The cryptocurrency market is currently experiencing a mixed performance across the board.

The broader cryptocurrency market has been experiencing a mixed performance over the last 24 hours. The total cryptocurrency market cap remains above $1.9 trillion despite adding less than 1% to its value.

Bitcoin is up by less than 1% in the last 24 hours and currently trades above $41k per coin. Ether maintains its price above $3,000 despite losing less than 1% of its value so far today.

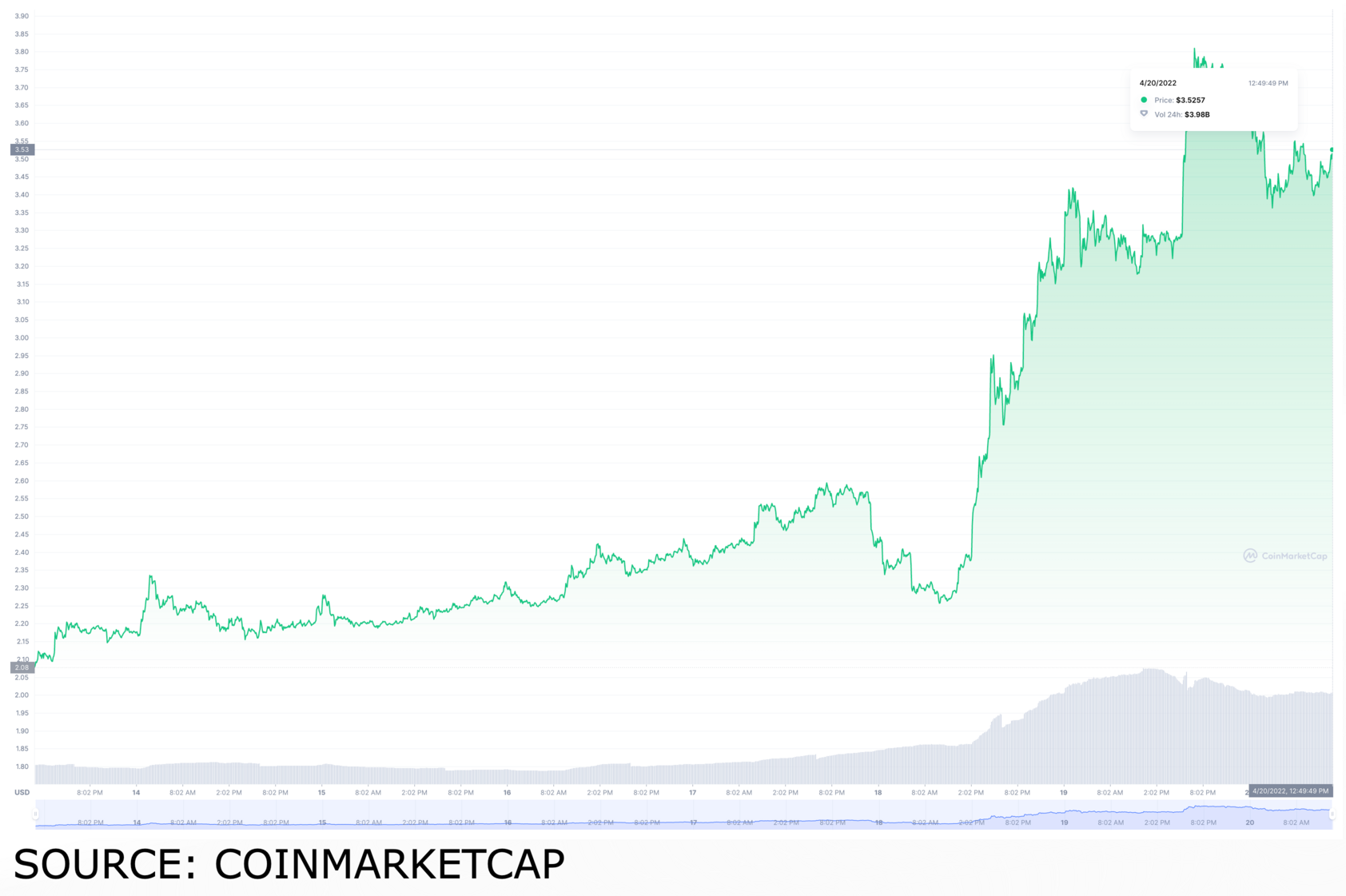

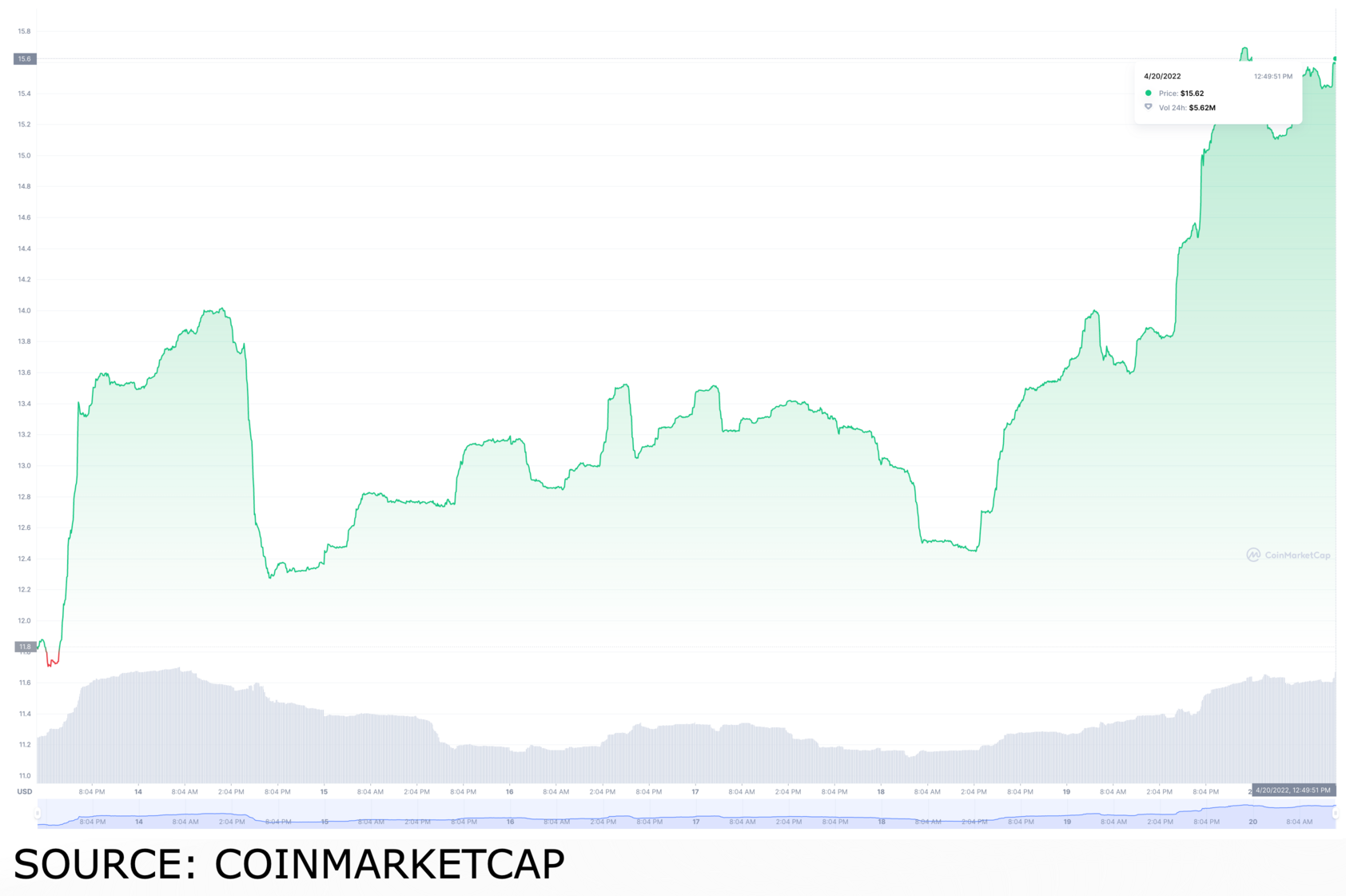

However, CAKE, the native token of the Pancakeswap decentralised exchange, is the best performer amongst the top 50 cryptocurrencies by market cap. CAKE is up by more than 8% in the last 24 hours, outperforming the other top coins and tokens during that period.

The major catalyst behind CAKE’s ongoing positive performance is the completion of its Masterchef V2 migration. The Pancakeswap team announced a few hours ago that the migration to V2 is now complete.

Pancakeswap informed its community members that they will need to migrate their farms and pools staking to the new MasterChef to keep earning staking rewards.

Key levels to watch

The CAKE/USDT 4-hour chart is currently bullish, thanks to Pancakeswap’s ongoing positive performance. The technical indicators show that CAKE is outperforming the other major cryptocurrencies at the moment.

The MACD line is within the positive region, indicating bullish momentum. The 14-day relative strength index of 72 shows that CAKE is close to entering the overbought zone.

At press time, CAKE is trading at $9.28 per token. If the bullish momentum continues, it could hit the $9.87 mark before the end of the day, surpassing the first major resistance level in the process.

In the event of an extended rally, CAKE will trade above $10 for the first time since January 2022.

The post Here is why Pancakeswap is up by nearly 10% today appeared first on Coin Journal.