Die Ankündigungen der US-Zentralbank könnten dem Kryptomarkt bald auf die Sprünge helfen, doch der Ukraine-Konflikt sorgt zunächst für Verunsicherung.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Die Ankündigungen der US-Zentralbank könnten dem Kryptomarkt bald auf die Sprünge helfen, doch der Ukraine-Konflikt sorgt zunächst für Verunsicherung.

The protocol provides for a decentralised autonomous organisation (DAO) governance mechanism based on a Quadratic voting model.

iZUMi Finance, an innovative protocol for programmable liquidity mining built on the Uniswap V3 platform, has launched its highly anticipated decentralized autonomous organization (DAO), promising a revolutionary governance system powered by a quadratic voting mechanism.

According to an announcement shared with CoinJournal on Thursday, iZUMi Finance said its DAO governance token will be based on veNFT (veiZi).

The token is ERC271 standard compatible, meaning that users will have access to all the governance rights applicable to the platform. These will include the right to vote, boost and return staking rewards, iZUMi Finance said in the statement.

“veNFT’s are a major step forward for the industry in terms of NFT utilization. Whereas in most DAOs, governance votes are represented by the number of tokens held in a wallet, iZUMi DAO governance votes are represented by the number of tokens held within a veiZi NFT,” the protocol’s team added in their announcement.

On its Quadratic Voting mechanism, iZUMi Finance said:

“Each cycle’s iZi emissions will be determined and allocated according to the outcome of veNFT voting. For staking rewards, 50% of the platform’s revenue will be used to buy back iZi, which will be allocated to veiZi NFTs according to voting power. With NFT staked, veiZi will be used to boost iZUMi i’s farming pool APR by up to 2.5 times.“

Users can mint veiZi NFTs via any iZUMi wallet address, which will happen when they lock their iZi tokens for a given period. However, it’s also possible to buy the tokens on third-party NFT marketplaces.

As an interest-bearing NFT, veiZi offers a unique opportunity for holders to get monthly rewards through staking.

An iZUMi wallet can only stake one veiZi NFT, but the platform’s technology allows for an extension of the locked period. If a user wants to, they also can opt to unstake their tokens once they successfully redeem their rewards.

iZUMi Finance’s programmable liquidity as a service feature is available on Uniswap V3 multi-chains.

DAOs have increasingly found a footing in recent months, with many users attracted to the commitment to decentralisation projects put forth via governance tokens.

Many projects now offer users the right to vote on governance issues, with the trend growing as decentralised finance (DeFi) becomes even more entrenched in the crypto ecosystem.

The post iZUMi Finance launches a revolutionary DAO with veiZi NFTs appeared first on Coin Journal.

Aave and the three other tokens COMP, MKR and REN have shown ‘clear price bottoms recently’, according to on-chain analytics platform Santiment.

Aave’s price has dipped 2.5% in the past 24 hours and nearly 15% over the past week as of writing, with the altcoin’s price falling alongside that of major cryptocurrencies such as Bitcoin and Ethereum.

The top two crypto assets by market cap are down 4% and 3.3% respectively amid a slowdown across the markets, with sentiment driven by inflation concerns, the US Federal Reserve’s move to hike rates and tensions related to the Russia-Ukraine crisis.

While cryptocurrencies are likely to trade lower as they mirror losses in the equities market, Santiment has noted that Aave (AAVE), Compound (COMP), Maker (MKR) and Ren (REN) could offer a great buy opportunity in the short term.

