„Von den 80 Prozent der Top-50-Hedgefonds weltweit, mit denen wir gesprochen haben, wollen alle auf irgendeine Art in den Kryptobereich einsteigen“, so Olsson.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

„Von den 80 Prozent der Top-50-Hedgefonds weltweit, mit denen wir gesprochen haben, wollen alle auf irgendeine Art in den Kryptobereich einsteigen“, so Olsson.

BNB Chain has successfully burned over 1.8 million BNB tokens in a transaction completed on 19 April 2022.

Per data from Binance explorer, the transaction saw 1,830,382.48 BNB burned. The market value of the tokens at the time of the burn was over $772 million.

🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 1,830,382 #BNB (772,363,806 USD) burned at #Binancehttps://t.co/x1VxRpqgt1

— Whale Alert (@whale_alert) April 19, 2022

Binance CEO Changpeng Zhao had earlier confirmed the removal of the over 1.8 million BNB. He also acknowledged the successful burn, stating that this activity is part of BNB’s whitepaper.

$741,840,738 worth of #BNB will be taken out of circulation soon.

Real time info: 👇https://t.co/BikWciOHY7#BNB is deflationary. If you don’t know what that means, you lack basic financial knowledge to get lucky in this world. Harsh but true. Time to learn.🙏

— CZ 🔶 Binance (@cz_binance) April 19, 2022

This was BNB’s 19th burn (for Q1 2022) after Binance adopted an auto burn system that automatically triggers from an on-chain command.

The auto burn system allows for a planned removal of BNB from circulation and takes into account the coin’s price and total blocks generated in the given quarter on the Binance Smart Chain. For Q1 2022, the total number of blocks was 2581627, with the average price at $403.22.

During the 18th burn, over $729 million worth of BNB was removed from circulation.

The next burn is estimated to also see 1.8 million BNB (estimated at $769 million) taken out of circulation. According to data on the BNB Chain, the 20th burn is expected to occur at an average price of $424.59.

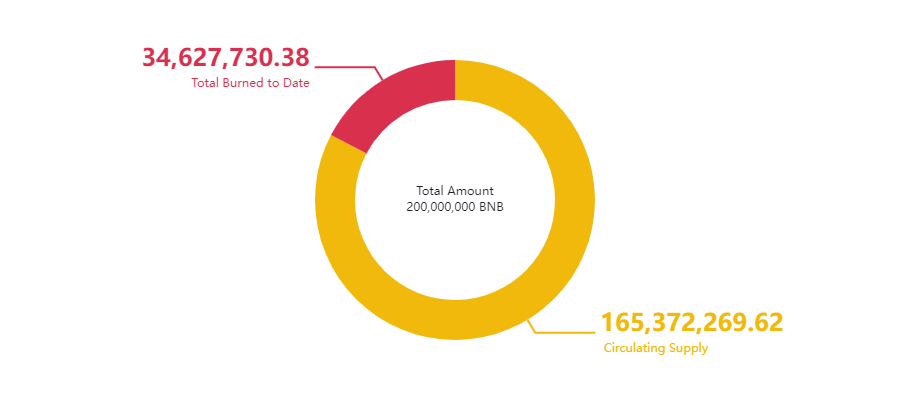

BNB Chain plans to reduce the total supply from 200,000,000 BNB tokens to 100,000,000. As of the latest burn, a total of over 34.6 million tokens have been destroyed. Data shows the circulating supply is currently just over 165.3 million.

BNB supply

BNB supply

BNB was trading at $420 at writing time, with the token’s value up by 4.4% in the past 24 hours. BNB/USD has added nearly 7% in the past week.

The post BNB Chain burns $772M worth of BNB appeared first on Coin Journal.

The crypto markets were higher this morning, with the majority of the top 10 cryptos registering gains over the past 24 hours. The dire predictions of a market crash, made by Fortune and other leading media, have not materialized.

The announcement that Russia might accept crypto as legal tender has not impacted the markets as much as expected.

Bitcoin climbed around 5%, trading above $40,000 at the time of writing. Ethereum was up around 4%, and Cardano, XRP, and Solana all recorded gains of around 5%.

The biggest gainer in the top 10 is Terra, up 15% at time of writing. Terra announced the introduction of self-repaying loans and its stablecoin UST surpassed its rival BUSD, Binance’s stablecoin, by market cap.

At #16, NEAR Protocol is up 13%, once again picking up a recent bullish trend.

Outside the top 20, ApeCoin jumped around 9%. Most other cryptos also registered gains. All top 100 coins are in the green except Stacks and Decred, which were the only two in the green yesterday.

The biggest winners are ICON and the Sandbox’ SAND wth 12%, Loopring with 11%, Zcash with 15%, and THORChain with 16%. Privacy coins are increasing in value.

STEPN’s GMT token is the biggest gainer by far, having added 40% to its value at the time of writing. Stepn announced a revised GEM (mystery box) system and reached the important milestone of 300,000 DAU (Daily Active Users).

Recently, they launched STEPN x ASICS NFTs, a unique collection of NFT sneakers in partnership with premier sports brand ASICS. It is available on Binance’s NFT marketplace. All of these factors contributed to spectacular price growth.

Another canine-themed token, Sanji Inu, is making the rounds. It’s up 842% in the last 24 hours.

Sanji Inu is broadly described as a community driven platform promoting financial well-being by empowering people of all ages and cultures to be in control of their money and create their own wealth opportunities.

The post Highlights April 19: Cryptos in the green despite bearish prognosis appeared first on Coin Journal.

Viele Kryptowährungen verloren in den ersten beiden Monaten des Jahres 2022 erheblich an Wert. Während die Zahlen aus der zweiten Märzhälfte auf einen stetigen Preisaufwärtstrend hindeuteten, waren die Gewinne nicht groß genug, um die zwischen Januar und Februar verzeichneten schweren Verluste auszugleichen. Die Auswirkungen dieses bärischen Marktes spiegeln sich in den Zahlen zum Handelsvolumen wider.

Das Interesse der Anleger an Bitcoin ist ebenso wie der Kryptomarkt stark zurückgegangen. Das Handelsvolumen des Flaggschiffs unter den Kryptowährungen sank zwischen Januar und März dieses Jahres um 3,6 Billionen USD von rund 6,02 Billionen USD im ersten Quartal des vergangenen Jahres auf 2,42 Billionen USD.

Eine Aufschlüsselung dieser Zahlen zeigt weiter, dass das kombinierte Handelsvolumen im ersten Quartal 2022 nur leicht über dem Durchschnitt der ersten drei Monate des Jahres 2022 lag. Das Handelsvolumen von Bitcoin überstieg in den letzten beiden Monaten des letzten Jahres 2 Billionen USD mit 2,15 Billionen USD und 2,26 Billionen USD. Die diesjährigen entsprechenden Zahlen sind auf 923 Mrd. USD und 671 Mrd. USD geschrumpft.

Die eintägigen Monatshöchststände von rund 123 Milliarden USD und 350 Milliarden USD wurden im Januar und Februar 2021 verzeichnet. Diese Höchststände fielen in diesem Jahr auf 84 Milliarden USD und 46 Milliarden USD.

Dieser Trend war auch zwischen März 2021 und März 2022 zu beobachten. Das Handelsvolumen der führenden Kryptowährung wurde in diesem Jahr von 1,61 Billionen USD auf 830 Milliarden USD um fast die Hälfte reduziert.

Obwohl Bitcoin am 29. März auf ein Quartalshoch nördlich von 48.000 USD raste, verzeichnete Bitcoin zwischen Januar und März keine positive Nettopreisänderung. Das Krypto-Asset eröffnete das Jahr mit 46.300 USD, wie Daten von CoinMarketCap zeigen. Am letzten Tag des Quartals hatte sich Bitcoin über 45.800 USD eingependelt.

Die Veränderung des Bitcoin-Preises im gleichen Zeitraum im Jahr 2021 war sehr signifikant. Zum Vergleich: Das BTC/USD-Paar stieg von etwa 29.000 USD am ersten Tag des letzten Jahres auf ein Quartalshoch von etwa 61.700 USD. Nach diesem Hoch verzeichnete das Paar eine gewisse Korrektur und beendete das Quartal bei rund 59.000 USD.

The post Bitcoin-Handelsvolumen im Q1 2022 war 60 % niedriger als im Q1 2021 appeared first on BitcoinMag.de.

The Near Protocol price is in an upward trend as the ecosystem growth continued. The token is trading at $17.12, which was about 130% above the lowest level in February. Its market cap has surged to more than $11.35, making it the 17th biggest cryptocurrency in the world.

Near Protocol is one of the biggest blockchains that seeks to become a leading player in the industry. The network is currently transitioning to become a fully sharded platform. Sharding is a complex process that breaks blocks into smaller pieces known as shards. As a result, the process helps to increase the overall throughput.

April has been a successful project for the Near Protocol. For one, the developers raised over $350 million from investors. These funds will be used to grow the ecosystem by providing grants to developers and to hire more developers. The new fundraising happened a few months after the developers raised another $150 million.

The Near Protocol price has also risen because of the ongoing ecosystem growth. According to DeFi Llama, the network’s total value locked (TVL) has risen to over $1.4 billion. The TVL of Near itself has risen to $476 million while that of Aurora has jumped to more than $960 million.

On Tuesday, NEAR rose sharply after the TVL in Ref Finance jumped to over $200 million. It has risen by 14% in the past 24 hours and 52% in the past seven days. This makes it the biggest application built in Near Protocol. Other applications in the network have also seen a strong jump of TVL. For example, Burrow rose to over $143 million while Meta Pool rose to more than $143 million.

The daily chart shows that the NEAR price has been in a strong bullish trend in the past few months. Along the way, the coin has formed what looks like a cup and handle pattern. This pattern usually sends a signal that the bullish trend will continue.

It has also moved above the 25-day and 50-day moving averages. The coin has also risen above the ascending trendline shown in brown. Therefore, the Near Protocol price will keep rising as bulls target the all-time high of $20.50.

The post Near Protocol price prediction as Ref Finance TVL surges appeared first on Coin Journal.