Solana is a leading blockchain project that seeks to become a leading player in the industry. It was started in 2019 and has managed to raise more than $335 million from venture capital firms. SOL, its native token, has become one of the biggest cryptocurrencies with a market capitalization of over $33 billion. So, here are the top five things to consider when buying Solana.

Solana is an Ethereum-killer

Ethereum is a leading blockchain project that aims to become the go-to platform for blockchain developers. It has become an influential platform that has been used to build some of the most popular platforms in the industry. Some of the best-known blockchains built using Ethereum are Decentraland, Aave, Axie Infinity, and Uniswap.

Ethereum is known for its inefficiency. As a second-generation platform, apps built using the network have slow speeds and high costs. For example, the average transaction cost in Ethereum is more than $20, which is a high amount for most people. Worse, as a proof-of-work platform, Ethereum is energy inefficient since it costs about $2.5 per day to mine Ether.

Therefore, Solana is attempting to create a platform that is significantly faster, cost-effective, and energy-efficient. While Ethereum handles less than 20 transactions per second, Solana is able to handle more than 2,000.

Solana is also environment-friendly since it uses a technology known as proof-of-stake that relies on validators. Most importantly, Solana’s cost of transaction is significantly lower considering that it costs about $0.00025 per transaction. Therefore, many developers are opting to use Solana in the past few months.

Solana ecosystem is growing

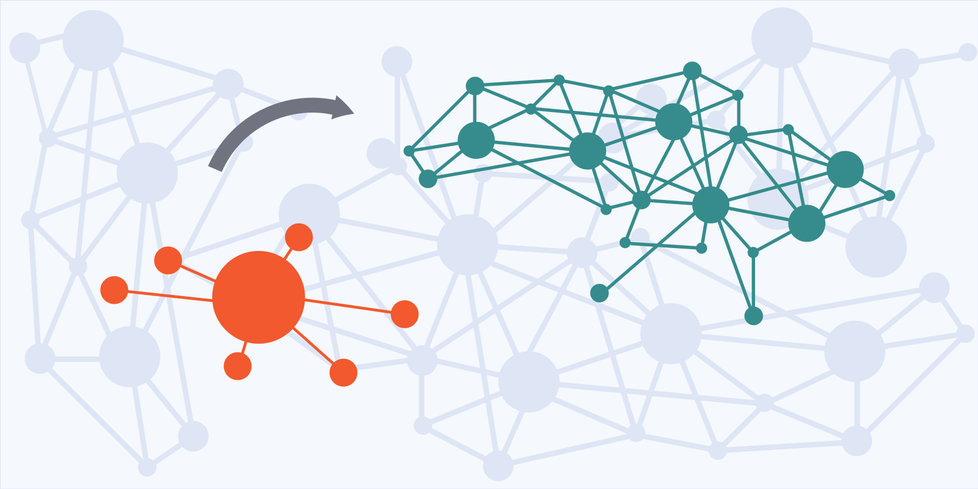

The next key thing you need to know is that Solana’s ecosystem is growing as developers look for alternatives to Ethereum. In the past few years, the number of applications that have embraced the network is in an uptrend.

Some of the apps using Solana’s network are well-known. For example, Brave Brower uses Solana to power its Basic Attention Token (BAT). Brave is a popular browser that is used by more than 50 million people from around the world. It pays them to see adverts when surfing the web.

Audius is another application that has embraced Solana. It is a music streaming platform that seeks to become a leading alternative to Spotify, Apple Music, and Amazon Music among others. Audius lets independent musicians make money whenever people listen to their music.

Solana has also been used to build StepN, a leading application that is disrupting the fitness industry. Users first buy NFTs and then they are paid using the GMT token. The market cap of StepN has been in a strong growth in the past few months.

In total, Solana has been used by developers building all types of applications. According to DeFi Llama, the network has a total value locked (TVL) of over $6 billion. This makes it the fifth-biggest platform in the industry after Ethereum, Terra, BNB Chain, and Avalanche.

Solana is facing strong competition

If you want to buy Solana, you need to know that the network is facing strong competition as more developers seek to dethrone Ethereum. There are many such projects. The biggest competitor to Solana is Ethereum itself.

While Ethereum has been known for slow speeds and inefficiency, its developers are building Ethereum 2.0. The goal is to transition Ethereum from a proof-of-work to a proof-of-stake network, meaning that transactions will be confirmed using validators instead of mining.

Further, Ethereum will embrace a technology known as sharding that will make its transactions much faster. Therefore, there is a likelihood that more people will stick with Ethereum.

Second, Solana is facing competition from platforms like Terra, Avalanche, Polygon, Cronos, Fantom, and Tron. Some of these platforms have faster speeds than Solana. For example, Avalanche is able to handle over 4,500 transactions per second.

Similarly, Kadena is able to handle more than 480,000 transactions per second even while using a proof-of-work mechanism, Therefore, Solana will likely struggle to compete in the coming years as the industry gets crowded.

Solana TVL is slowing

While Solana is a decentralized platform, the reality is that it uses several centralized platforms like Amazon and Cloudflare to work. Therefore, when there is an outage in these platforms, Solana, and apps hosted in its ecosystem tends to be affected.

In the past year, Solana has experienced about 6 outages, the most in the decentralized industry. For example, in January, it suffered an outage that pushed it offline for days.

The impact of these outages is that many developers have now opted to embrace other platforms to build their applications. Also, the total amount of money staked in Solana has been on a downward trend. The total value locked (TVL) has dropped from an all-time high of $14.9 billion to about $6 billion.

Some applications that have seen a sharp decline in TVL are Saber, Serum, and Almond. Marinade Finance, Raydium, and Solend have also seen a sharp decline in TVL.

Solana faces an uncertain future

Solana has been a strong blockchain platform in the past few years. It has become one of the most traded coins in the world. According to Staking Rewards, Solana worth over $30 billion has been held by stakers. This is a significantly strong amount.

However, with competition in the industry rising and with the total value locked in the network slowing, Solana faces an uncertain future ahead. Its future will depend on how fast developers will be in improving the network. You can check out some of the best cryptocurrency apps for buying Solana.

The post Should I Buy Solana? 5 Things You Should Consider appeared first on Coin Journal.