who own the coin dump it fearing more losses. There are also concerns that about the lack of inflows into the coin.

Learn more about how to buy cryptocurrency.

Further, fears of the hawkish Federal Reserve have pushed more people out of the market as evidenced by weak performance across the board. For example, the tech-heavy Nasdaq 100 index has dropped by 26% from its highest point this year. Similarly, the Dow Jones and the Nasdaq have all declined by more than 10% from their highs.

Meanwhile, Terra price is also struggling as its DeFi platforms see intense outflows. According to DeFi Llama, Terra’s total value locked (TVL) has declined by more than 18% in the past 24 hours. This is a deeper decline than other chains like Ethereum, Solana, and BNB Chain.

The TVL currently stands at $20.19 billion. Its biggest applications have seen their TVL drop by more than 20% in the past 24 hours. For example, the TVL of the Anchor Protocol has slipped by 16% while those of Lido and Astroport have fallen by over 20%.

Terra price prediction

In my last article on Terra, I warned that the coin would see a major decline since it was forming an inverted cup and handle pattern. This prediction was accurate as the coin has crashed sharply in the past few days.

Terra has moved below the 25-day and 50-day moving averages while the MACD and the Relative Strength Index have moved to the extremely oversold levels.

Therefore, the LUNA price will likely have a brief rally this week especially when the US publishes weak consumer inflation data. If this happens, the next key resistance to watch will be at $60.

The post Should you buy Terra LUNA as it gets extremely oversold? appeared first on Coin Journal.

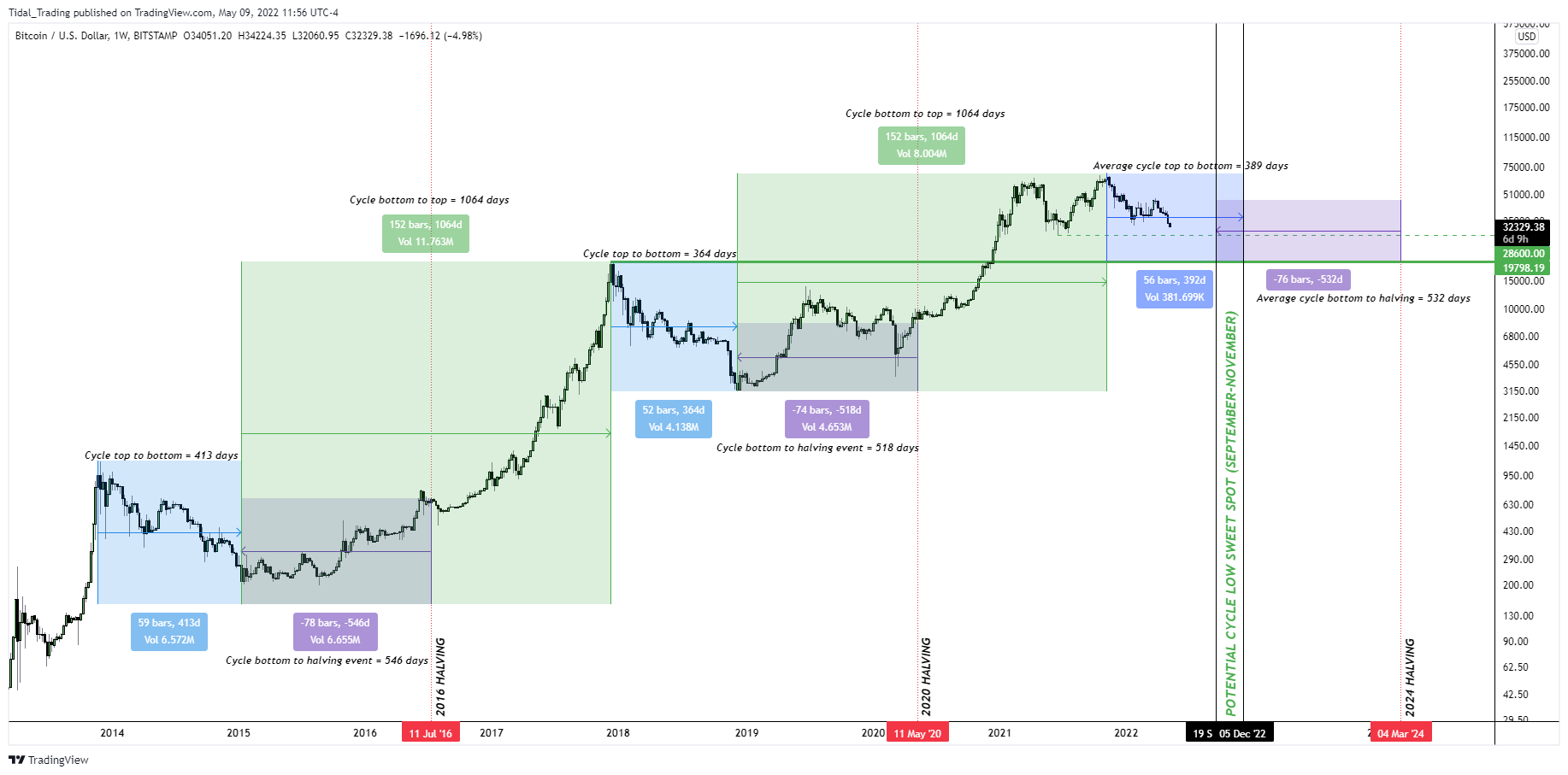

Chart showing historical price movement for BTC. Source:

Chart showing historical price movement for BTC. Source: