Bitcoin fell to lows of $56k again as crypto dumped amid a fresh surge in stocks.

Many altcoins are mirroring this dump, including Polygon and Bitcoin Dogs. Yet, as the market experiences new downside pressure at the start of a historically tough September, most experts are doubling down on a bounce for Bitcoin in coming months.

Is this the same outlook for Polygon price? What about the Bitcoin Dogs token?

What are analysts saying about Bitcoin (BTC)?

The latest outflows from spot Bitcoin exchange-traded funds – which recorded a net outflow of $288 million on Sept. 3 to hit a five-day streak – illustrate the robust challenge buyers face. But despite a difficult August and largely anticipated struggle in September, top analysts remain bullish on Bitcoin price long term.

In the short term, QCP Group analysts say a crucial indicator, the volatility momentum indicator, has triggered for both Bitcoin and Ethereum. According to a post on X, the crypto market is set for heightened volatility, with a potential momentum shift to the upside.

CryptoQuant analyst Crypto Dan suggests BTC could see a short term rebound if market sentiment flips positive amid the expected Federal Reserve interest rate cut in September. An opposite outcome would see the flagship cryptocurrency struggle through the remaining months of 2024.

Polygon price prediction as MATIC transitions to POL

Polygon has officially activated the MATIC to POL token migration, with POL the new native token for gas and staking on the main Polygon PoS chain.

The token migration is a 1:1 swap for MATIC to POL, which means the new token retains token supply metrics such as 10 billion total supply.

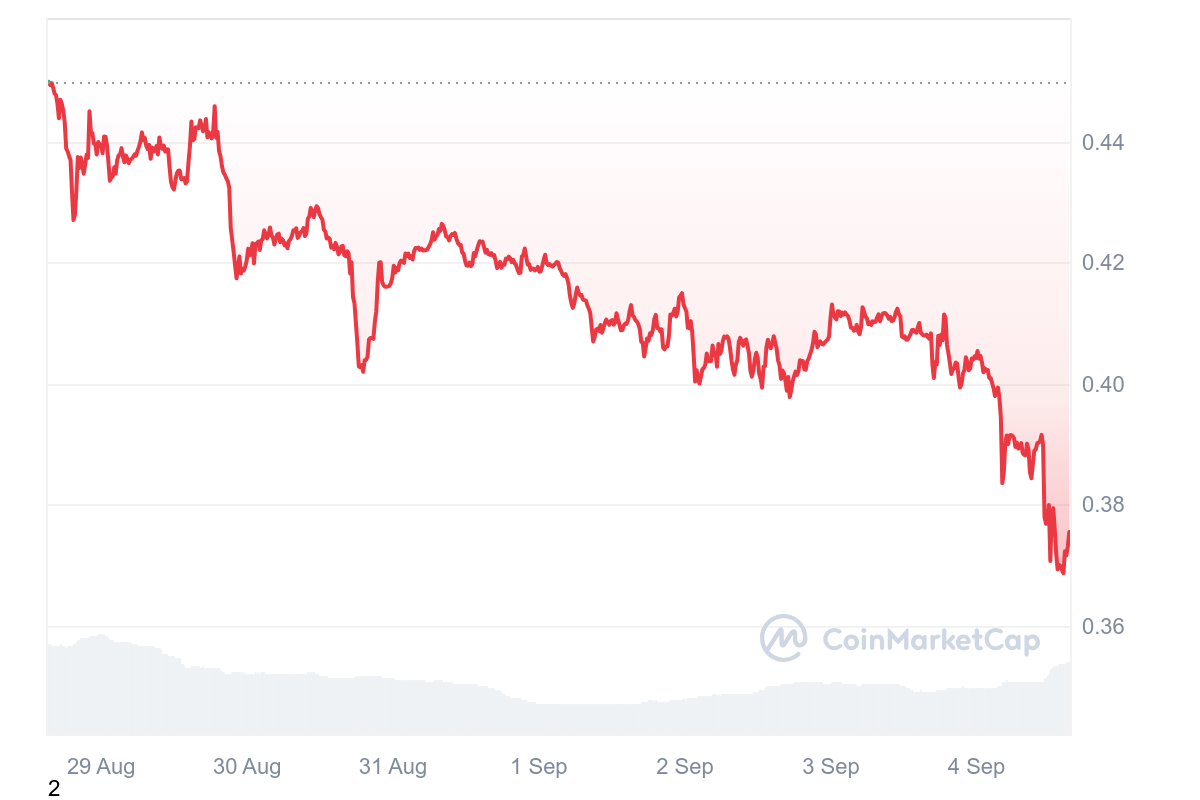

While this is a key network upgrade that has received support from major exchanges, the price reaction has been largely muted. After spiking to highs of $0.59 in August, price is down 18% in the past month to around $0.37.

In late August, analysts at Santiment highlighted that despite MATIC price declines, on-chain activity suggested a potential reversal. With daily RSI and MACD indicators pointing to bears having an upper hand, Polygon price might have to reclaim $0.40 for bulls to come into the picture.

0DOG price prediction

Bitcoin Dogs (0DOG) is the project that delivered the first ICO on Bitcoin.

The 0DOG token has been listed on major crypto exchanges MEXC, Gate.io and DEX platform Uniswap. Despite retreating from the all-time high of $0.04934 reached on Aug. 22, 0DOG price has increased more than 85% from the all-time low of $0.0063 reached on Aug. 28.

While price has dipped 8% in the past 24 hours and volume is down 35%, the overall outlook is positive. 0DOG is one of the top five trending tokens on Gate.io.

🔥#GateWeb3 Most Popular Overview🚀

📈24H Trending Crypto Top5👇:

1️⃣ $DOGI +58.83%

2️⃣ $WOLF +48.72%

3️⃣ $ORDI +20.66%

4️⃣ #0DOG +18.35%

5️⃣ $SUNDOG +13.87%😝What currencies did you trade today⁉️

😍Enter Web3👉:https://t.co/MxOahPymT7#GateWeb3 #Trending@DogiDrc20… pic.twitter.com/jn0w58zbm6

— Gate Web3 Wallet (@GateWeb3Wallet) September 3, 2024

As well as the exciting prospects of landing on other top tier exchanges – Binance could be a major move – there’s mounting enthusiasm around the Bitcoin Dogs game. The platform also targets the nascent Bitcoin ecosystem with an exclusive NFTs project.

Combined with multiple potential bullish catalysts for Bitcoin in 2024 and 2025, 0DOG price could reclaim its ATH and target $0.5 and the psychological $1 in coming months.

You can learn more about Bitcoin Dogs here.

The post 0DOG and MATIC price prediction amid Polygon’s token swap appeared first on CoinJournal.