- Brad Garlinghouse says Ripple is confident the SEC’s case will ultimately „be dismissed.“

- XRP price shot up nearly 8% after the news

- Ripple has maintained that its XRP token is not a security, earlier questioning a SEC official’s comments on Bitcoin and Ethereum

Ripple CEO Brad Garlinghouse has called the latest decision by a New York judge in the Ripple vs. US Securities Exchange Commission (SEC) case as a “huge win” for the blockchain company.

“If you weren’t paying attention then, you should be now. Huge win for Ripple today!” Garlinghouse said.

His comment followed an order by US District Judge Analisa Torres denying the SEC’s motion to strike down Ripple’s Fair Notice defense.

🚨JUDGE TORRES DENIES SEC MOTION TO STRIKE FAIR NOTICE DEFENSE.

JUST ADDED to our Document Library:

✅Order from Judge Analisa Torres that Denies the @SECGov Motion to Strike @Ripple’s Fair Notice Defense 👇https://t.co/5LuEauaWAd— CryptoLaw (@CryptoLawUS) March 11, 2022

Part of Judge Torres’ order reads:

“The SEC does not contend that Ripple’s affirmative defense is untimely, and the Court shall not conclude, at this early stage of the case, that Ripple’s defense is invalid. Accordingly, the SEC’s motion to strike Ripple’s fair notice affirmative defense is DENIED,”

Garlinghouse ‚confident‘ SEC’s case will be dismissed- ultimately

The SEC sued Ripple and top executives Brad Garlinghouse and Chris Larsen for what it called the illegal sale of unregistered securities related to the XRP token. The case has been active since December 2020, with Ripple maintaining that XRP is not a security.

Commenting on the cases against him and Larsen, the Ripple chief noted:

“While we would have preferred the cases against Chris and me to end now, the SEC must now prove its claims. We are confident that ultimately all of them will be dismissed.”

Stuart Alderoty, General Counsel at Ripple said that Friday’s court order “makes it clear there’s a serious question whether the SEC ever provided Ripple with fair notice that its distributions of XRP – since 2013 – would ever be prohibited under the securities law,”

He lauded the judge’s decision and added that it might be time “the sun sets on the SEC’s “regulation by enforcement” approach.”

XRP price jumped nearly 8% following the news before the token pared some of the gains late afternoon.

The post Ripple CEO: Denying SEC’s Motion to Strike Fair Notice defense is a ‘huge win for Ripple’ appeared first on Coin Journal.

Source: TradingView

Source: TradingView

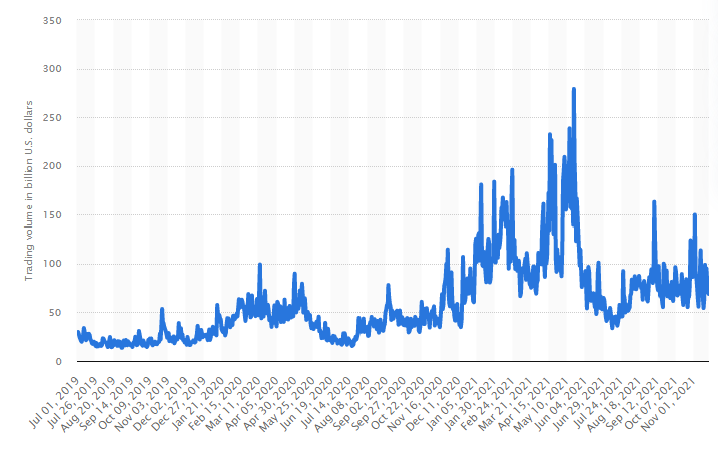

Tether 24H volume 2019-2021, via Statista

Tether 24H volume 2019-2021, via Statista