Nach der Ablehnung des direkten Bitcoin-ETFs von Fidelity beantragt die Investmentfirma nun zwei weitere, indirekte Indexfonds.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Nach der Ablehnung des direkten Bitcoin-ETFs von Fidelity beantragt die Investmentfirma nun zwei weitere, indirekte Indexfonds.

Die Analysten gehen überwiegend davon aus, dass es für Bitcoin zurück nach unten geht, doch eine „Überraschung“ ist durchaus möglich.

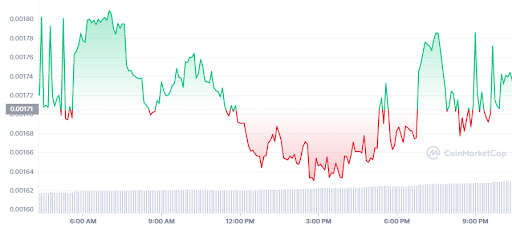

Like most meme coins, SafeMoon (SAFEMOON) was fully counting on increased hype and social media buzz to “moon”. But ever since the hype started to die out, the meme coin has been tumbling and with sentiment in crypto looking very sluggish, more losses could come in the near term. Here are some notable highlights:

At press time, SAFEMOON was trading at $ $0.001682, down nearly 5% in less than 24 hours.

After initial hype in 2021, the risk-off sentiment by investors in crypto has seen much of that die out.

There have been efforts to consolidate circulating supply in a bid to help push the price up but so far it’s tumbling.

Data Source: Coinmarketcap.com

Data Source: Coinmarketcap.com

SafeMoon has tried to rid itself of the meme coin tag by adding a few underlying features into its ecosystem. There was the SafeMoon wallet for example that launched on iOS and Android. But this has done nothing to increase investor appetite towards this token.

Although there was some rally at the start of the year, the general trend this month has pointed largely downwards. If this downward trend will reverse, SAFEMOON needs to find some decent upward trajectory to test overhead resistance at $0.002.

But this looks highly unlikely, especially now that many investors are taking minimal risk. As a result, we expect SAFEMOON to keep falling in the coming weeks.

We are at a stage in the crypto market where fear is the most dominating factor among investors. As such, this is perhaps not the best time to take risky bets.

By being a meme coin, SAFEMOOM is a risky speculative asset. It’s not something you want to hold during times of immense market volatility. So, it would be best to wait until sentiment in the market improves before moving in on the coin.

The post SafeMoon (SAFEMOON) – Meme coin is tumbling as the hype continues to die out appeared first on Coin Journal.

After a massive blood bath for most parts of January. Sandbox (SAND) is starting to crawl back some of those losses. In the last three trading sessions, the token has closed in the green, suggesting that perhaps a trend reversal is playing out. But despite this, you should be cautiously optimistic and we will tell you why. First, some highlights:

At the moment, Sandbox (SAND) has rallied 40% higher compared to its lowest price during the January downtrend.

Despite this, the metaverse token is still nearly 65% down for its ATH recorded in 2021.

Even with the recent rally, technical indicators show that Sandbox (SAND) still remains in bearish momentum.

Data Source: Tradingview.com

Data Source: Tradingview.com

The last three days have brought renewed optimism among Sandbox (SAND) investors that perhaps the token is about to reverse its downward trend. While this is somewhat true, there are still some important indicators that suggest the token is still not out of the woods yet.

For example, even with the rally the past three days, Sandbox (SAND) is still below the 100- and 50-day moving average, suggesting a bearish outlook in the near term. The RSI readings also suggest that there is still a lot of room for selling pressure.

In a nutshell, the three-day rally seems more like a dead cat bounce. While it’s still a good thing, we expect Sandbox (SAND) to snap back to its downtrend at least in the near term.

Well, it depends if you want some exposure to metaverse tokens. Based on current crypto trends, there is no doubt these tokens will be big in the future. But if I were you, I would wait for the correction on Sandbox (SAND) to end. That way, you don’t hold downside risk, and you also get in on a discounted price.

The post The Sandbox (SAND) is rebounding – Here is why you should be cautiously optimistic appeared first on Coin Journal.

As sentiment in crypto remains fearful, many investors are holding back from making any new acquisitions. But there are some assets in the market that are offering the incentive to buy. Basic Attention Token (BAT) is one of them. Based on recent price action, the token appears to be in the prime buying zone right now. But should you swoop in? Well, analysis to follow below but first, some notable highlights:

BAT has been rising over the last three or four days with most investors buying the dip in huge numbers.

At press time, BAT was trading at $0.855, up about 2% in 24-hour intraday trading.

The token has also surged at least 30% higher compared to its lowest point this month.

Data Source: Tradingview.com

Data Source: Tradingview.com

After tanking by nearly 60% from its all-time highs in 2021, it looks like there is some semblance of recovery by BAT. The token has seen some consistent rise in the last four days albeit they have been modest.

However, BAT is still trading below the 25- and 50-day moving averages, suggesting that the downward trend is probably not reversing.

If indeed bulls are not able to push the price action further, selling pressure could push it down towards the next support of $0.645. But if BAT is strong enough to cross the $1 mark, then we may see increased bullish momentum in the coming days.

Basic Attention Token (BAT) is the native token for Brave, the largest decentralised browser on the planet. Now, demand for decentralised browsers has not picked up yet.

But as more users continue to raise privacy concerns with traditional browsers, then it is likely that Brave will be a big asset. In that case, if you want to invest in BAT long-term, this is the right time to do it.

The post Basic Attention Token (BAT) appears to be in the prime buying zone appeared first on Coin Journal.