As another week comes to a close in this eventful macroeconomic climate, let’s take a look at how the world of cryptocurrency looks, before we all take a breath over the weekend.

Key Points

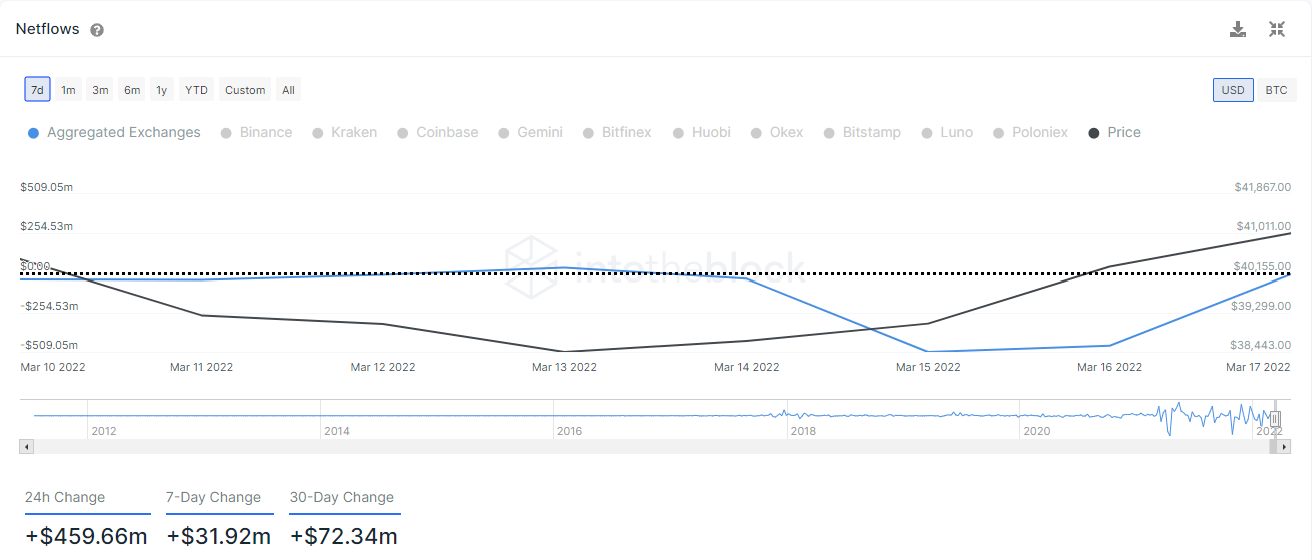

- Bitcoin net outflows from exchanges breach $1 billion for the week

- Tuesday sees highest daily outflows in ETH since October

- Moderate uptick in new and active addresses for Bitcoin

Bitcoin

Net Flows

Data via IntoTheBlock

Data via IntoTheBlock

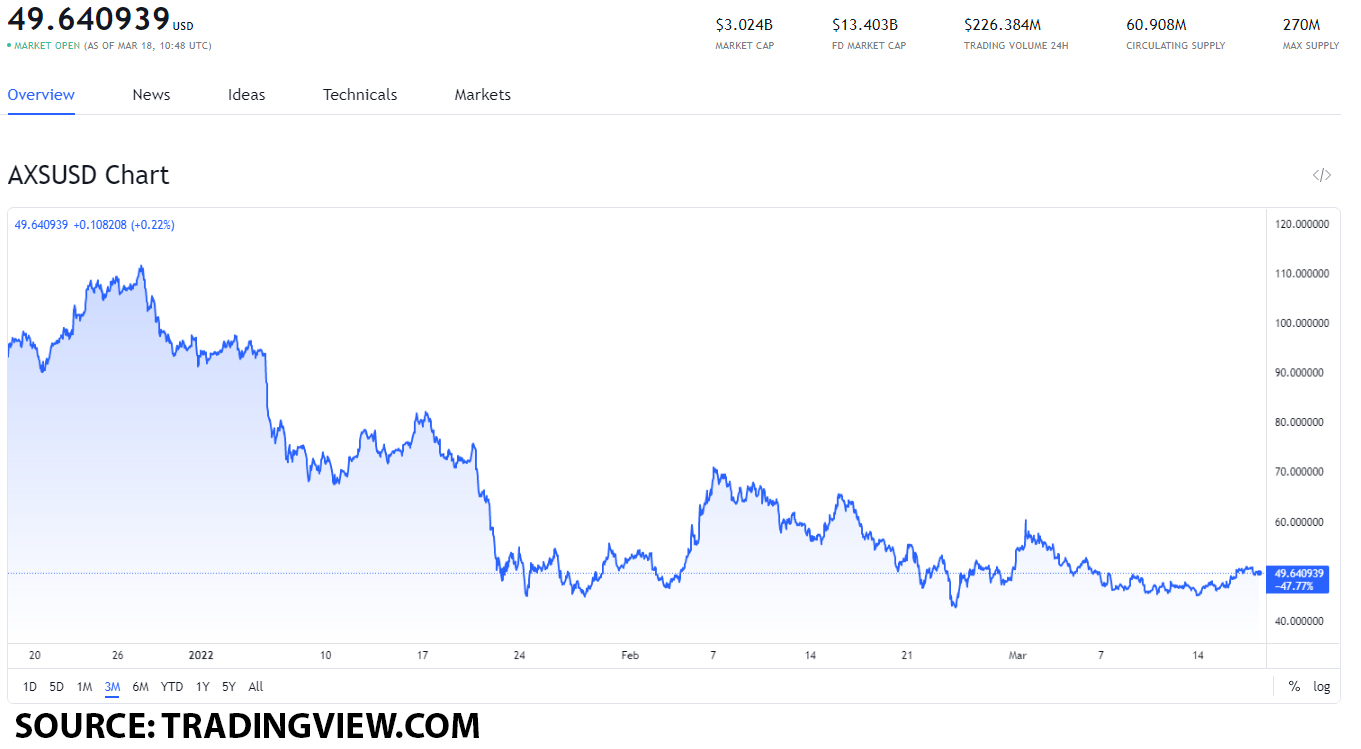

A nice milestone for Bitcoin this week, as net outflows from exchanges breached the billion dollar mark, as displayed on above graph. One of the go-to indicators of sentiment, a net outflow from exchanges typically means accumulation, while a net inflow signals selling pressure.

Volatility

Price-wise, we “closed” last Friday at $39,200, while currently we sit at $40,700. Looking at volatility, the 30-day annualised standard deviation remained relatively stable at circa 63%. This is shown on the below graph, but if we want to translate these numbers to simple English, we can simply say that this week Bitcoin was … chill. As the world seems to be falling down around it, Bitcoin has been actually been quite well behaved. Who would have thought?