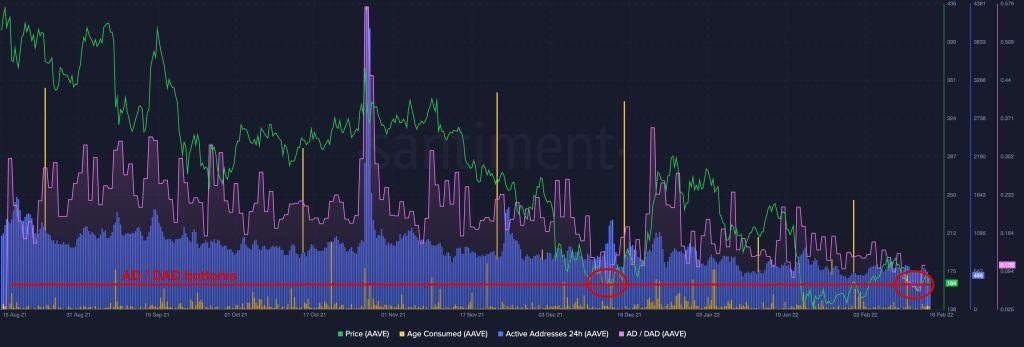

In a “spotting the dips” analysis, Santiment points to the ratio of active deposits to daily active addresses (AD/DAD) to highlight that the four altcoins could be trading at “clear bottoms.”

“AAVE, COMP, MKR, and REN have all shown very clear price bottoms recently. And they have all been accurately predicted by looking at how many active deposits have made up the total address activity of [the] asset,” the analytics platform noted.

Looking at Aave, Santiment notes:

“Looks like price likes to grow from this metric’s bottom. We could suggest that low values of AD/DAD ratio are indicating a nice buy opportunity.”

AAVE chart showing the AD/DAD ratio. Source: Santiment.

AAVE chart showing the AD/DAD ratio. Source: Santiment.

On the likelihood of opposite price action, the platform shared:

“Higher levels of AD/DAD indicate ‘exit’ points, where holders probably tend to exit their positions. The higher deposits (AD), the higher holders ‚panic‘ level.”

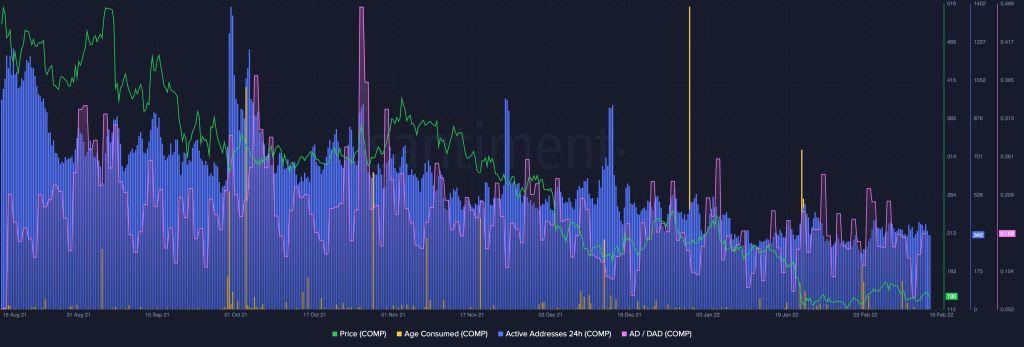

Santiment suggests Compound (COMP) is also poised for an upside. “Compound’s AD/DAD dipped to all time low just a few days ago. Good sign,” they wrote.

Compound chart showing the dip in the active deposits to daily active addresses. Source: Santiment

Compound chart showing the dip in the active deposits to daily active addresses. Source: Santiment

Maker’s AD/DAD also shows the latest dip has pushed prices to a decent buy level. However, it’s likely to dip even more after reaching current levels at the end of January. Santiment says the ratio could surge more, indicating further declines, but “not as strong as other tokens.”

REN/USD touched year-to-date lows on 24 January, with a decent spike in February helping it break above $0.40. However, an 11% dip over the past seven days has left it battling pressure around $0.35.

Another “panic” move to recent lows could offer a fresh buying opportunity.

The post Aave (AAVE), Compound (COMP) and Maker (MKR) might offer buy opportunities: Santiment appeared first on Coin Journal.

Ukraine has been in the news a lot recently. Well, it has cropped up again, although not in the way you may expect.

