Über die Krypto-Wettplattform Stake setzt der Rapper eine beträchtliche Summe auf das Finale der Footballliga.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Über die Krypto-Wettplattform Stake setzt der Rapper eine beträchtliche Summe auf das Finale der Footballliga.

Kia America and NFT platform Sweet have announced a collaborative effort that will see fans of the automotive provider’s “Robo Dog” collect the robot puppy and see 90% of sales go towards supporting the PetFinder Foundation.

Sweet is a New York-based NFT marketplace that counts among its users, top personalities in the sports, entertainment, and fashion world.

In addition to the initial contribution, PetFinder will also benefit from further funding from a 10-percent royalty scheme involving any secondary sale of the Robo Dog NFT.

The initiative is meant to help the Petfinder Foundation assist animals “in need find their forever homes,” Kia America said in a press release shared with CoinJournal.

Russell Wager, VP of marketing at Kia America noted that pet surrenders at shelters have increased over the last year after the pandemic, with numbers up as more people return to work.

“Although tens of thousands of animals have found their forever homes, pet surrenders to shelters are increasing as people return to work and there are many pets whose stories deserve to end as happily as Robo Dog’s did in our Super Bowl spot,” he added.

The Robo Dog is a non-fungible token (NFT) series Kia minted on the Tezos blockchain and became the firm’s star at the Super Bowl.

According to the announcement, the NFT series will be available in three unique collections.

Kia has launched 10,000 Robo Dog Adoption Pass NFTs, available for free on 11 February. Anyone that successfully claims the adoption pass NFTs will have access to a presale of 10,000 generative Robo Dog NFTs, the firm said. The presale will take place on 18 February on the Sweet.io platform.

“On February 13th, coinciding with the big game, six, one-of-a-kind, art inspired Robo Dog NFTs will be made available at a starting bid of $299, the original MSRP of the robotic pup before he escaped the electronics store. The auctions run through February 18th at 12pm ET,” Kia America added.

„Robo Dog“ image courtesy of Kia America

The post Kia America’s “Robo Dog” NFT release to help ‘animals in need find Forever Homes’ appeared first on Coin Journal.

Bitcoin’s adoption is at an early stage, according to Wells Fargo

Like the 1990s, when the internet saw an explosion in mass adoption, crypto is set on a similar trajectory

Marcus Sotiriou, an analyst with London-based digital asset trading platform GlobalBlock, says “it’s only a matter of time” before major banks and companies still on the sidelines join the crypto bandwagon.

Multinational financial services firm Wells Fargo this week published a report that was highly bullish on cryptocurrencies, suggesting that it’s only a matter of time before we see an explosion in crypto adoption.

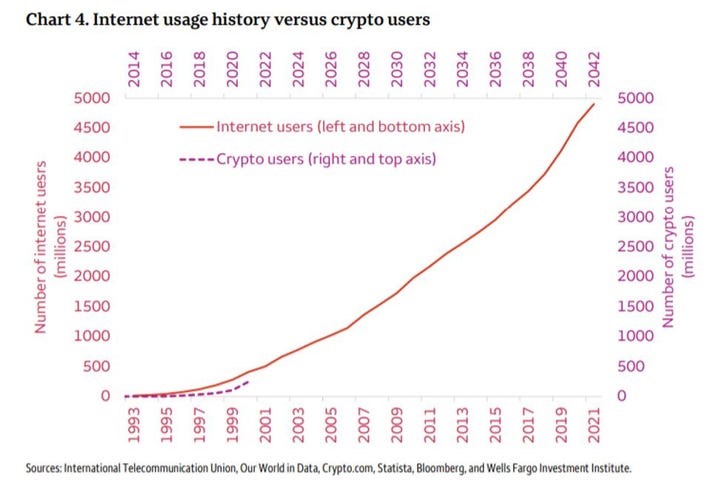

The banking giant looked at the adoption of the internet in the 1990s and the current trend for Bitcoin and other digital assets to conclude that crypto is on a path to exponential growth and adoption.

According to the company, crypto’s “adoption percentages” today mirror those recorded during the nascent years of the internet. With use cases in the digital asset space getting the recognition that they deserve across the globe, Wells Fargo predicted that people are quickly embracing the technology.

But at just 3% of the global population, or about 221 million people, the future is bright for crypto should the trend hold and reflects that seen with the internet, the report added.