Data via IntoTheBlock

Data via IntoTheBlock

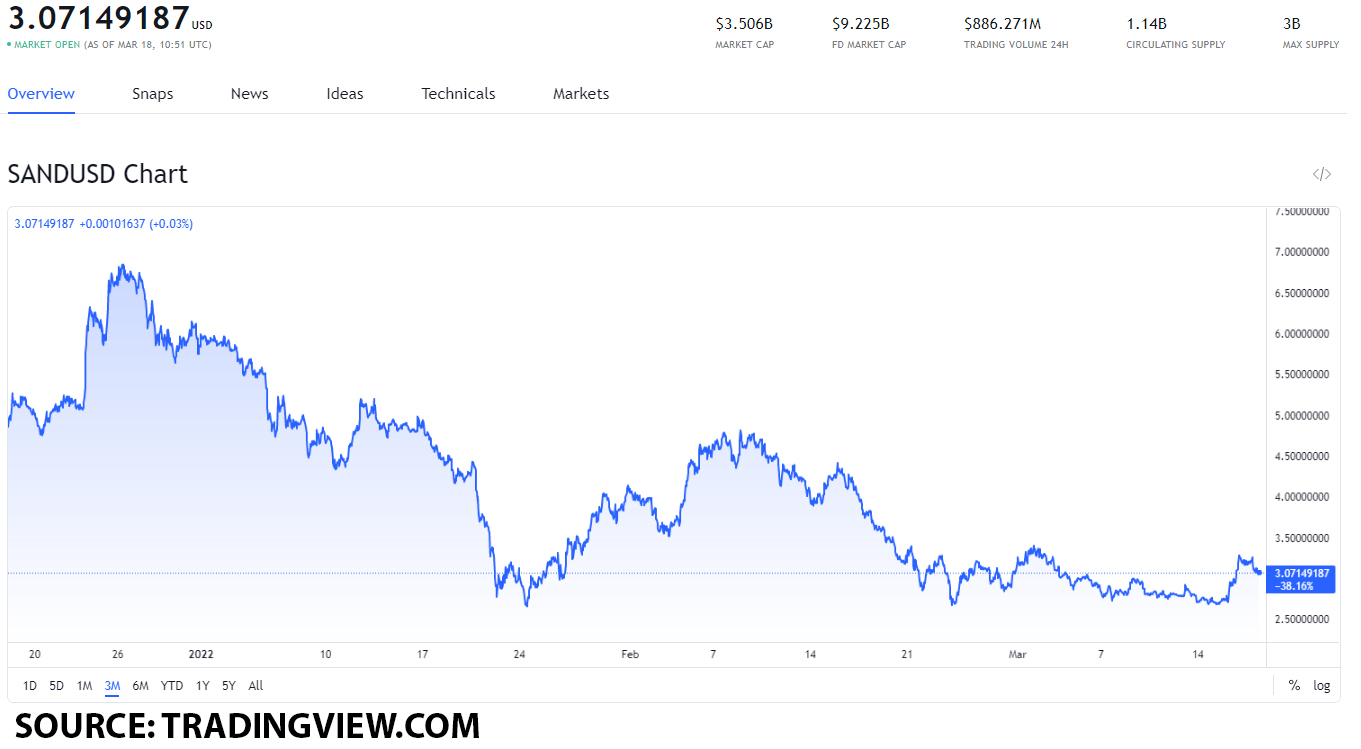

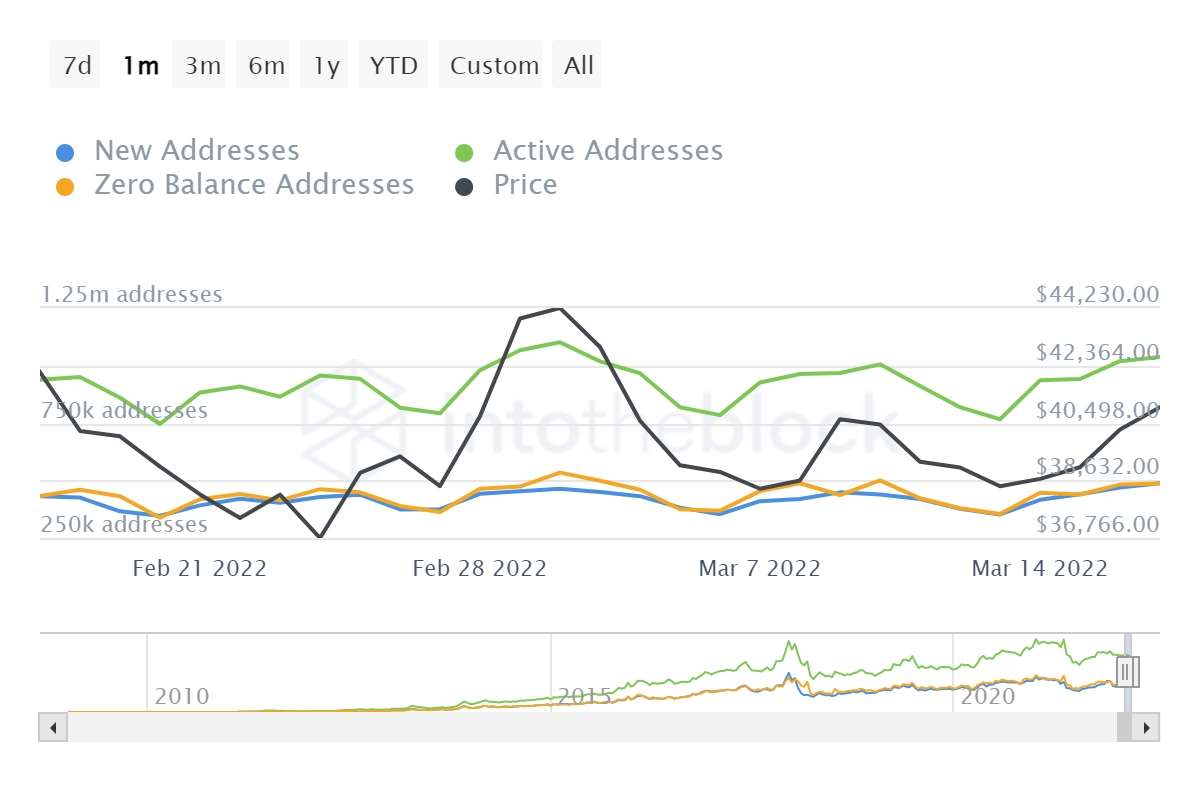

Addresses

Some moderate uptick here too, with an 11% increase in new addresses since last week. Active addresses were relatively stable (up 3%) and there was a fall of 2% in zero-balance addresses. All pointing, again, to a steady but unspectacular week for Bitcoin. If only all the weeks were like this – this must be what it feels like to hold stocks, right? Maybe next week we will get some more movement, helping to make this piece a little more entertaining!

