The analyst says February could see a green candle if $37,000 holds as key monthly support, which could potentially open the path to $50,000.

Bitcoin price has failed to break above $39,000 this week, having bounced near the level multiple times since the upside from lows of $33,000 last week.

BTC is currently 2% down and looking to retest the $38k support level, which if it fails to hold, could see the flagship cryptocurrency dip further.

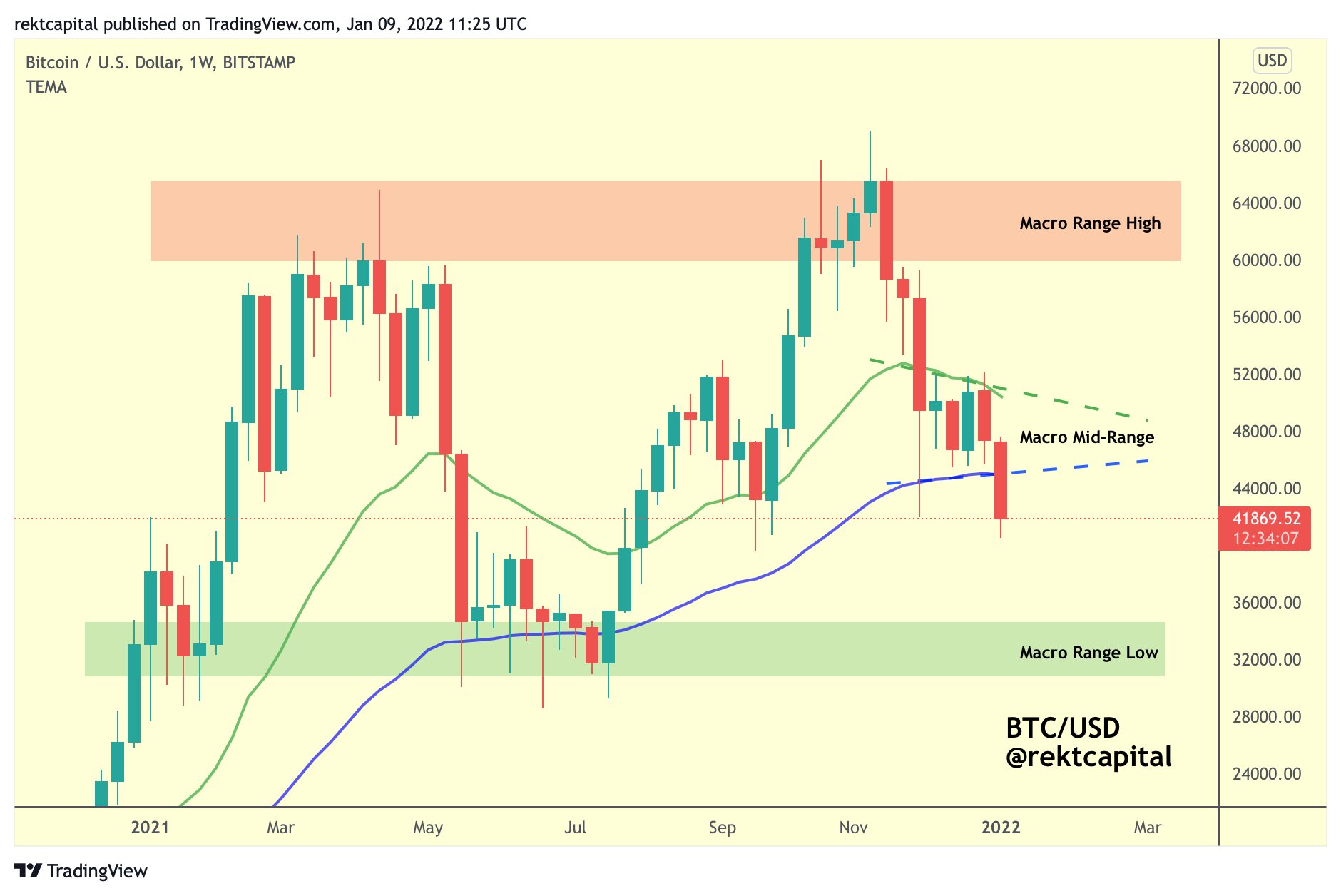

Pseudonymous crypto trader and analyst Rekt Capital says the declines keep Bitcoin in a consolidation phase, with support and resistance at two exponential moving averages (EMAs) on the weekly chart.

According to him, Bitcoin price has dipped below the two EMAs which macro-wise, represent the mid-range area.

“Since BTC lost its Mid-Range area as support… [It] has revisited the Macro Range Low area (green).Macro-wise however, BTC is still just consolidating between $28000-$68000 (green-red),” he noted in a tweet shared on Wednesday.

Chart showing BTC price below the two EMAs. Source: Rekt Capital on Twitter.

Chart showing BTC price below the two EMAs. Source: Rekt Capital on Twitter.

The analyst says Bitcoin is thus set to trade within the lower half of its range low-range highs of $28K-$68K. The benchmark crypto will stay within this “macro range for the next weeks,” Rekt added.

He highlights the $43-$48K range as a critical barrier below which BTC price is likely to hover until bulls reclaim the two EMAs. If this scenario plays out, he believes fresh momentum will see Bitcoin break back into the upper half the $28k-$68k.

Weeks ago, #BTC lost its Mid-Range as support

Which means BTC will occupy the lower half of the $28K-$68K macro range for the next weeks

BTC will stay below $43-$48K until BTC is able reclaim these two EMAs to confirm a return into the upper half of the range#Crypto #Bitcoin https://t.co/2Gs7jL6cvo pic.twitter.com/6m1SWgtSZG

— Rekt Capital (@rektcapital) February 2, 2022

BTC set for a “green February”

Looking at monthly support, the analyst notes Bitcoin has had three successive negative closes so far. It includes January that saw BTC/USD slip over 20%.

According to Rekt, Bitcoin is likely to see a reversal in February. His outlook is that the monthly candle shows a retest and bounce off a key level at $37,000.

Beyond the green Monthly support level, #BTC has only ever seen a 3-month downtrend, at most

The last time $BTC experienced a 3-month downtrend beyond the green level…

BTC enjoyed a green Monthly candle

Could BTC be setting itself up for a green February?#Crypto #Bitcoin pic.twitter.com/MJQXv4QC0q

— Rekt Capital (@rektcapital) February 2, 2022

“The last time BTC successfully turned this level into support was in August 2021 [and] that retest preceded a move to $50,000,” he added.

The last time Bitcoin rebounded off lows of $30k was in July 2021, with an uptick to highs above $52k followed by a retest of $40k and another bounce all the way to its all-time high in November.

The post Rekt Capital: Bitcoin’s dip below mid-range support highlights $43-$48K as a key barrier appeared first on Coin Journal.