Today, the government officially passed a law legalising Bitcoin and other cryptocurrencies. The bill was originally passed last September, although Ukrainian President Volodymyr Zelanskyy had sent it back to parliament for changes. Today, four months later, it has been formally signed into law.

“The development of a new industry will allow attracting transparent investments and will strengthen the image of our country as a high-tech state,” Mykhailo Fedorov, Ukraine’s vice prime minister of digital transformation, had commented on the bill in September.

It is a positive step that strives to protect digital asset owners, exchanges and other stakeholders in the industry. Particularly notable is the inclusion of the terms digital wallet, private key and virtual assets in Ukrainian legislation for the first time. While there will always be groups who protest the introduction of regulation into crypto, overall it is a promising development for the industry and should encourage more transparency and confidence for those operating in Ukraine, as well as reducing fraud. The hope is that covert mining operations, evasive tax schemes and other “shadow” crypto activities should now decrease, while innovation will spike and foreign investment will flow into the country.

Unfortunately, there is an elephant in the room here. Even diehard crypto fans are unlikely to be queuing up to book one-way tickets to Ukraine, given the ongoing issues with a certain Mr. Putin. The reality is that you can list all the Ukrainian crypto positives you want – such as low taxes, streamlined legal framework, improvement in technical infrastructure and an abundance of engineers – but as long as there are 150,000 Russian troops stationed at the border, Ukraine’s hope to become the digital asset hub of Eastern Europe isn’t likely to be achieved anytime soon.

However, political concerns aside, it sees Ukraine steam towards the front of the European countries legal framework on crypto. While South America has been particularly welcoming in their approach to crypto legalization, Europe to date has not been as warm. The EU has begun to place a tighter leash on crypto transfers, striving to make them more traceable. While individual states have legalized it – perhaps most notable was the passing of a law in Germany last year allowing German Spezialfonds to allocate up to 20% of their assets to crypto – Ukraine still had high hopes to lead the virtual charge on the continent, back when the bill was originally put forward.

Of course, the final interesting quirk in this story is the stark contrast compared to Russia. Putin has been notoriously anti-crypto, pushing for an outright ban on the industry and instead focusing efforts on the development of a central bank digital currency.

It’s one more thing for them to disagree with Ukraine on.

The post Ukraine legalises Bitcoin and other cryptocurrencies appeared first on Coin Journal.

The UAE is eyeing companies and other providers within the growing crypto industry with a licensing framework that makes the country a crypto-friendly jurisdiction.

The United Arab Emirates is reportedly eyeing the global crypto and fintech space with plans for licensing framework set to attract the world’s leading virtual asset service providers, a report published by Bloomberg on Thursday says.

According to the report, the crypto licenses are meant to make it easy for major digital asset firms and other financial technology providers to set up in the country, with the goal being to make the UAE a global hub.

The Securities and Commodities Authority, UAE’s securities regulator, is said to be working on the final outlook of the proposed licensing regime.

When unveiled, sources closer to the matter told Bloomberg, the framework will provide a seamless licensing route meant to see crypto exchanges and other VASPs want to set up their offices and operations in the country.

The national crypto licensing program is reportedly developed in accordance with guidelines provided by the Financial Action Task Force (FATF). Per the global regulator, countries need to ensure stringent registration protocols are followed when allowing crypto-related companies to set up operations, the key being to ensure anti-money laundering (AML) compliance.

In UAE’s case, the securities regulator (SCA) will work alongside the central bank to oversee the national regulation of crypto companies. Meanwhile, local financial regulators will have the mandate to handle licensing processes specific to their region and in line with the crypto company in question.

In offering a crypto-friendly environment, the UAE is likely targeting a huge part of the crypto market that could be looking at destinations such as Hong Kong and Singapore.

As well as the crypto licenses, the country wants to attract miners via key regulations that support the industry while promoting the use of green energy.

The post UAE to issue crypto licenses as it pushes to become a fintech hub appeared first on Coin Journal.