Data via IntoTheBlock

Data via IntoTheBlock

Ethereum

Let’s see if we can poke around with Ethereum a little and uncover any trends.

Net Flows

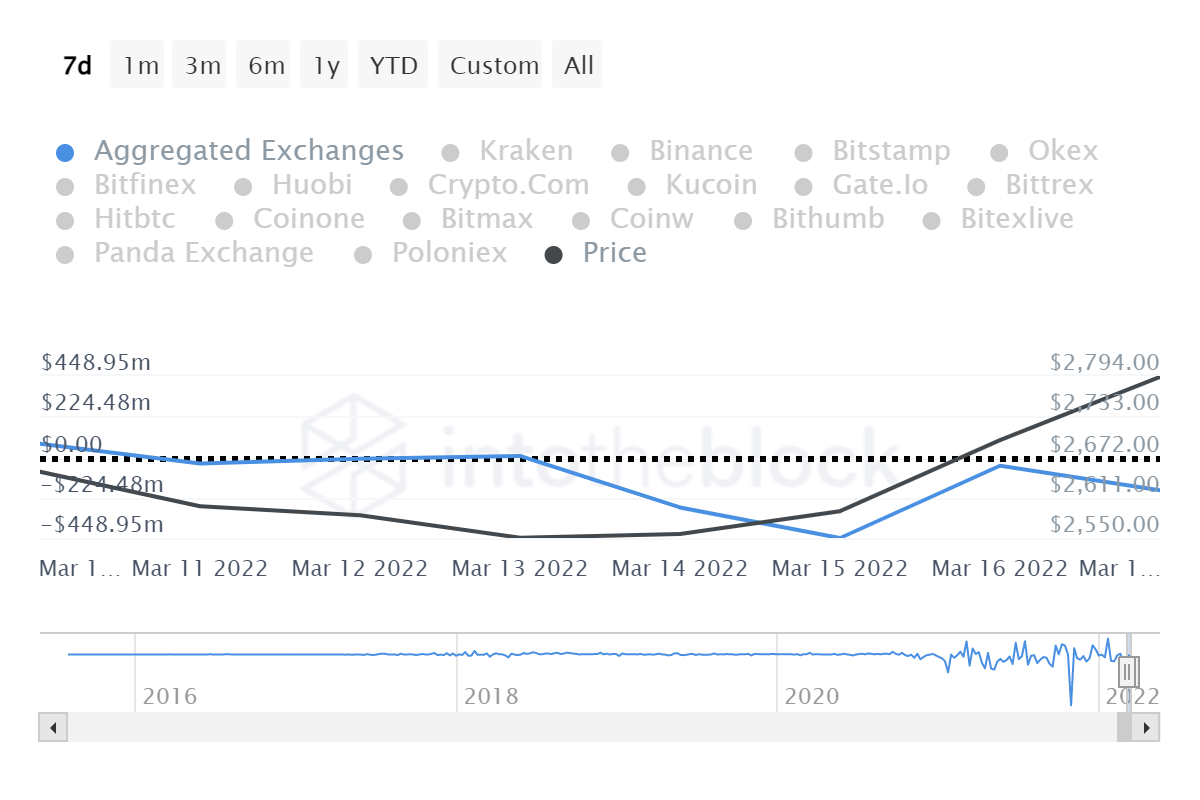

There was nice net volume here too, with close to a billion dollars flowing out of exchanges over the last week. This was buoyed mainly by Wednesday, which saw $448 million in net outflows. For context, in dollar terms that’s the 24th largest daily outflow volume ever – and the second largest this year.

Data via IntoTheBlock

Data via IntoTheBlock

Precedent

The largest of 2022, you may be wondering, was January 4th. Known as “Blue Monday”, they say it’s the most depressing day of the year – the return to work after the holidays. Apparently, people settled down to their computers to withdraw their crypto gifts into their cold wallets this year. Unfortunately, Ethereum plunged 21% in the next four days – so let’s hope that’s not a signal of what’s to come here.

