Monero (XMR) has seen some decent rallies in recent days. However, the coin has failed to surge past a crucial supply zone, falling sharply from there. So, what is next for this popular privacy token? Well, some analysis to follow below but first, here are some highlights:

-

Monero (XMR) has struggled to clear the crucial $180 supply zone and has fallen sharply every time

-

At press time, the privacy token was trading at around $168, down by about 6% in 24-hour intraday trading.

-

Bulls must transform $180 from a supply to a demand zone if XMR will rally further above $200.

Data Source: Tradingview

Data Source: Tradingview

Monero (XMR) – Price prediction and analysis

Monero (XMR) has had its ups and downs over the years. The coin has faced several regulatory issues and had to be delisted in some major exchanges. But this has not stopped the coin from truly surging.

After coming under severe selling pressure at the start of the year, XMR has recovered sharply. But bulls have struggled to take the price action above the $180 supply zone. As traders take profit at this zone, XMR has fallen sharply every time it has tested that threshold.

If bulls are going to take XMR above $200, they must overcome the $180 mark. If they don’t, then it is likely the coin will fall back to its current demand zone of $140. At the time of writing, Monero (XMR) was trading at $168.

Is Monero (XRM) worth buying?

A lot of privacy tokens have come out in the last few years. But Monero (XMR) still ranks among the most successful ones. After hitting highs of $519 in May last year, XMR has failed to retest those levels again.

This downtrend gives dip buyers a perfect chance to get in. While it may take longer for XMR to return to $500, there is still enough upside to make good returns from the current price.

The post Monero (XMR) Falls again from the crucial $180 supply zone – What next for bulls? appeared first on Coin Journal.

Data Source: Tradingview

Data Source: Tradingview

Data Source: Tradingview.com

Data Source: Tradingview.com

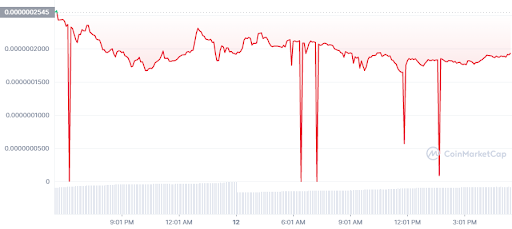

Data Source: Coinmarketcap.

Data Source: Coinmarketcap.