Key takeaways

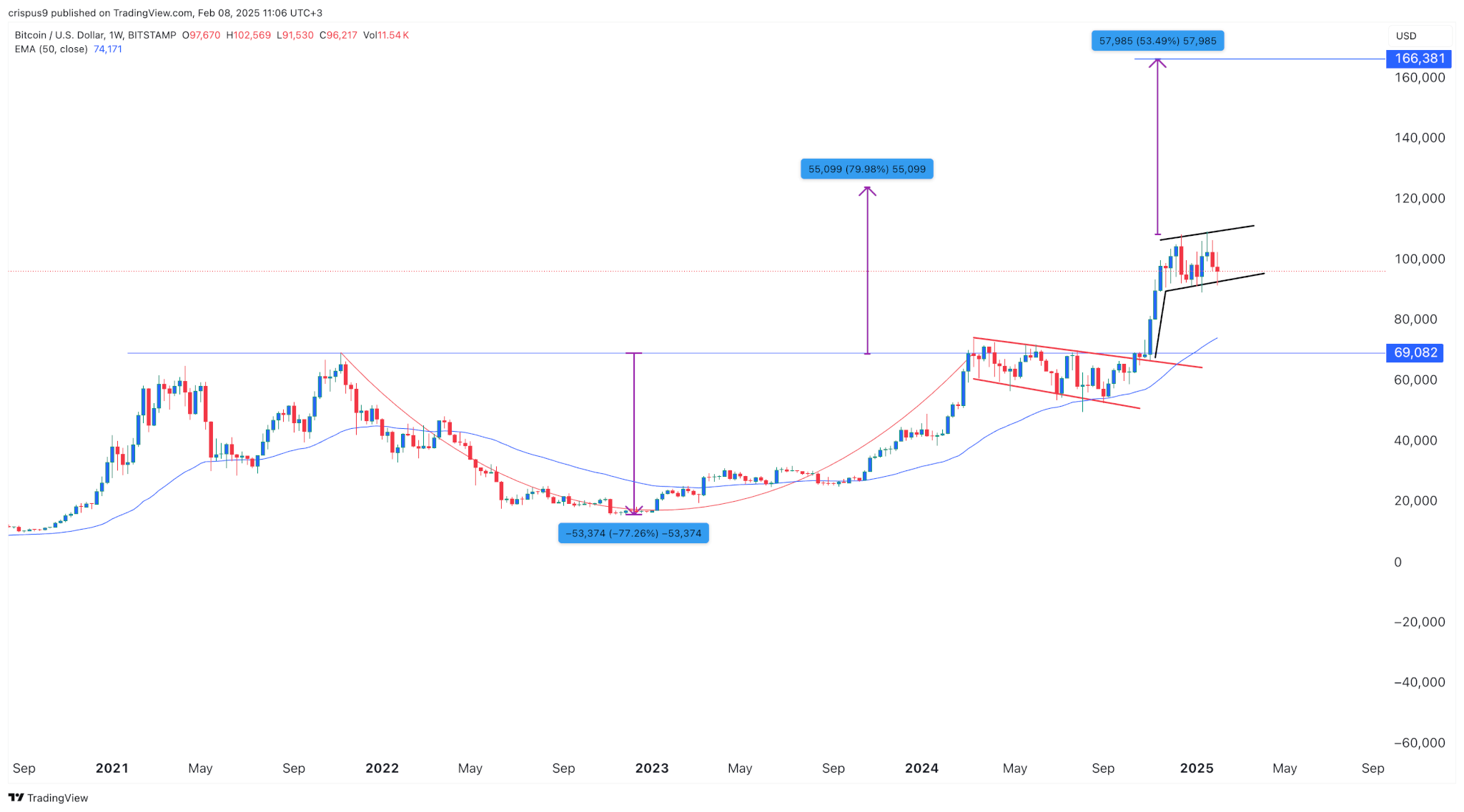

- Bitcoin is up nearly 1% in the last 24 hours and now trades above $97k.

- The Remittix presale has nearly doubled in two weeks, raising over $11 million from investors.

Bitcoin hits $97k in a weekend rally

The cryptocurrency market is rallying this weekend, with Bitcoin and other major altcoins currently in the green. This is a shift from recent weeks, where Bitcoin had struggled during the weekend.

The world’s leading cryptocurrency by market cap is up 1% in the last 24 hours and now trades above $97k per coin. At press time, the price of Bitcoin stands at $97,262 and could rally higher in the near term.

Despite the recent volatility, investors remain bullish about Bitcoin’s price potential in the medium to long term. This could translate to confidence in altcoins, especially those building infrastructure for users.

What is Remittix?

One project that is currently building an exciting infrastructure for users is Remittix. In a market dominated by stablecoins, Remittix is building a PayFi project that would make cryptocurrency payments easier for users.

In its whitepaper, the team described Remittix as a payment network that merges the best parts of traditional payment systems with decentralized Finance. The merger of these two is called PayFi.

Remittix is designed to empower users to pay fiat into any bank account worldwide using crypto. The platform will enable users to easily connect their crypto wallets and send cryptocurrencies to recipients who can receive the money in their preferred fiat currency.

An exciting feature of Remittix is that it comes with no hidden fees, no expensive conversation rates and the recipient will have no idea the original payment was sent in crypto.

Remittix’s working model

Remittix is an exciting platform because it is easy to use, making it ideal for novices and experts in the ecosystem.

To use Remittix, the user will enter the recipient’s bank details into Remittix, just like in a standard bank transfer. The sender must also enter how much they want to pay and the payment reference to be displayed on their bank statement. Remittix will generate a quote for the sender and show the amount of crypto to transfer and the exact amount charged in fees.

Once this is done, the sender transfers the crypto to the unique deposit address provided. The crypto will then be liquidated and transferred to the recipient via bank transfer.

Upon the successful completion of a transaction, the sender will get a receipt. Furthermore, users can obtain updates about their payment in the Remittix dashboard. Typically, payments will arrive at the recipient’s bank account within 24 hours. The full amount will arrive, and the reference will be included.

Remittix presale hits $11m

The project’s unique operational model is already attracting investors. Within two weeks, the Remittix presale doubled in the amount raised from investors. The presale has now surpassed $11 million, selling over 449 million $RTX tokens in the process.

According to the team, the presale target is $36 million. There are 750 million tokens available in the presale, with nearly 450 million already sold. The Remittix liquidity pool and team token will be locked for three years

Remittix has undergone a full smart contract audit which was passed with no issues within the contract, further solidifying their commitment to safety and transparency for their customers.

The native $RTX token will launch on centralised exchanges and on Uniswap. To participate in the ongoing presale, investors can purchase the $RTX tokens using USDT, USDC, and accepted cards.

The RTX token is currently sold for $0.0539 per token, with the price set to increase to $0.0567 in the next presale stage

Should you invest in the Remittix project now?

Remittix is building a payment infrastructure that could change how users interact with cryptocurrencies. This PayFi project could boost crypto adoption by making it easier to send crypto to others as fiat.

The project has raised over $11 million so far, and at this rate, the presale could be over in the coming days or weekend. The presale is an excellent opportunity for investors to get in early on this project. It is an opportunity to buy the RTX tokens at a possible discount price before it starts trading on centralised and decentralised exchanges.

The post Bitcoin surpasses $97k as Remittix’s presale surpasses $11m appeared first on CoinJournal.