Die Gruppe erklärte, dass bei allen Technologien, darunter auch Krypto, eine Emissionsreduktion oder Emissionssteigerung möglich seien, je nachdem, wie man diese steuert.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Die Gruppe erklärte, dass bei allen Technologien, darunter auch Krypto, eine Emissionsreduktion oder Emissionssteigerung möglich seien, je nachdem, wie man diese steuert.

The UK is taking this and other steps as it looks to position itself as a global hub for crypto-asset technology innovation, Economic Secretary to the Treasury said at the UK Fintech Week 2022.

The UK is set to bring stablecoins within its regulatory framework on electronic payments, opening the assets to further adoption across the country.

The plans came to light on Monday, highlighted by a government official during the InnFin Global Finance Summit event in London.

According to Economic Secretary to the Treasury John Glen, the government is seeking appropriate and actionable steps that should put the UK at the forefront of crypto innovation.

The government wants to see the country become a “global hub” for crypto technology and investment, Glen said.

And one of the steps involves the gradual fine-tuning of the country’s regulatory guidelines so that stablecoins become a legal payment option for consumers. These steps will also be tailored toward supporting stablecoin issuers and service providers.

Economic Secretary @JohnGlenUK announced today that stablecoins will be brought into UK payments regulation.

This places the UK financial services sector at the forefront of technology, creating conditions for stablecoin issuers and service providers to operate and invest. pic.twitter.com/14SsIGW5bf

— HM Treasury (@hmtreasury) April 4, 2022

The Finance Ministry’s recommendations also include the realization that growth within the digital asset space could provide a major boost to consumer choice. As such, UK’s government is eyeing a new regulatory approach that can support not just the stablecoin sector, but other sectors within the broader digital assets markets.

“If crypto technologies are going to be a big part of the future, then we, the UK, want to be in,” Glen said at the UK Fintech Week 2022.

Plans to have stablecoins brought within the UK’s regulatory environment have been coming since last year. However, there’s a new pace to the whole idea.

On Monday, HM Treasury (UK’s Economic and Finance Ministry) announced that Chancellor of the Exchequer Rishi Sunak had asked the Royal Mint to create an NFT and issue it by summer.

Chancellor @RishiSunak has asked @RoyalMintUK to create an NFT to be issued by the summer.

This decision shows the the forward-looking approach we are determined to take towards cryptoassets in the UK. pic.twitter.com/cd0tiailBK

— HM Treasury (@hmtreasury) April 4, 2022

Other major plans around crypto from the British government include wider consultations around decentralised autonomous organisations (DAOs) and decentralised finance (DeFi). For the latter, the key considerations are around DeFi loans and staking.

According to the finance ministry, the new legislation forms part of the broader goal to have a Financial Market Infrastructure Sandbox in place by 2023.

The post UK government wants to make stablecoins a legal payment method appeared first on Coin Journal.

Das Bitcoin-Mining in Norwegen macht 0,77 Prozent der BTC-Hashrate aus und nutzt dabei zu 100 Prozent erneuerbare Energie.

Another country has entered the cryptocurrency party, and it’s a big one. The United Kingdom’s Economic and Finance Ministry announced this afternoon that the country will be amending its regulatory framework to allow the introduction of stablecoins as a means of payment.

Sure, it’s not like Boris Johnson has gone full-El Salvador and introduced Bitcoin as legal tender, but it’s still an important step and one that may cause a domino effect, especially given it is coming from Britain.

The most criticised aspect of El Salvador’s Bitcoin initiative, of course, is the notorious volatility that Bitcoin suffers from. With stablecoins, that is not an issue, with their value pegged to fiat counterparts.

This is part of the reason that this announcement is such notable news – this is very much a targeted initiative looking at introducing crypto specifically as a means of payment, rather than simply loosening the overall regulation on the industry.

Her Majesty’s Treasury (otherwise referred to as the Exchequer – I’m still learning my British acronyms as I intend to move to London later this year), were quite bullish in their assessment of stablecoins in their statement Monday: “The rationale for doing this is that certain stablecoins have the capacity to potentially become a widespread means of payment including by retail customers, driving consumer choice and efficiencies”.

