Der Chef des Hardware-Wallet-Anbieters Ledger glaubt, dass immer mehr Leute Vertrauen in Bitcoin fassen und das den Kurs nach oben treibt. Daten von Glassnode bestätigen seine Vermutung.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Der Chef des Hardware-Wallet-Anbieters Ledger glaubt, dass immer mehr Leute Vertrauen in Bitcoin fassen und das den Kurs nach oben treibt. Daten von Glassnode bestätigen seine Vermutung.

The Ledger CEO says more retail buyers continue to look at Bitcoin, with non-zero addresses on the rise.

Pascal Gauthier, the CEO and chairman of hardware wallet firm Ledger, says it is people pushing the price of Bitcoin higher.

The crypto executive noted this during an interview with CNBC at the Crypto Finance Conference in St. Moritz, Switzerland.

On the issue of Bitcoin’s price growing exponentially over the past year, Gauthier said that all this is down to retail interest in the cryptocurrency. He believes more people want Bitcoin and as such, demand is pushing prices higher.

He noted that the trend over the past few weeks has been that more addresses have been created, with a growing number holding the minimum number of BTC. The Bitcoin network saw almost 1 million new addresses in November, with BTC price at the time having raced to its all-time high of $69,044 on 10 November.

The Ledger chief also added that the number of retail holders was increasing relative to whales, suggesting it’s the small buyers that continue to push the price of Bitcoin higher.

“There is a profound retail trend everywhere in the world; they trust Bitcoin more and more. It’s the people that will push the price up,” he said.

Bitcoin has rebounded from below $40,000 reached on Monday and currently trades around $43,700. The upward pressure comes at a time US inflation data shows a 7% jump year-on-year, the fastest rate since 1982.

Meanwhile, Bitcoin flows from exchanges have continued despite the recent sell-off. On-chain data analysis platform Santiment says this is a signal of less sell-off pressure.

👌 Despite #Bitcoin being 36% below its #AllTimeHigh 2 months ago, coins continue to move away from exchanges at an impressive rate. The 26.3k $BTC difference between exchange outflow & inflow yesterday is an encouraging sign of less ongoing selloff risk. https://t.co/GZWYrAWvY7 pic.twitter.com/qiUQ6ntWfD

— Santiment (@santimentfeed) January 12, 2022

On a different note, Gauthier spoke about the broader crypto space and noted that the space witnessed an explosion of projects that outperformed Bitcoin.

Last year saw Ethereum, which notched more than 455% in yearly gains, outpace Bitcoin’s +75% upmove. While ETH is expected to reach a new peak as its network grows amid institutional inflows, the Ledger founder believes the crypto industry will also be looking at projects like Solana and other top ten projects.

For Solana, the Ledger CEO says it already has a great value proposition in relation to its non-fungible token (NFT) offering. This, he noted, could be expected from several of the protocols as they mature, driving adoption and prices.

Gauthier however says that last year’s massive rally could see several cryptocurrencies settle into a consolidation phase.

On blockchain networks, his main takeaway was that tokens are the “security” of the blockchain network. As such, he believes that a network is as secure as the price level of its native token.

The post Bitcoin price is going up because more people trust it, Ledger CEO says appeared first on Coin Journal.

Kryptovermögenswerte sind nicht mehr länger eine Randerscheinung des Finanzsystems. Das wirft Bedenken im Hinblick auf die finanzielle Stabilität auf, wie es in einer neuen Untersuchung des IWF heißt.

Daten zeigen, dass die Menge an verlorenen oder gehaltenen Bitcoins ein Jahreshoch erreicht hat. Miner akkumulieren seit Anfang des Jahres „massiv“.

The IMF says Bitcoin’s high correlation with stocks means it’s more of a risk asset.

The financial institution calls for greater global regulation of the ecosystem to reduce potential risks to the rest of the market.