Chart showing internet usage compared to crypto user growth. Source: Wells Fargo

Chart showing internet usage compared to crypto user growth. Source: Wells Fargo

While Wells Fargo expects crypto to “hit a hyper-infliction point” not far in the future, its call also includes a warning that many projects will likely also fail.

Some of the world’s largest banks still hold a negative outlook for Bitcoin and other cryptocurrencies.

But Marcus Sotiriou, an analyst with UK-based GlobalBlock digital asset trading firm, believes this won’t be the case for long.

According to him, the likes of Bank of America will soon take a different stance on crypto as did JPMorgan, led by its CEO Jamie Dimon.

Institutional investors are already increasingly interested, the analyst points out. This week, KPMG Canada became the lasted when it revealed it had added Bitcoin and Ethereum to its treasury.

Bitcoin could be a primary beneficiary of the massive adoption, GlobalBlock’s Sotiriou noted on Friday.

Bitcoin’s retreat from highs of $45,500 this week means bulls are facing prospects of further weakness. The outlook, according to Sotiriou, is likely to be exacerbated by the broader sentiment across markets following yesterday’s hotter than expected US inflation data.

He also notes that the rejection after BTC/USD jumped nearly 40% since its January lows suggest bulls need will to bounce above this week’s intraday highs and hold off sellers to confirm a bullish continuation.

BTCUSD was trending around $43,643 at the time of writing.

The post Wells Fargo says crypto is headed for hyper-adoption appeared first on Coin Journal.

This year started with a market plunge that saw the majority of cryptocurrencies like Bitcoin and Ethereum nosedive.

Bitcoin has, however, been trying to correct the downtrend only for the bull correction to be cut short below $45K. Today, BTC dropped by more than 4% sending Bitcoin below $44K.

At the time of writing Bitcoin was trading at $43,609.63.

Bitcoin price has been up and down after it dropped below $40k in January following the announcement by the FED that it was going to increase the interest rates gradually in the coming months. This followed reports that the U.S annual inflation rate has hit a 40 year high of 7% and that the interest rate will be increased for the first time in more than three years.

Currently, Bitcoin’s support level is at $42,578 and will have to reclaim $44,208 before retesting the resistance level at $45,161. If it happens to go below the support level, then it can drop to as low as $41,625, which will be a big blow to the world’s leading digital asset.

While Bitcoin registered a drop today, other cryptocurrencies have followed suit today. Ethereum, for example, has dropped by 5% to $3,097.4.

Other Altcoins have recorded even bigger losses. Both XRP and Polkadot (DOT) have dropped by over 9% in the last 24 hours. Respectively, Solana (SOL) also dropped by 8% to trade at $106.15.

Due to the sudden downtrend, the entire market cap valuation has dropped by approximately 3% from above $2 trillion to $1.943 trillion.

Bitcoin investors are however optimistic that the coin will resume the bullish trend soon.

The post Bitcoin fails to get past $44K and loses 4% due to accelerating inflation rate appeared first on Coin Journal.

György Matolcsy , the governor of Hungary’s central bank (MNB), wants to see the European Union (EU) ban crypto trading and mining.

In a press statement published on the official MNB website, Matolcsy noted that it’s time for the eurozone to undertake the tough regulatory step.

In his view, cryptocurrencies can be used to perpetuate illegal activities. He also noted that the crypto space tends “to build up financial pyramids,” alluding to long-held criticism that crypto is a bubble’

“The EU should act together in order to preempt the building up of new financial pyramids and financial bubbles,” he added.

He pointed to China’s ban on crypto trading and mining in 2021 and the proposal from Russia’s central bank that the country needed to take similar steps.

“I perfectly agree with the proposal and also support the senior EU financial regulator’s point that the EU should ban the mining method used to produce most new bitcoin,” he said in the statement.

His comments on Russia however come days after Moscow and the Russian central bank reached an agreement to have cryptocurrencies regulated.

He proposes that EU citizens and other investors can be allowed to access and own crypto assets outside of the block.

However, regulators would still track these holdings, the MNB chief added.

His comments come at a time the EU has indicated development of a digital euro is on track.

The post Hungary’s Central Bank calls for a ban on Bitcoin trading and mining in the EU appeared first on Coin Journal.