Her Majesty’s Treasury (otherwise referred to as the Exchequer – I’m still learning my British acronyms as I intend to move to London later this year), were quite bullish in their assessment of stablecoins in their statement Monday: “The rationale for doing this is that certain stablecoins have the capacity to potentially become a widespread means of payment including by retail customers, driving consumer choice and efficiencies”.

The statement continued that the amendment of regulation to facilitate these stablecoins was just one aspect of a “package of measures” aimed at incorporating blockchain technology into the UK and creating a “global hub” – so while payment is the first item on the list, as we just mentioned, the UK are also signalling their intent to eventually go beyond this niche and embrace the wider crypto industry, too.

With the volatility of “normal” cryptocurrencies rendering them impractical right now for commerce, stablecoins are primed to take the step up…if regulators get on board. This move by the UK, therefore, is a massive signal of intent – because it is so achievable. “If crypto technologies are going to be a big part of the future, then we – the UK – want to be in, and in on the ground floor” the Economic Secretary, John Glen, said at the Innovate Finance Global Summit. “In fact, if we commit now…if we act now…we can lead the way”, he continued.

We got thoughts from Katie Evans, DeFi Expert at Swarm Markets, on what this may mean, as an insider in the industry. „London is a massive global financial hub, and it has to keep up with the constantly-changing face of financial technology“, she said. „The UK Government does seem to be paying attention to the fact that the race is on to build the crypto centres of the next 50 years, and this is in essence its way of setting out its stall“. Evans was also enthused that stablecoins in particular were a point of focus, pointing out that they serve as „a useful on-ramp for potential crypto asset users“ and are „one of the simplest to assess and approve in crypto terms, bringing them in line with existing financial markets regulation“.