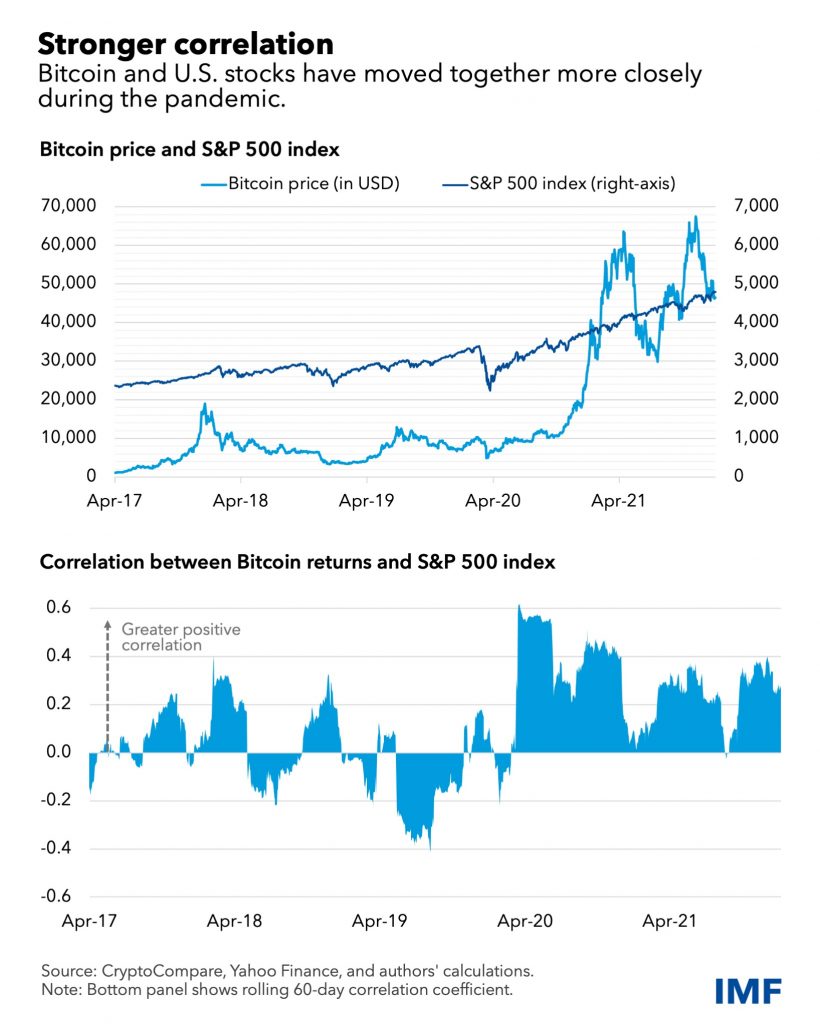

Bitcoin has outperformed the S&P 500 since 2017, with little to no correlation to the stock indexes before 2019 when the Covid-19 pandemic hit.

Since then, Bitcoin and other cryptocurrencies have largely moved in sync with the major stocks on Wall Street.

After plummeting in March 2020, crypto and equities began to surge as investors returned to risky assets, a scenario that now sees the International Monetary Fund (IMF) say could pose contagion risks to the broader financial markets.

“The correlation coefficient of their daily moves was just 0.01[before 2020], but that measure jumped to 0.36 for 2020–21 as the assets moved more in lockstep, rising together or falling together,” the Washington DC-based financial institution said.

Chart showing a correlation between Bitcoin and the S&P 500. Source: IMF blog

Chart showing a correlation between Bitcoin and the S&P 500. Source: IMF blog

While the IMF report published on 11 January states that cryptocurrencies “are no longer on the fringe of the financial system,” it takes a negative view of the correlation with stocks.

The report claims that Bitcoin’s increased adoption and the rising correlation it’s showing with stocks limits the supposed “risk diversification benefits” that see many investors opting for it over traditional safe have assets such as gold.

The correlation between Bitcoin and the S&P 500 is shown to be way higher than seen between stocks and gold and major global currencies.

And the IMF says the lockstep trading seen with the stock market suggests Bitcoin is more of a risky asset and not a hedge asset.

According to the IMF, this puts the markets at risk- specifically saying it threatens “contagion across financial markets.”

In its assessment, the institution says any sharp declines across the Bitcoin market threaten risk aversion among investors. This, it adds, might see investors aver from investing in stocks.

“Spillovers in the reverse direction—that is, from the S&P 500 to Bitcoin—are on average of a similar magnitude, suggesting that sentiment in one market is transmitted to the other in a nontrivial way,“ the report added.

Pointing to systemic concerns, IMF suggests the adoption of a global regulatory framework targeted at oversight and potentially helping to stem risks to the financial system.

In December, CNBC’s “Fast Money” trader Brian Kelly said Bitcoin and Nasdaq were trading in lockstep. He pointed to the 30-day correlation as having been around 47% at the time, with Bitcoin usually a leading indicator for the stocks index.

The post Bitcoin’s growing correlation with stocks raises risk of contagion across markets, says IMF appeared first on Coin Journal.