I’m not really sure what exactly caused such a spike this Tuesday, given the lack of activity elsewhere. Maybe, just maybe, it’s plain old coincidence, huh? Or maybe somebody was afraid they would be tempted to redeem their ETH to buy a load of Guinness ahead of St Patrick’s Day. I don’t know.

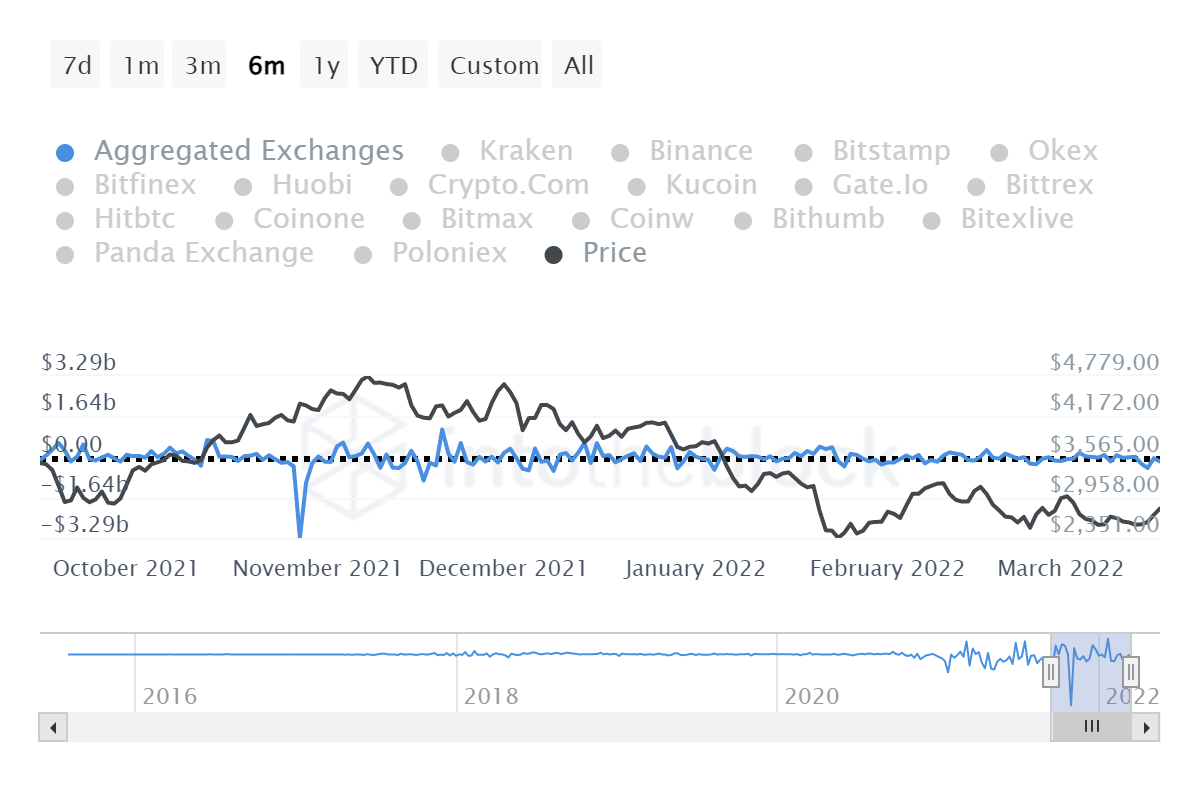

Denominated in ETH terms, however, it marks the largest daily withdrawal since last October, at close to 180,000 ETH. In Ocotober, Ethereum did the opposite to January– ramping 14% in just over a week. Although it’s important to note that at 750,000 ETH, the withdrawal last October was over 4X what we saw on Tuesday. The graph below highlights the size of this move compared to last October, as well as the price action (black line). So be careful with your conclusions.

Data via IntoTheBlock

Data via IntoTheBlock

Closing Thoughts

So, a somewhat notable tidbit to close the week from Ethereum then. Bitcoin behaved, while the crypto markets largely followed. A nice week without too much volatility. If only they were all like this, I reckon my heart rate would be significantly lower. Then again, wouldn’t life be less fun?

Still, next time we get those ugly red candle days, I’ll look upon weeks like this with green-eyed envy. In crypto, it could always be worse. Happy Weekend !

The post Could this on-chain metric catapult Ethereum’s price? appeared first on Coin Journal.