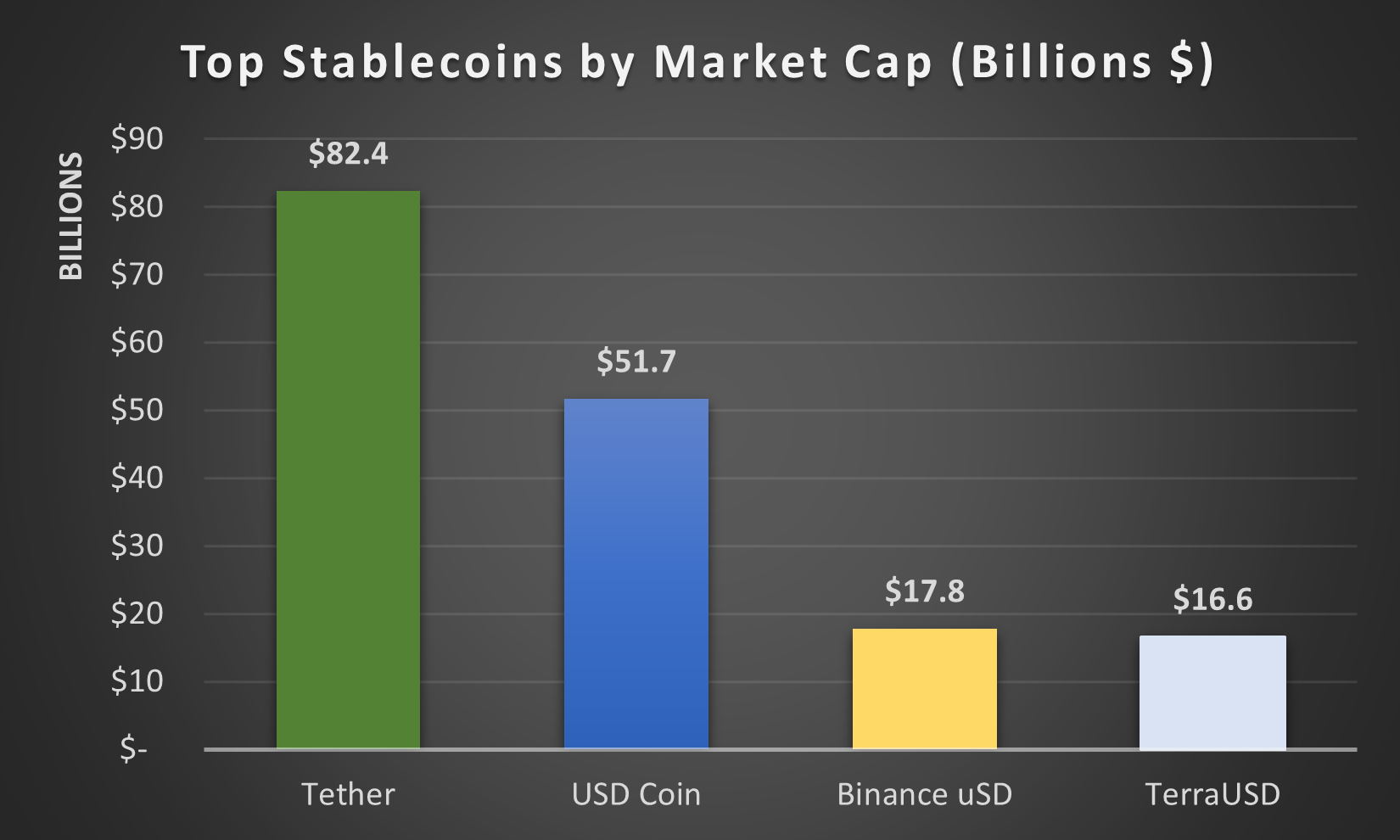

Another interesting tidbit? The non-appearance of Central Bank Digital Currencies (CBDCs) in the announcement. This is very much looking at stablecoins such as Tether, Circle etc to be used as a medium of exchange, when many would have anticipated a CBDC announcement as more likely.

It’s a big marker to lay down, as the UK are now set to become one of the first countries to provide clear guidance to the crypto industry as to how stablecoins can be implemented. This story will grow and is far from over, but today is an important first step.

The post UK embraces crypto, looks to regulate stablecoins appeared first on Coin Journal.

While LUNA has strong fundamentals, ETH has bigger news short-term

Terra is one of the fastest-growing platform blockchains in the market, and its TVL is rocketing.

Ethereum is the number one platform blockchain and is in the process of moving to POS.

With the transition to Eth 2.0 almost done, Ethereum has better prospects than LUNA in the short term.

Terra LUNA/USD has emerged from the shadows to become one of the largest platform blockchains of 2022. As recently as January 2021, not many people knew about LUNA. However, it now outranks many other blockchains and is only second to Ethereum in terms of Total Value Locked. LUNA’s success is linked to the growing adoption of UST and other algorithmic stable coins built on the Terra blockchain. With the adoption of these stable coins on a growth trajectory, LUNA’s value is uniquely positioned to explode going forward. This makes it one of the highest potential cryptocurrencies to keep an eye on in 2022.

On its part, Ethereum ETH/USD continues to be the most significant player in the platform blockchains market. The majority of smart contracts run on the Ethereum blockchain. While people constantly complain about Ethereum’s lack of scalability and high fees, Ether is unlikely to be dethroned anytime soon. This has a lot to do with its security and the fact that it can’t be censored. Essentially, Ethereum is the perfect platform for anyone seeking to run decentralized applications that can be counted on to run properly.

Both LUNA and ETH will likely perform well in 2022 and for years to come. However, ETH looks like a much better bet in the very short term. That’s because it has more big news coming up compared to LUNA. Recently, the testnet merge of Ethereum was completed, an indicator that the much-awaited shift to Ethereum 2.0 is almost over. It is largely expected that the full transition will happen by mid this year. Once this happens, the FOMO it will create could see ETH rally for the rest of the year.

Both LUNA and ETH are excellent investments to hold in 2022. Comparatively, though, Ethereum has better prospects in the short term. The odds are in its favor due to the much-awaited finalization of the transition to Ethereum 2.0.

The post Why Ethereum is a better buy than LUNA in the short term appeared first on Coin Journal.